January 2023

By Mark FisselPosted on January 18th, 2023

2022 Market Review Inflation : The Trend Continued

from Clint Edgington, CFA

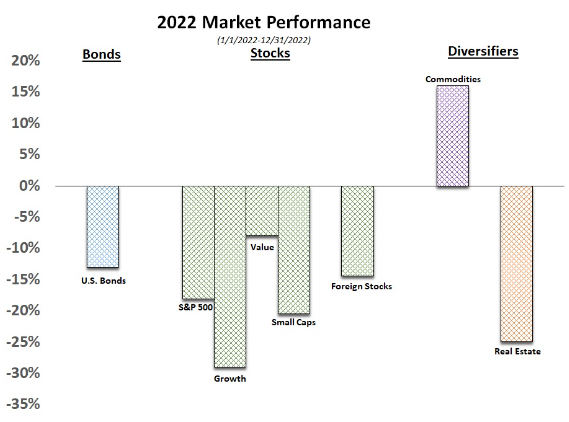

In our 2021 market review, we discussed the sources of our current inflationary economy and assumed it would continue. And continue it did, negatively impacting almost all asset classes. Supply chain issues, rising oil prices, and an increase in the money supply from Covid stimulus continued the trend, with inflation peaked at 9.1% in June 2022 with mild deceleration since then.

In an attempt to rein this in, the Fed conducted its fastest interest rate tightening cycle since the early 1980’s during the Volker era. The speed of the Fed’s actions was surprising, especially in light of their comments during 2021 that inflation seemed to be “transitory”, but not historically record setting once we look quite long term.

The interest rates increases and high inflation made 2022 broadly the worst year for fixed income since most indices were created. Essentially no part of the fixed income market was spared. Interest rate sensitive sectors, such as bonds and real estate took a hit, and existing bonds became worth much less. Although dwarfed by the effects of rising rates, credit spreads increased modestly, as investors priced in higher defaults.

SECURE 2.0 ACT Signed into Law

The SECURE 2.0 Act of 2022 was included in the recent $1.7 billion spending bill and signed into law December 29, 2022. The new law builds on the SECURE Act of 2019. The SECURE Act of 2019 was sweeping legislation that took 10 years to bring to fruition. The additional changes moved at a much faster pace and combined provisions from several bills that have been introduced over the last few years.

New provisions include increasing the RMD age to 75, mandatory automatic enrollment for new workplace retirement plans such as 401ks, increases to catch-up contributions, and student loan payments can be treated as retirement plan contributions so employees can still receive a company match. Most provisions go into effect after 2023, though some changes start this year.

Three Stretch IRA Alternatives

The passage of the SECURE Act in 2019 effectively eliminated the stretch IRA, an estate planning strategy that allowed an inherited IRA to continue growing tax deferred, potentially for decades. Most non spouse beneficiaries, including children and grandchildren, can no longer stretch distributions over their lifetimes.

When Should Young Adults Start Investing?

As young adults embark on their first real job, get married, or start a family, retirement might be the last thing on their minds. Even so, they might want to make it a financial priority. In preparing for retirement, the best time to start investing is now — for two key reasons: compounding and tax management.