February Market Review

By Clint EdgingtonPosted on March 8th, 2022

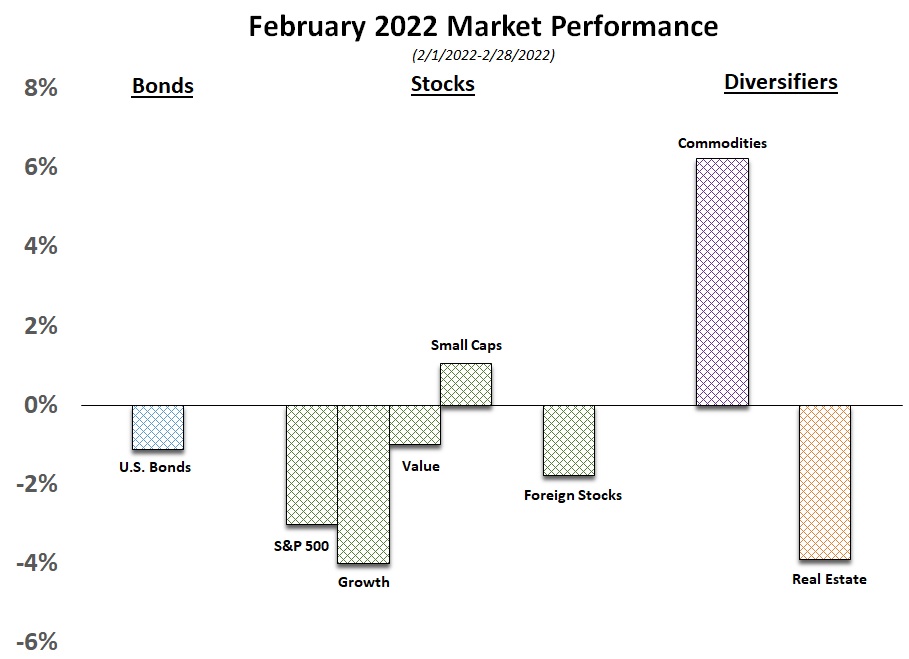

February saw markets uniformly down. Initially investors fretted over global Central banks tightening monetary policy, with the highest headline CPI of 7.5% annual inflation in the U.S. since 1982. Fears of Russia-Ukraine conflict overshadowed this, however, and culminated on February 24th with the invasion of Ukraine, bringing the S&P 500 briefly into correction territory.

The only industry sector showing strong positive performance was the Energy sector, as energy prices have risen in anticipation of supply constraints due to Russia’s contribution to that sector.

March is seeing a continuation of events that rattled markets in February, with the broad market again entering correction territory, and the Nasdaq entering a bear market.

Oil has doubled in price from a year ago and will likely fuel already high inflation. The U.S. banned Russian oil imports on Tuesday – the U.S. imports 8% of its oil from Russia. Americans will continue to see higher prices at the pumps for the time being.

The economic impact of a continued war in Ukraine is certainly on the mind of investors. Whether inflation and rising energy costs lead to a prolonged downturn remains to be seen.