Third Quarter Market Review

By Clint EdgingtonPosted on October 12th, 2021

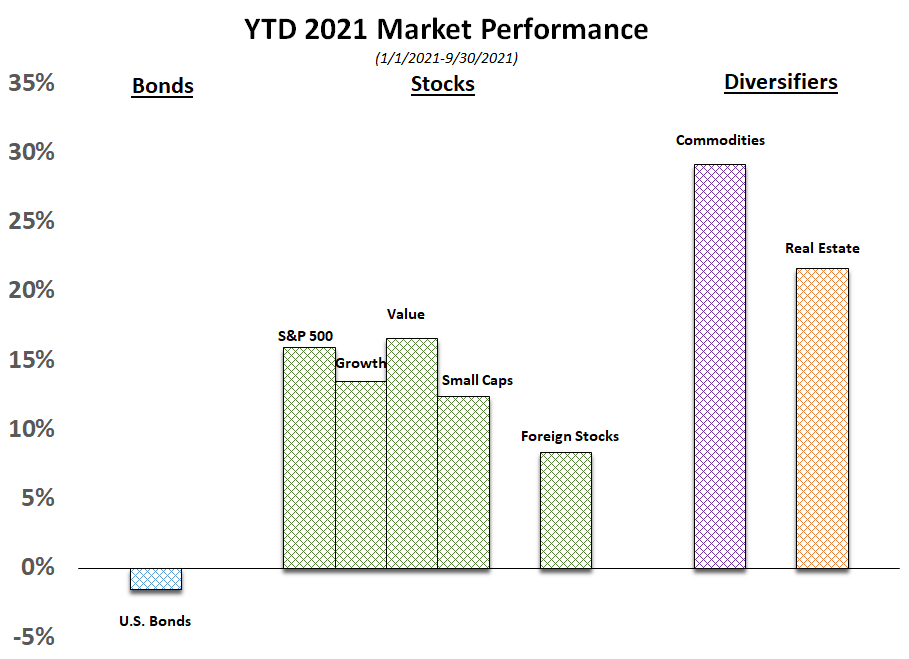

Broad markets have enjoyed a buoyant 2021, with bonds being the only major segment of the market to show a loss.

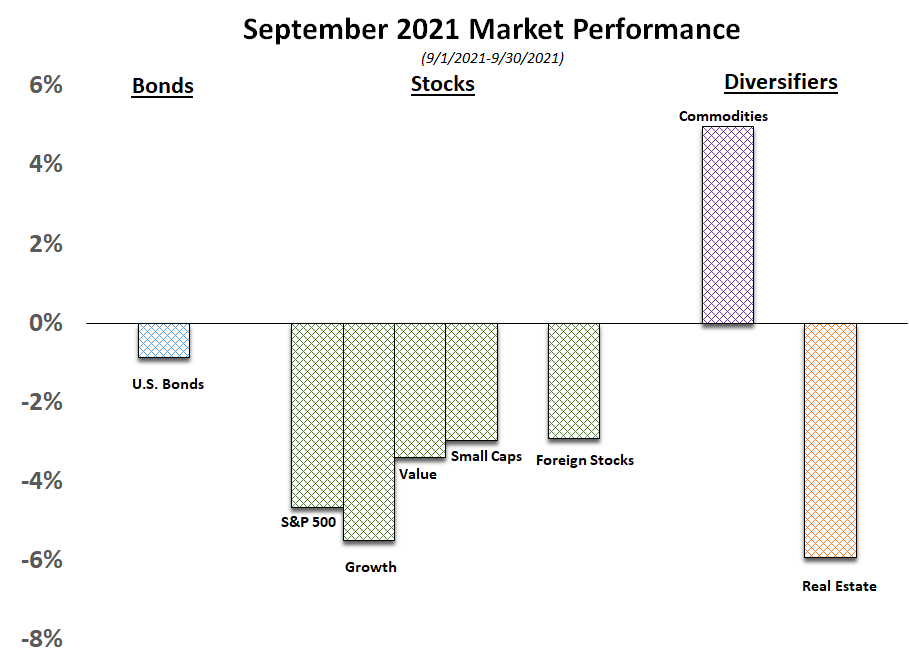

The buoyancy, however, did not last through September. Political, regulatory, and inflationary risks reared their heads in the U.S. arena as tremors were felt from China with the China Evergrande credit crunch impacting capital markets, and an energy crunch[1] affecting their factories. September brought the worst performance since the Covid panic began; with the S&P having its worst month since March of 2020.

