June 2021 Market Recap

By Mark FisselPosted on July 7th, 2021

By Clint Edgington, CFA

June saw a continuation of the global economic rebound scattered with supply chain constraints and inflationary pressures that has characterized 2021, with an increase in volatility in both the bond and equity markets. We believe these trends, including increased volatility, have legs.

Economic growth was confirmed as U.S. GDP increased at an annual rate of 6.4% in the first quarter of 2021. While this is a backwards looking gauge of activity, we can see other forward looking indicators showing a continuation of the expansion, such as The Institute for Supply Management’s forward looking index of Services showed growth at 60.1%, down slightly from the previous month’s all-time high of 64% (anything over 50% is expansion). Employment continues to increase, with June’s data coming in higher than expected with 692,000 new jobs filled vs. 600,000 expected. Yet as job openings remain at all-time highs unemployment continues to hang around the 5.9% area, which may change as emergency COVID-19 unemployment benefits fall off in June and July.

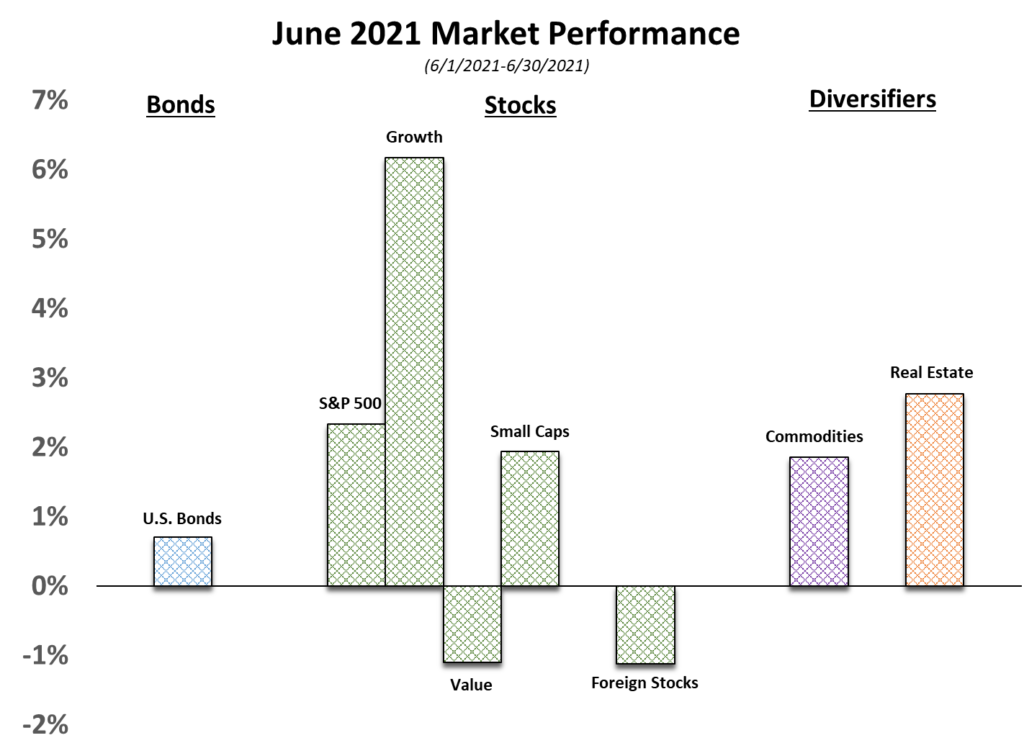

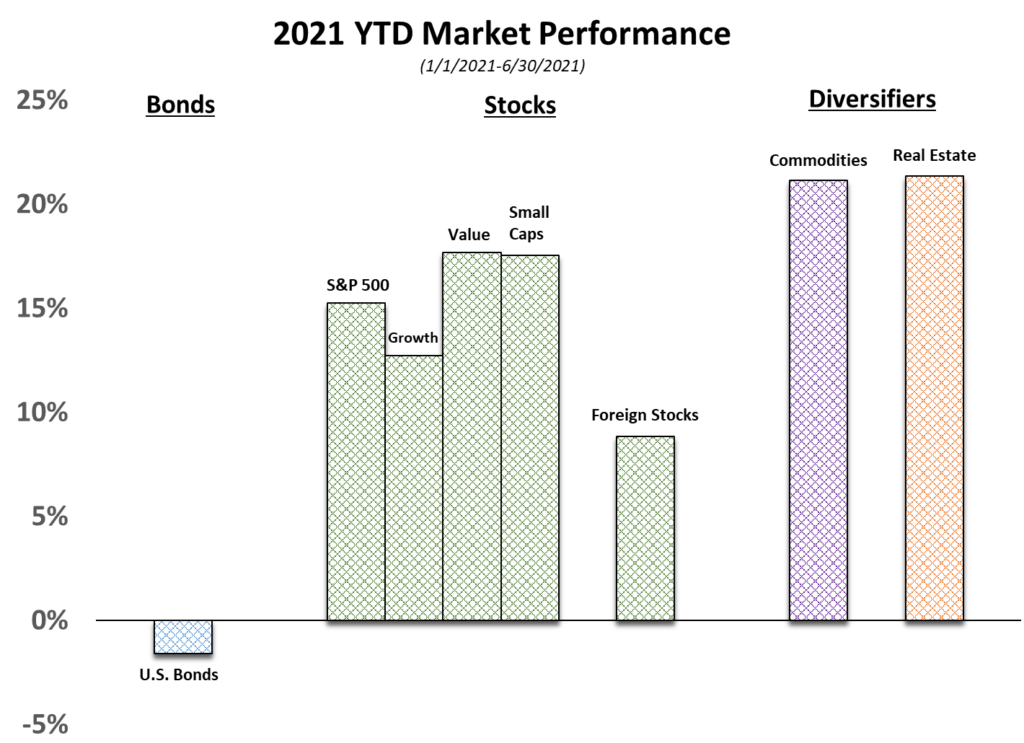

As such, U.S. equity markets had a good June and a great first half of the year.

This increased economic activity, coupled with supply constraint hangovers from the Covid-19 virus and increased Fiscal stimulus unsurprisingly has increased inflation and expectations of more on the way. In June the BLS released their monthly Consumer Price Index that reported that the last 12 months saw a pickup in inflation to 5%, “the largest 12 month increase since…2008.” While we all see this in our