January 2023 Market Review

By Clint EdgingtonPosted on February 3rd, 2023

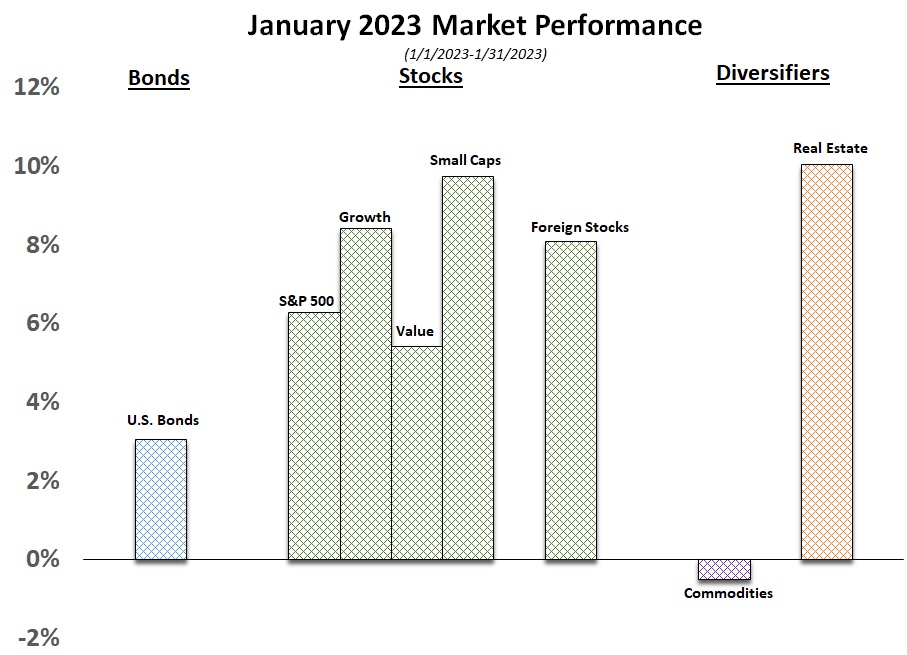

January was a good month for investors, with markets ending higher despite concerns that the economy may be headed toward a significant slowdown or even a recession. Each of the benchmarks posted solid gains, except for commodities which were down. Crude oil prices declined in January for the third month in a row.

Recent economic data gave market participants hope that that inflation may have peaked, with December showing a decrease in prices. The All Items index increased 6.5% over a 12 month period ending in December 2022. This was the smallest increase in 14 months, and down significantly from the June 2022 peak. Also showing signs of slowing is Core CPI, which excludes food and energy. It increased by 5.7% over the same time period, the lowest it’s been since 2021.

Ten-year Treasury yields fell 32 basis points , due to expectations of a less aggressive Fed policy, which gave bonds a needed boost.

The Treasury yield curve inverted, with the yield on the one-month bond around 4.53%, and the 10-year bond yield at 3.52%. An inverted yield curve is often seen as an indicator of economic weakness.

Foreign markets rebounded with China exiting its zero-Covid approach and remaining open to trade despite growing COVID cases there.

Eye on the Month Ahead

With inflationary pressures slowing in December, the Federal Open Market Committee announced a 25-basis points rate increase following its meeting on February 1. The benchmark rate is now between 4.5 – 4.75%. Fed Chairman Jerome Powell stated he does not expect any cuts in interest rates this year, and that a couple more rate increases are expected. Economic data will likely be noisy, today’s blowout unemployment report, for example, showed a surprising amount of job gains throughout the economy, with no real softening in the construction industry, as one would expect with interest rates spiking. Contradicting these gains, wage growth appeared to slow.