Q3 2023 Market Review

By Clint EdgingtonPosted on October 12th, 2023

The first half of 2023 saw global stocks strong returns buoyed with hopes of a soft landing and supported by a seemingly sustained trend of inflation dropping, culminating with June’s CPI reading of 3% being the lowest since March of 2021.

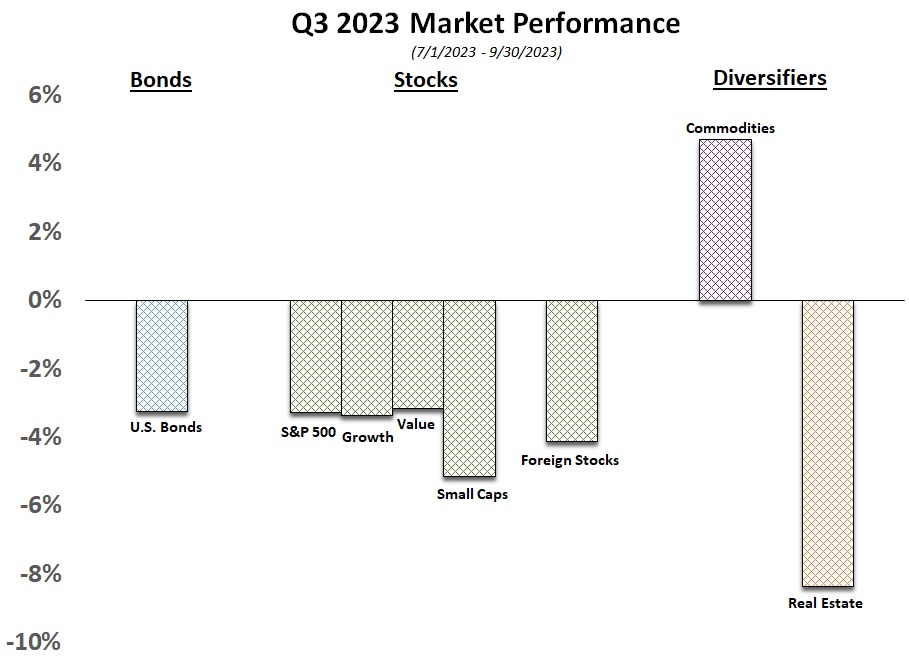

The 3rd quarter of 2023 saw these hopes diminish. Inflation veered away the Fed’s target rate[1] as did global stock investor’s hopes that a soft landing was assured. At the final Fed meeting of the quarter, interest rates were held steady, but the Board signaled rates would stay higher for longer. As such, bonds dropped and global equities broadly declined as well, with the S&P losing 3.3% over the quarter.

As is typical with an increase in interest rates, smaller company stocks and growth stocks led the way down; with larger companies and value stocks providing a bit of ballast. The lone area showing resilience was commodities, driven by higher prices following production cuts by Saudi Arabia and Russia.

While the U.S. labor market remains historically strong, the unemployment rate rose .3% in August and the latest reading remains stable.

While the quarter’s reversal is disappointing, 2023 has, thus far, still generally been a good one for investors, with the S&P still up over 13% on the year.

[1] 3.2% CPI (July reading) followed by a 3.7% reading released in September (August’s CPI).