Inflation- The Trend Continued

By Clint EdgingtonPosted on January 17th, 2023

In our 2021 market review, we discussed the sources of our current inflationary economy and assumed it would continue. And continue it did, negatively impacting almost all asset classes. Supply chain issues, rising oil prices, and an increase in the money supply from Covid stimulus continued the trend, with inflation peaking at 9.1% in June 2022 with mild deceleration since then.

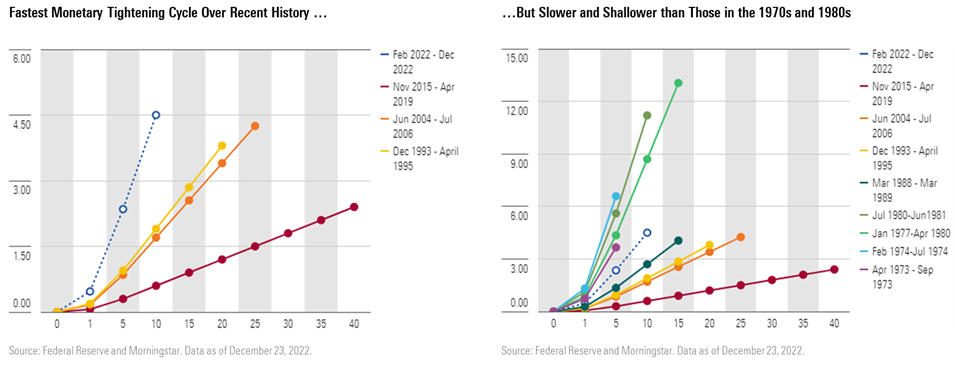

In an attempt to rein this in, the Fed conducted its fastest interest rate tightening cycle since the early 1980’s during the Volker era. The speed of the Fed’s actions was surprising, especially in light of their comments during 2021 that inflation seemed to be “transitory”, but not historically record setting once we look quite long term.

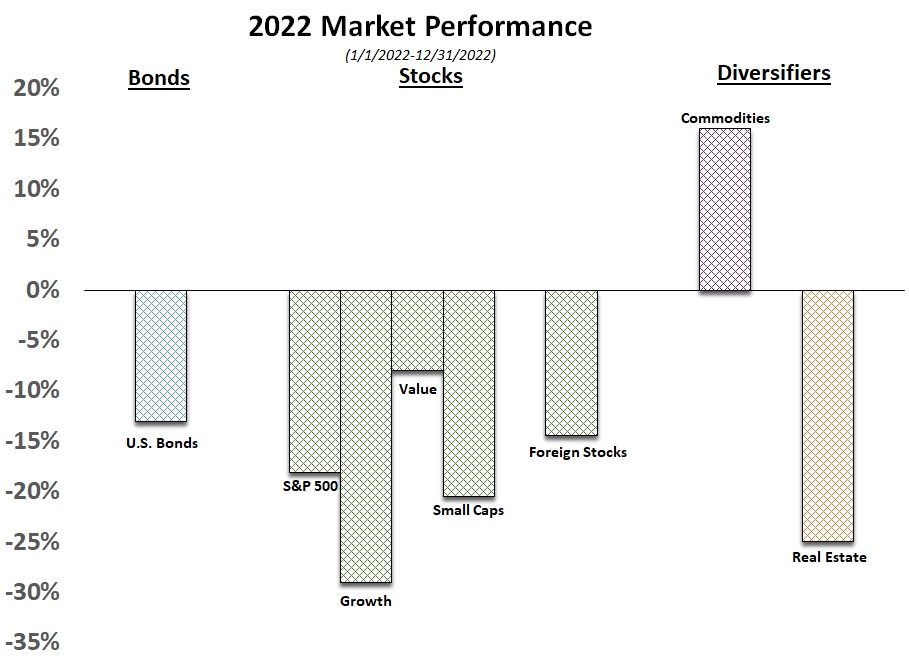

The interest rates increases and high inflation made 2022 broadly the worst year for fixed income since most indices were created. Essentially no part of the fixed income market was spared. Interest rate sensitive sectors, such as bonds and real estate took a hit, and existing bonds became worth much less. Although dwarfed by the effects of rising rates, credit spreads increased modestly, as investors priced in higher defaults.

For equities, which are generally valued as the present value of their future cash flows, the interest rate is the metric used to discount. A higher interest rate discounts faster and thus, equity valuations broadly decreased, giving back the lion’s share of gains from 2022.

While the broad market was down just under 20%, the growthier portion of the market -projected to have little cash flow in the near term but more in the distant future, got crushed by 30%, as a higher discounting rate impacts that discounting mechanism more. Many highflying names lost their luster.

