Inflation Upside?

By Anne ZavagliaPosted on October 4th, 2022

With inflation at a 40-year high, it may feel like doom and gloom. Markets are down from their January peak, costs have soared especially for food and energy. However, there are a few bright spots.

Increase in Federal Income Tax Brackets and the Standard Deduction (SD)

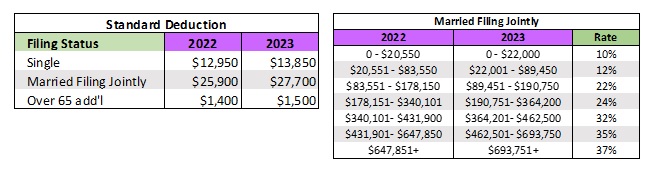

We will likely see larger adjustments to the federal income tax brackets for 2023. These are adjusted for inflation on a yearly basis and tied to seven federal income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

The increase may help those who are straddling between brackets to fall, or stay, into a lower marginal bracket. From 2021 to 2022 the income tax brackets increased by 3%. The announcement for 2023 will come in later this month and it is anticipated the increase will be near 7%.

It is estimated that 90% of taxpayers take the standard deduction. The standard deduction increased more than 3% from 2021 to 2022. A 7% increase for 2023 will also help lower taxable income.

It is estimated that 90% of taxpayers take the standard deduction. The standard deduction increased more than 3% from 2021 to 2022. A 7% increase for 2023 will also help lower taxable income.

For example, in 2022 if you are married filing jointly and your AGI is $115k, minus the standard deduction, your taxable income is $89,100. Taxable income above $83,550 is taxed at 22%

In 2023, if you have an AGI of $115k, minus the standard deduction, your taxable income will be $87,300, falling below the 22% bracket.

Planning Opportunities

If you think you will fall into a lower marginal tax bracket next year because of increases to the income brackets and SD, you may look for ways to shift income into 2023. For example, if you are self-employed, you may decide to hold off on billing, so income is received in 2023. Or you may be able to hold off on a yearend bonus.

Pushing income into 2023 may also benefit those who will file a FAFSA next year (October 2023). Income used for the 2024-25 school year will be based on 2022 income.

Social Security COLA Increase

The announcement for COLA increases comes in October as well. For 2022 the increase was 5.9%, the highest increase since 1982. 2023 will likely see an even bigger increase.

While this is certainly beneficial for Social Security recipients, if your provisional income is more than $34,000 on a single return, or $44,000 on a joint return, up to 85% of your benefits may be taxable. Unlike the income tax brackets, provisional income is not inflation adjusted.

Provisional income is generally equal to the combined total of:

- 50% of your Social Security benefits,

- your tax-exempt interest, and

- other non-Social Security income that makes up your adjusted gross income (minus certain deductions and exclusions).

Inflation Adjusted Bonds

High inflation has made inflation protected bonds, known as I-Bonds, more attractive. The composite rate is 9.62% for bonds purchased through October. This rate applies for the first six months you own the bond. After 6 months, the adjusted rate will be based on the inflation rate set November 1, 2022. The bonds must be held for at least a year and investors are limited to purchasing $10k per calendar year.

I-Bonds can be a nice short-term savings tool. The interest is exempt from state tax and federal income tax can be paid the year they are redeemed. I-Bonds can also be used to fund education and may be beneficial for those a year or two away from starting college. This is a nice way to lock in rates for the short-term, allowing more time for 529 accounts to bounce back before pulling funds out to pay for tuition.

Grandparents can gift I-Bonds to a minor. For parents purchasing I-Bonds, the interest earnings may be excluded from federal income tax when used to finance education if they meet certain qualifications.