Q1 2023 Market Review

By Clint EdgingtonPosted on April 12th, 2023

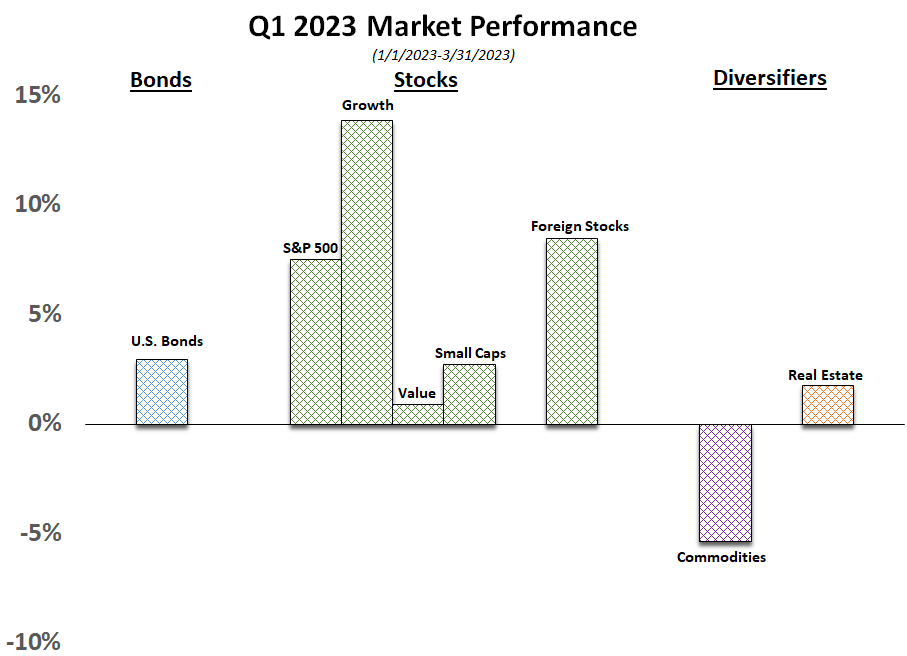

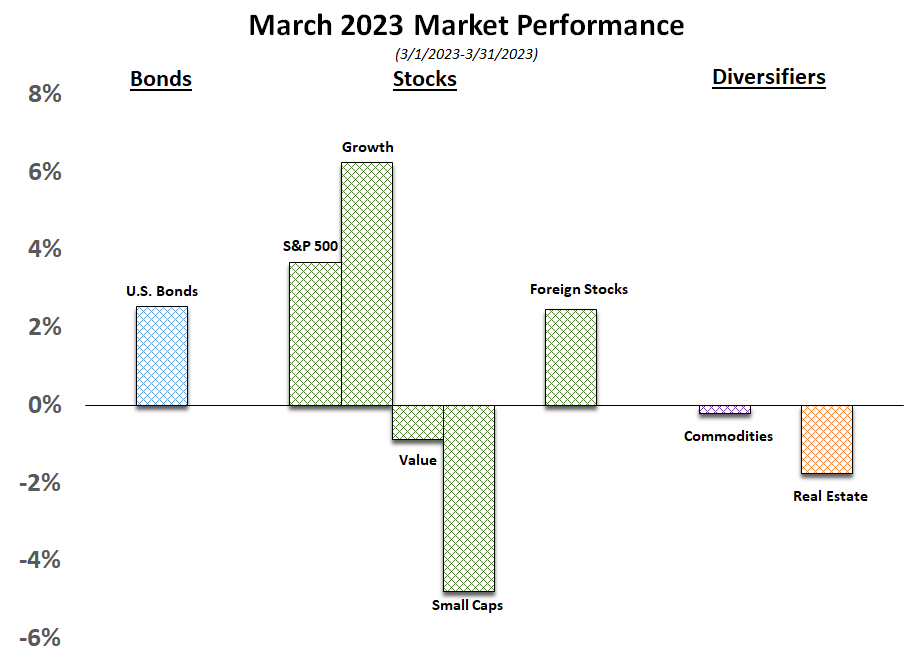

March saw the financial markets extend this quarter’s rebound from the brutal 2022, both from a headline perspective and within most sectors. Still, stocks ended the quarter stuck near bear market territory, down 13.5% from their last high set last January.

