The Year in Review

By Clint EdgingtonPosted on January 11th, 2024

The echoes of central banks’ historic monetary stimulus to counter the Covid-19 virus, the resulting inflation, and the unwinding of that monetary stimulus to contain that inflation continued to play out in 2023.

Hoping 2022’s market returns were solidly in the past, 2023 began on a positive note and ended the year trending higher. The ride for investors throughout the year was a bumpy one as investors assessed the impact of inflation, rising interest rates, an unexpected banking crisis, and rising global tensions.

Yet, the economy proved resilient

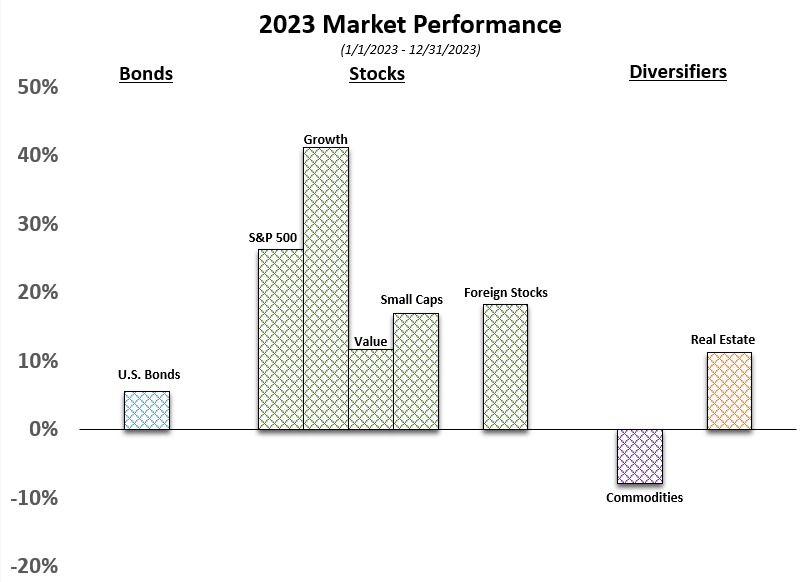

Corporate profits rose and the once anticipated economic recession never materialized. Technology stocks rebounded in 2023, with mega caps and artificial intelligence leading the way. Growth stocks ended the year up more than 40% while defensive sectors lagged. The Bloomberg Aggregate Bond Index, which has the worst return in its history after declining nearly 13% in 2022, rose a little over 5.0% in 2023.

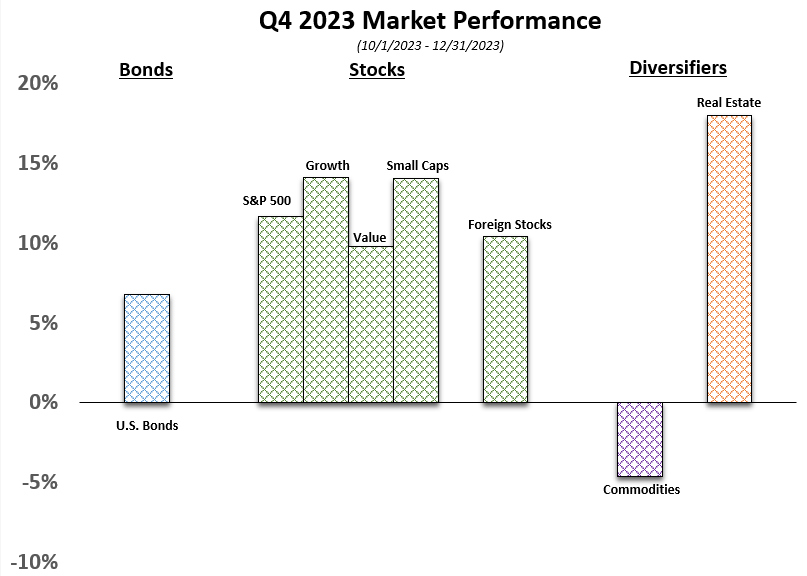

The fourth quarter started off with a head fake. Readings in mid-September and mid-October made traders question the declining trend; driving yields up and dragging bond and equity prices down in October. Throughout November and December, however, Inflation data continued its downward trend. November’s reading showed inflation of 3.1% year over year; a range the Fed will likely be comfortable with. Their long run goal is to get back down to 2% inflation.

Investors became optimistic that the restrictive Fed policy that we’ve been experiencing would begin to loosen. In his November 28 speech, “Something Appears to Be Giving”, Fed Governor Christopher Waller’s indicated the potential for near term rate cuts. He excited the markets with his comment, “The question is whether inflation can continue to make progress towards 2%. There are some factors favoring this outcome, so let me walk through them…” where he focused on eases in the housing and labor market.

However, Chairman Jerome Powell’s December 1st speech walked it back a bit; “what we call “core” inflation is still 3.5%, well above our 2% objective….Monetary policy is thought to affect economic conditions with a lag, and the full effects of our tightening have likely not yet been felt. Having come so far so quickly, the FOMC is moving forward carefully, as the risks of under and over-tightening are becoming more balanced.”

In all, investors became more optimistic that the Fed would become less restrictive. Both equity and fixed income markets had a great quarter.

The Year Ahead

The timing of Federal Reserve rate cuts in 2024 is yet to be seen. Inflation data for December 2023 was mixed with core CPI (the index minus food and energy) up by 0.3 percent. However, core CPI for the last 12 months is at 3.9 percent, down from 0.1 percent in November. While inflation seems to be taming, slowing to the desired 2% may take until the end of 2025.