July 2021 Market Recap

By Clint EdgingtonPosted on August 5th, 2021

The continuation of the re-opening of the U.S. continues to show the health of the U.S. economy even while dealing with various supply chain issues. The Fed continues to be accommodative and yields on the 10 year treasury continued their recent decline.

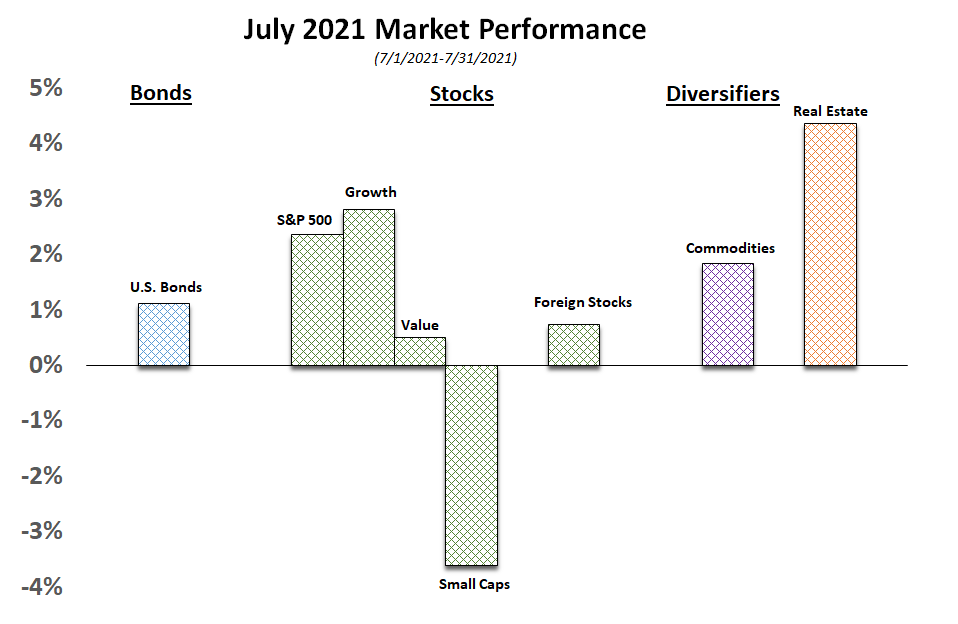

As such, U.S. equity markets continued their positive streak in July.

However, the positive returns the overall market returned, masks divergences within different sectors and size. Yes, the economy is very healthy. The emergence of the Delta variant has, however, created uncertainty as to ramifications of potential future partial restrictions.

U.S. case counts are back on the rise. With 49% of our population vaccinated, it appears that deaths are still benign – but will almost certainly rise in the short term. This “average” hides many nuances that could create economic issues however; vaccination rates vary widely by location, deaths lag case counts, etc. Local vaccination rates appear to drive local impacts; and industries with a geographic concentration may be hit harder than typical industries and affect general supply chains.

When we peel back layers of the market; it seems as though the market is predicting overall economic growth but a mini-replay of the initial COVID trade; with technology and growth companies (i.e. Zoom) doing very well, but old line companies (i.e. Value) that have higher odds of being impacted, not doing as well. Smaller companies without resources to adapt, do poorly. As I write this, I’m not confident in that interpretation and it will be interesting to see if it continues.

Foreign markets, while performing better than last month, continue to underperform U.S. Equities due to the re-opening; as global vaccination rates are much lower (15%). Important to the analysis of our global supply chain is the fact that low income countries, on average, only have a 1.5% vaccination rate. Continued supply chain shocks should be expected in the foreseeable future.