Economy, Inflation and Interest Rates: The Path Forward

Though consumer balance sheets and the labor market look quite healthy, a decline in economic activity will likely be the lagging result of the increase in interest rates.

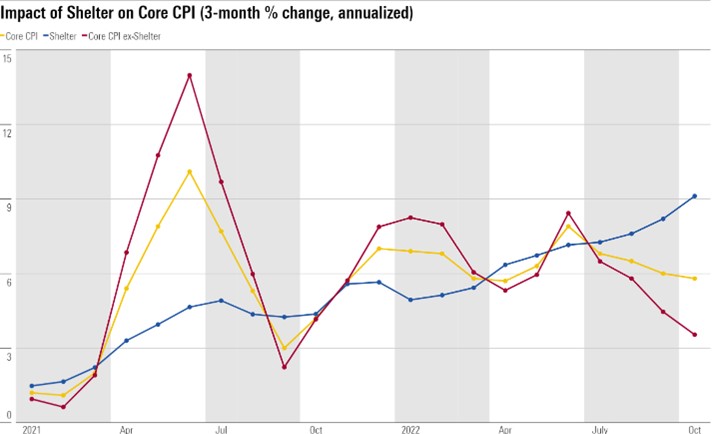

Yet we’ve seen in recent numbers a deceleration and even a decrease in the headline inflation numbers, with the CPI decreasing in December. However, there is no clear downward trend yet. When the volatile food and energy segments are stripped down to the “Core CPI”, there was still an increase. The index rose 0.3 percent in December.

We believe there will be a downward trend in the reasonably short term, however. Real estate, in particular, is affected by interest rates, but with a significant lag. With prices likely decreasing and significant new supply coming on the market in the next two years it seems highly likely that the “shelter” component of CPI will begin moderating and even decreasing. With that, Core CPI should follow.

Against that backdrop, significant government expenditure, and the resultant hiring, will begin in earnest in 2023 to fulfill the promises of the Infrastructure and Investment Act, resulting in a new source of demand for raw materials and workers; adding to inflationary pressures.

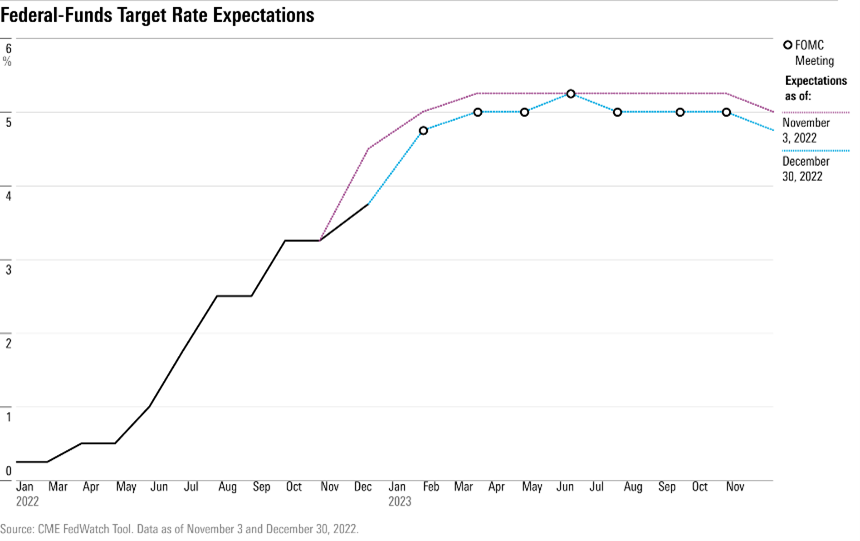

While the Fed has signaled another 50bps rate increase at the next meeting, the market is discounting that somewhat. It will be interesting to see if they stick with the 50 bps rate cut or drop to only 25 bps.

The consumer appears, on most counts, to be fairly healthy. With significant recent housing price gains, and banks still remembering lessons from the Great Recession, it doesn’t appear significant distressed sales will occur. The health of the consumer could surprise us, however, as many “Buy now Pay later” schemes won’t be showing up in official government data- there could be significant shadow debt on the consumer’s balance sheet.

Equity Valuations

Corporate earnings have stayed relatively high, and with lower equity prices, valuations have come in line with historical norms.

The MSCI World Growth Index is trading at 21 times earnings compared to the beginning of 2022’s 31 times earnings, and with the Value counterpart falling from 14 to 12; valuations have come back into line.

Lower valuations and inflation trends, backed with relatively strong consumer and corporate balance sheets, give us reason to be cautiously optimistic for a brighter 2023 and 2024.