Q2 2022 Market Review

By Clint EdgingtonPosted on July 11th, 2022

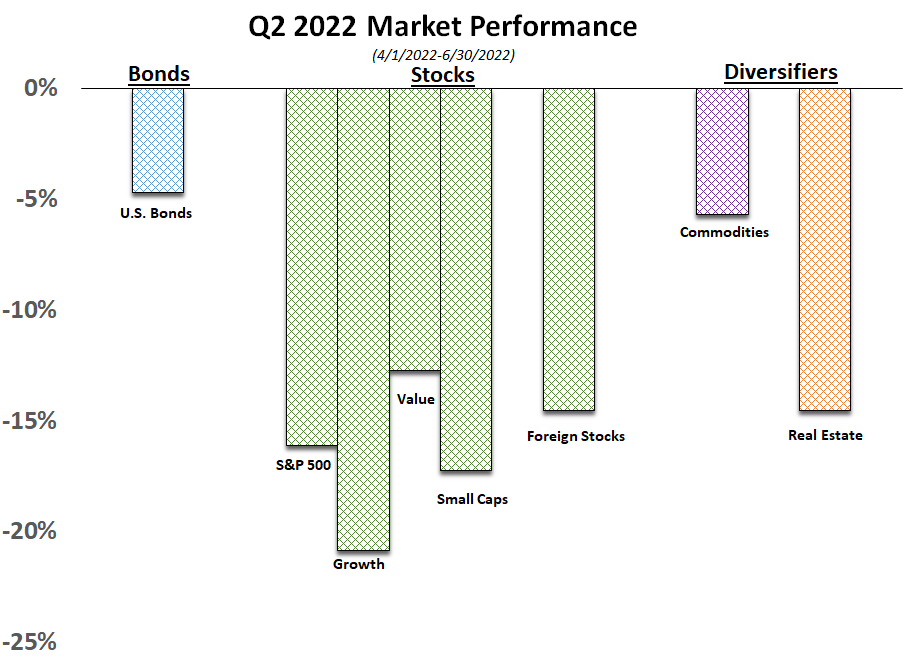

With inflation, interest rate, and geopolitical fears taking the stage and reversing market advances in the beginning of 2022, the second quarter extended these trends. Fear of a recession began setting in as confidence in the Federal Reserve’s ability to coordinate a soft landing came into question.