Within the sectors, generally performance could be characterized as a reversal of trends that occurred in 2022. Growth stocks punished the hardest by the increasing interest rates (and the discounting of cash flows ) reversed their fortunes with a 20% gain on the quarter. Value stocks, less impacted by interest rate discounting, had a less than exciting gain.

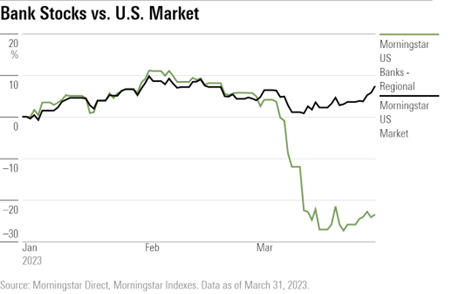

While the S&P 500 emerged with a 7.5% gain for the quarter, there were wide variations within the various sectors of our economy. A different “excitement” was felt within the banking sector, as it bore the brunt of the Federal Reserve’s 13 month rate hike. We saw the closing of three regional banks, a forced takeover of Credit Suisse, and a new backstop lending facility being put in for banks.

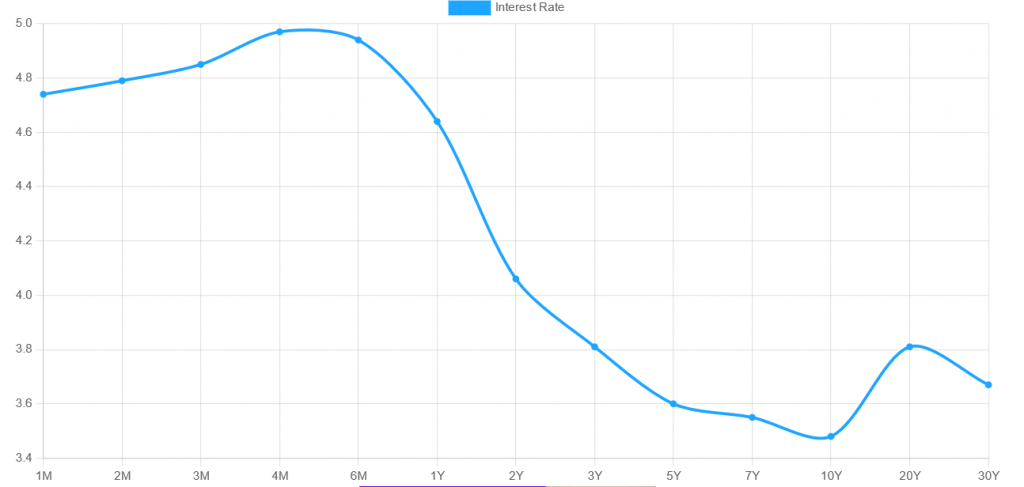

Within the bond market there were significant swings in expectations for Fed policy. New Year’s optimism gave way in the face of a strong jobs report in February and Chairman Powell’s regarding the “extremely tight” labor market. The bond markets became extremely inverted, and the change in the term structure of interest rates over the quarter was significant. While shorter term interest rates went up, the longer term rates remained relatively low.

After the month closed, the BLS released their monthly Consumer Price Index (“CPI”) reading, with the gauge showing significant cooling to the prices consumers pay, with the headline index increasing at 5% year over year. This is the slowest annual increase since May 2021 and a significant cooling from February’s 0.4% month over month and 6% yoy gain. “The index for shelter was by far the largest contributor…” in March, yet it decreased slightly from 0.8% increase last month to 0.6% this month.

While one month doesn’t make a trend and the data will be noisy, we still believe that this will continue to soften due to the lagging effects of interest rates on the real estate market and the supply coming online later this year. Fixed income markets took this as a relief, and shorter term rates have gone down since the start of the quarter.