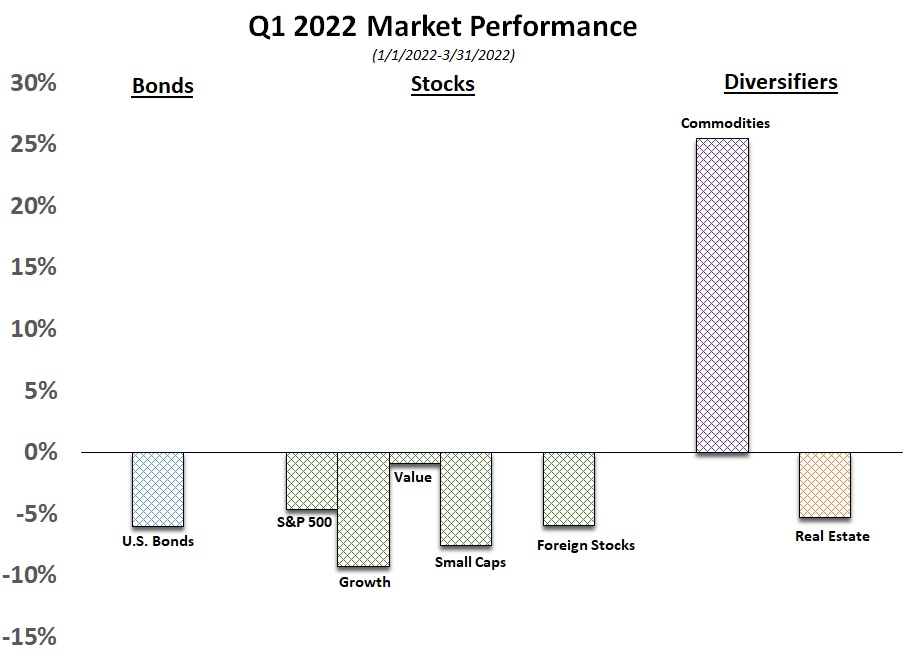

Geopolitical tensions and inflation strike: Markets uniformly down 2022 Q1

By Clint EdgingtonPosted on April 12th, 2022

World equity markets’ great 2021 is not continuing in 2022, while fixed income markets’ underwhelming performance last year is.

Inflationary pressures have been in the works for some time.

Beacon Hill Commentary from January 2021:

“It’s difficult to think about how the immense amount of money pumped into our economy by the monetary and fiscal stimulus works; that the money pumped in has to bubble back up somewhere.

While future real returns (returns after inflation) are paltry or negative for bonds, it’s likely going to weigh on stock returns as well…. My guess is to assume the Fed will likely get its wish of higher inflation. Riding that wave through inflation resistant assets is probably prudent.”

Beacon Hill Commentary January 2022: “A trend is a trend…”

This stimulus created the economic effects we saw in 2020 and continued in 2021. These trends are unique; higher inflation, higher risk-based asset prices, with assets that can’t keep up with inflation hurting. Very positive global equity market returns with negative fixed income returns doesn’t happen often; and 2 years in a row hasn’t happened for almost 50 years…. Will the trend continue going forward? While I won’t proffer a guess on short term equity returns, we believe inflationary pressures will continue.

Investors were focused on inflation at the start of the year, and therefore, interest rates. February saw the highest inflation in 40 years of 7.5%, and in March the trend strengthened, with the prices of all goods increasing 7.9% over the last 12 months.

To cool asset prices, the Federal Reserve raised interest rates by 0.25%, but calls within the committee called for more aggressive tightening. Further hikes are expected through the rest of 2022, with another 0.5% increase likely in May. The bond market has been pricing this in as we see with fixed income’s performance for the quarter.

Interest rate sensitive sectors, such as Real Estate, also felt the pain of higher future interest rates over the quarter, as did sectors with the highest valuations (e.g., “growth”). Less interest rate sensitive strategies, such as “Value”, provided some refuge from the storm.

While the focus was on inflation early in the year, all eyes shifted to the Russian invasion of Ukraine, the first large scale military action in Europe in decades. With the potential renewal of Cold War power structures at risk; risk-based assets dropped, and volatility has risen. Further inflaming inflationary fires, commodities that Russia and Ukraine historically export, such as wheat, oil, and gas will certainly not hit global markets at the same levels due to the destruction of the means of production and financial restrictions placed on them. This will continue to add to supply disruptions.