lives, towards the end of June we got a read on housing price increases, with the Case-Schiller index showing a 14.6% increase in pricing year over year ending in April. This will clearly cool, as input prices exhibiting temporary supply constraints will cool. The poster child of building materials with skyrocketing costs, lumber has quickly moved down from a peak of over $1,700 per linear xyz to $782 when we view July futures contracts.

The Federal Reserve, taking note of the pickup in inflation sounded more hawkish in their mid-June announcements; moving projections of rate increases into 2023 rather than the 2024 they previously showed. More than the rate increases, the market was spooked by the Fed’s much anticipated plans for its $120b monthly asset purchases, with Fed Chairman Jerome Powell stating that they had gotten to “talking about talking about” the process of slowing those asset purchases. Those asset purchases push the yield curve down. Talk of slowing these purchases shot the yield on the 10 year note up from 1.49% to 1.57% on that date; but rates have continued to slide since then, settling at the end of the month around 1.4% after Powell reversed course as he viewed recent inflation as transitory.

This decrease in interest rates gave Growth stocks an advantage over Value stocks for the month; contrary to Value’s decisive lead over Growth for the year. Inflation resistant investments, such as commodities and real estate continued their run for the year.

As always, a well-diversified, tax-managed portfolio that fits all aspects of your life will be the best hedge for whatever future markets may throw at us. Please reach out to us if there’s any assistance we can provide you.