November 2022

By Mark FisselPosted on November 4th, 2022

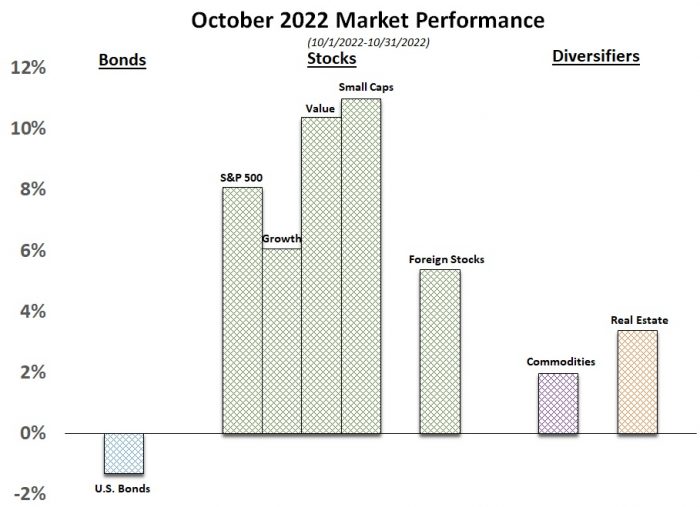

Markets Rebound in October

from Clint Edgington, CFA

| After a rough September, markets rebounded in October with the first monthly gain since July. After two quarters of contracting, GPD growth came in higher than expected at 2.6% for the third quarter. Investors were encouraged by the data, and most sectors posted notable gains. Value continued its outperformance against growth with the new backdrop of higher interest rates having to finance less cash flow centric businesses. Bond prices were pushed down, however, with interest rates continuing to rise in October. |

2023 Contribution Limits Increase

The IRS announced cost-of-Living adjustments for contribution limits to IRAs, 401(k)s and other qualified plans for 2023 on October 21. COLAs are indexed for inflation and the thresholds have jumped dramatically, much like increase to the 2023 federal income tax brackets. The increase creates an opportunity, particularly for those over age 50, to save more for retirement.

IRA Contribution Limits

The combined annual limit on contributions to traditional and Roth IRAs is $6,500 for 2023, an increase of 8.3% from 2022. The catch-up amount for those age 50 and older is the same at $1,000.

Donor-Advised Funds Combine Charitable

Impact with Tax Benefits

A donor-advised fund (DAF) is a charitable account offered by sponsors such as financial institutions, community foundations, universities, and fraternal or religious organizations. Donors who itemize deductions on their federal income tax returns can write off DAF contributions in the year they are made, then gift funds later to the charities they want to support. DAF contributions are irrevocable, which means the donor gives the sponsor legal control while retaining advisory privileges with respect to the distribution of funds and the investment of assets.

Is It Time to Buy an Electric Vehicle?

Many 401k participants saw, for the first time this year, Lifetime Single Life Annuity Stream illustrations on their quarterly statements. The Secure Act requires that the illustrations be included on statements at least once a year.

The income illustrations have proven to be confusing for many. The monthly payments are shown on statements as both a single life annuity, and as a joint and survivor annuity. The illustration is based on the participant’s current account balance, assumes they are 67 years old and that payments start today. It assumes a rate of return based on the 10-year constant maturity U.S. Treasury securities yield rate.