“A Trend is a trend. But the question is, will it bend? Will it alter its course through some unforeseen force and come to a premature end?” -Alexander Cairncross[1]

By Clint EdgingtonPosted on January 7th, 2022

2021 Post Covid Trend Continues: Inflation, Blistering Stock Prices, Bonds Hurt

As is usually the case, the headlines of a year that are memorable are generally negative. 2021 will likely be remembered for its contested Presidential election, events at the U.S. Capitol, and the continuation of the Covid-19 virus and its various variants.

Yet the market is a discounting machine, constantly estimating future cash flows from various investments and weighing it against the inflation that will affect the value of those cash flows and the future interest rates that can be invested into.

While these headlines are interesting, our economies and markets are still playing out the world’s reaction to the Covid-19 virus. The virus scared economies and consumers and temporarily shuttered businesses. Yet the underlying global economy was extremely healthy. Governments and central bankers, not knowing the depths of the potential ramifications of the virus on their economies, acted quickly and with strength, doing all they could to both drive interest rates down (monetary stimulus) and pump money into the real economy (fiscal stimulus).

This stimulus created the economic effects we saw in 2020 and continued in 2021. These trends are unique; higher inflation, higher risk-based asset prices, with assets that can’t keep up with inflation hurting. Very positive global equity market returns with negative fixed income returns doesn’t happen often; and 2 years in a row hasn’t happened for almost 50 years.

Our commentary this year echoes the commentary we put forth last January:

“It’s difficult to think about how the immense amount of money pumped into our economy by the monetary and fiscal stimulus works; that the money pumped in has to bubble back up somewhere. While savers in low risk investments or cash effectively finance this through lower valued future dollars and lower interest rates, stock investors generally gain. And they did….

As 2021 begins, where does that leave us? Has stimulus done its twofold job of permanently resuscitating our economy and inflating asset prices? My guess: yes.”

Why positive equity returns and negative fixed income returns?

This combination of healthy economy, rising input costs and accommodative Fed create a divergence in asset classes. Those assets that get the benefits of future rising revenues due to inflation (i.e. stocks, real estate, commodities) become more attractive. Assets that have fixed cash flows (i.e. bonds) have the value of those future cash flows become less valuable and, when the market recognizes that, their price goes down.

Why Are We Experiencing Inflation?

Increased production

Unlike our last recession in 2009 and 2010; demand for goods and services didn’t drop. U.S. GDP increased at annual rate of 2.3%[2](Q3), 6.7% (Q2), and 6.3% (Q1) in 2021.

Costs to produce have increased

All else equal, when production increases, the costs to produce the next widget increase, creating inflationary pressures throughout the economy. We usually think of 2-4% being a healthy, non-inflationary rate during periods of benign interest rates.

Covid brought about an additional inflationary factor, supply constraints. Both due to transmission concerns with the virus and localized affects, certain goods became in short supply quickly; causing producers to scramble and resort to higher costs alternatives. Again, leading to inflation.

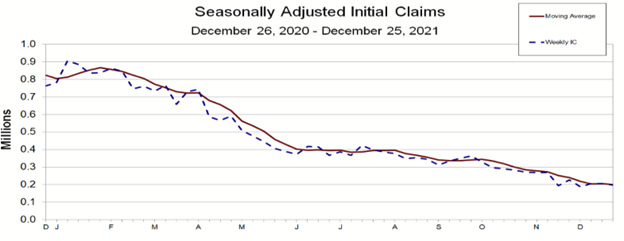

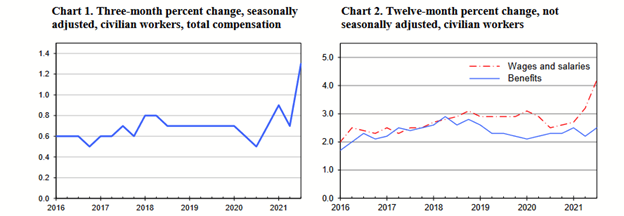

A major input cost to production is the labor required. With more demand for workers to increase production, the balance of power tilted towards workers being able to demand more wages. Fewer workers are laid off or fired and wages go up. Unemployment claims ended December at lowest level for decades.[3] Fewer available workers[4] with more job offers equates into higher wages[5]

Yet Central Banks around the globe have continued their accommodative stance of pressuring interest rates to stay low. Lower borrowing costs continue to incentivize companies to increase investment and production and the cycle continues.

Inflation is the result

The Consumer Price Index is up 6.8%,[6] and the Producer Price Index is up 9.6%[7]. The highest reading since 2010 after emerging from the “Great Recession”

Inflation’s impact on markets

With a healthy economy, businesses will be able to sell more in the future at higher prices and pass (some) of their increased input costs along to consumers. Generally, asset classes that react well to inflation have gone up. Stocks, Real Estate, and commodities generally do well in an inflationary period. Bonds, on the other hand, have a fixed stream of future cash flows (both interest and principal payments) which will be worth less in the future on a real basis. Therefore, nominal prices of bonds go down to reflect this.

This is in line with our thoughts on inflation increasing.

Will the trend continue going forward?

While I won’t proffer a guess on short term equity returns, we believe inflationary pressures will continue. While the inflation spikes that occurred in certain products with severe supply constraints will likely continue to diminish; inflation occurs when more inflation is expected. If you think a car you need to buy in a year will cost 10% more, you may buy the car now, pulling forward demand for that car and incentivizing the producer to increase production and kicking off an inflationary cycle. A self-fulfilling prophesy of sorts and, if fulfilled this time, we should expect the 1-2% inflation that we’ve had for the past decade to be a thing of the past.

How to position? We’ll stick with what we said a year ago.

“My guess is to assume the Fed will likely get its wish of higher inflation. Riding that wave through inflation resistant assets is probably prudent. 2020 has reinforced the lesson that none of us truly know how to time the market, and the smart move is to stay long term and diversified.”

[1] Sir Alec Cairncross

[2] https://www.bea.gov/sites/default/files/2021-12/gdp3q21_3rd_fax.pdf

[3] Week ended December 25 had 4 week moving average of 199,250; the lowest since 1969 (on an adjusted basis). https://www.dol.gov/ui/data.pdf

[4] November unemployment rate at 4.2%

[5] Compensation costs for civilian workers increased 3.7%[5]

[6] For period November 2020-November 2021 per BLS release https://www.bls.gov/news.release/cpi.nr0.htm

[7] For period November 2020-November 2021 per BLS release https://www.bls.gov/news.release/ppi.nr0.htm