Congress passed a stopgap spending bill, keeping the government open for the near future; allowing the focus to shift to raising the debt ceiling (which the House intends to vote on today) and Biden’s stimulus/infrastructure plan. The $1.2T “hard” infrastructure plan appears to have bipartisan support; while the $3.5T is more contentious. Infighting amongst Democrats will likely allow Republicans to trim the bill down to $1T-$2T; financed by more moderate tax increases than previously expected. Those tax increases likely will affect the top income tax bracket, capital gains, and corporate tax rates, amongst a few others.

U.S. Federal Reserve Chairman Jerome Powell signaled that tapering could begin as early as November and rate increases would likely be somewhere in the middle of 2022. Immediately after his press conference, longer bond rates went up and growth stocks went down. Value stocks outperformed growth stocks over the month, with almost all of that outperformance occurring directly after Powell’s press conference.

Inflationary pressures picked up, with August CPI clocking in at a heady 5.3%, powered by an energy crunch and other inflationary pressures discussed in past Market Reviews. Powell noted this but believes relief for consumers will be coming in recent months.

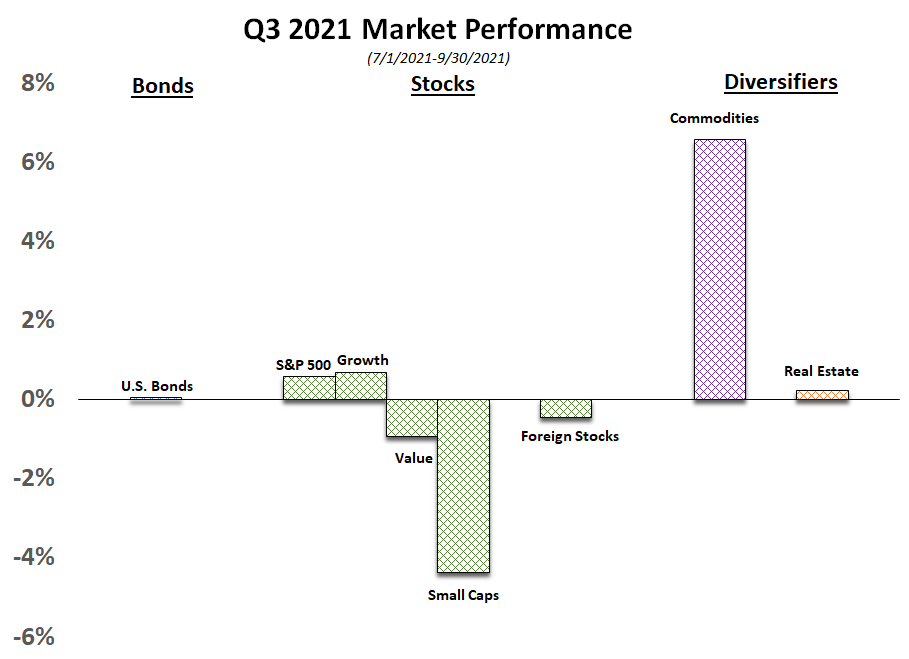

Overall for the past quarter, returns across most asset classes was relatively muted; with only commodities moving much as the energy sector was the only sector to hold up through September’s downturn.

[1] August Chinese manufacturing PMI dropped to 49.2. A reading below 50 indicates contraction. September has since come out at 50.