Q3 2022 Market Review

By Clint EdgingtonPosted on October 4th, 2022

The Fed’s rate increases are not slowing inflation as quickly as hoped. After remaining flat for a few months, inflation data released in mid-Sept was higher than expected. Core CPI, which excludes energy and food, was up 6.3% from a year ago and 0.6% from the month before. The Market reacted to the data, expecting continued steep Fed rate increases. Gains we saw earlier in the month were quickly wiped out with September ending below June lows. The bear market continues.

In an effort to bring inflation down, the Fed has raised rates five times this year. The federal funds rate, which was close to zero at the start of the year, is now in the 3% to 3.25% range. Fed officials have hinted they will continue raising rates until it hits 4.6% in 2023, and not cut rates next year. We imagine the Fed would prefer to talk rates up and take a more measured approach, however, as it tries to get back to 2% inflation. Federal Reserve Chairman, Jerome Powell, admitted the chances of a “soft landing” are unlikely.

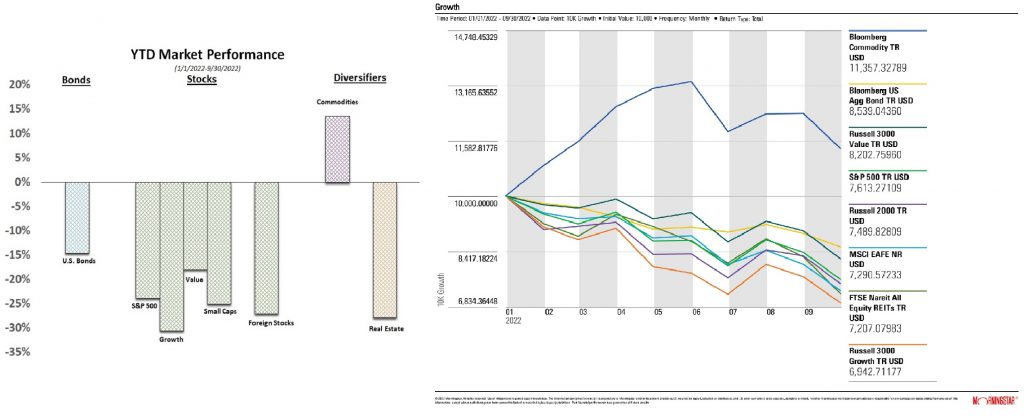

When interest rates go up equity markets tend to go down due to the increase in borrowing costs (servicing debt) and decrease in corporate earnings. All sectors continue to be down for the year except commodities which have seen a recent decline.

The quantitative tightening continues in other ways as well. The Fed began shrinking its balance sheet in June with $47.5 billion of assets rolling off its portfolio each month. That number increased to $95 billion in September. The ramped-up bond buying during the pandemic provided liquidity and helped keep interest rates low. Now we are seeing the opposite effect.

The 30-year mortgage is at its highest rate since 2007, making it more costly to borrower, but having the intended effect of bringing home prices down. Prices have already started to decline, down 5% from May.

How quickly the Fed’s continued tightening works, and whether it’s fully priced into the markets remains to be seen. Many of the current supply conditions are still related to the disruptions caused by Covid-19, and the labor market still seems healthy. It is unlikely that rising interest rates alone can bring supply and demand into alignment. In the meantime, it’s still anybody’s guess (as it always is) whether it’s further correction from here on out or not.