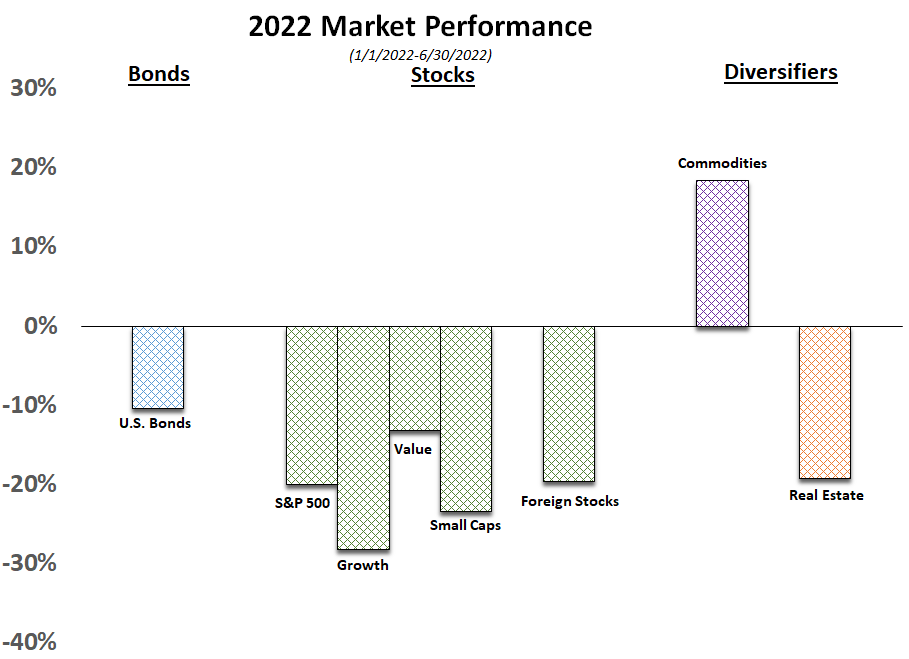

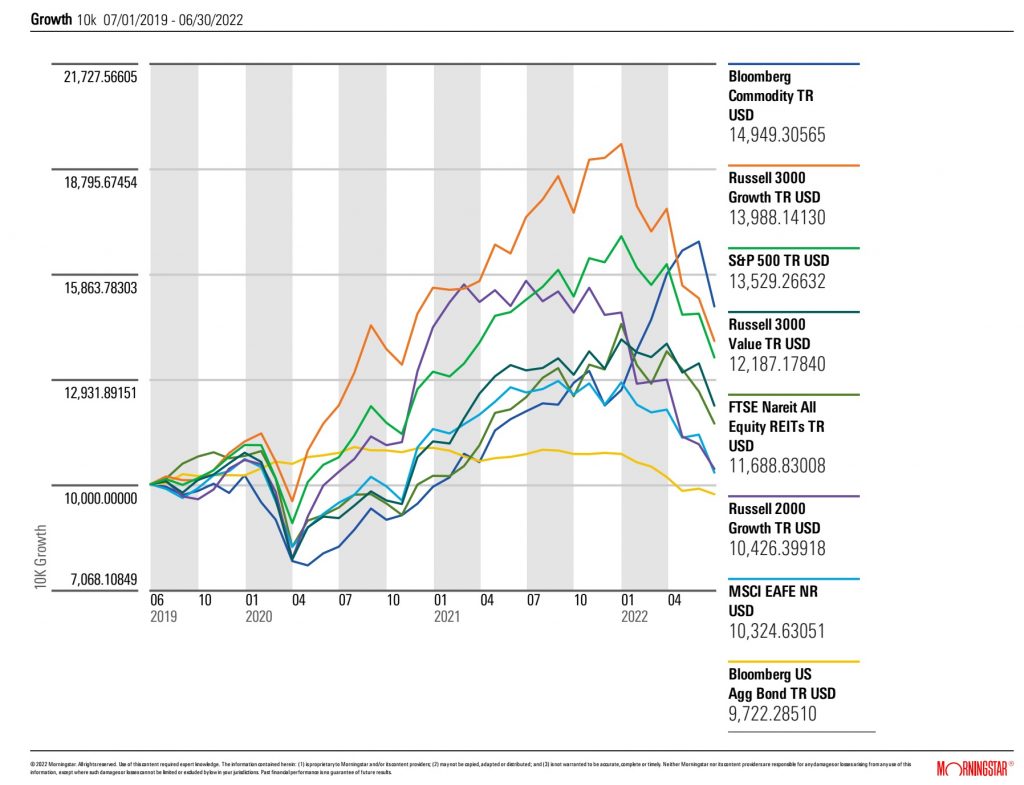

The first half of 2022 was the worst stretch for markets in almost 50 years, with a large sell off in both stocks and bonds. We officially entered a bear market in mid-June when the S&P closed at almost 22% lower than its January 3rd peak. All sectors are down for the year except commodities, which have recently seen a reversal as it’s predicted that demand will weaken as overall economic activity decreases.

Fiscal stimulus and quantitative easing helped prop the markets up during the pandemic, but also helped fuel inflation. The Fed’s rapid tightening to fight inflation and rising energy costs have contributed to losses this year. The Fed raised interest rates by 50bps in May, 75bps in June, and another rate increase is expected this month. In addition, the Fed began shrinking its balance sheet in June by reducing its treasury debt holdings.

Despite losses for the year, most assets classes are higher than they were pre-pandemic.

While a recession certainly has become more likely in the near term, it’s not a foregone conclusion that we’ll have a significant downturn either. With a negative GDP for Q1 of -1.6% there likely will be a negative output for Q2. Yet, the labor market is quite strong, with an unemployment rate below 4%. Americans had the highest savings rates on record during the pandemic (likely contributing to inflationary pressures now).