August 2020 Market Recap

By Clint EdgingtonPosted on September 1st, 2020

In our last market update, we felt the market is constantly trying to handicap “how the COVID-19 Pandemic will be solved, when…, and how much permanent damage…”. In short, the market liked the news on that front throughout August as case counts began to once again moderate and news of vaccine developments and timelines generally became more optimistic.

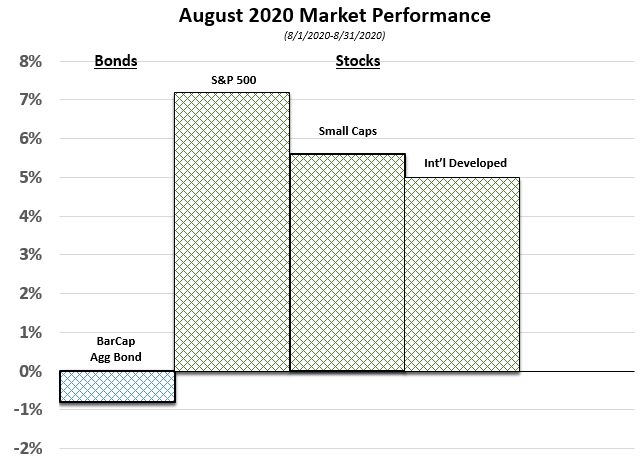

In addition, what may appear to be a nuanced change in Fed policy (from targeting a 2% inflation rate to maintaining a 2% average inflation) rate over time while maintaining it’s dual (and conflicting mandate) of maintaining full employment is anything but. Keep in mind, hikes to interest rates generally hit the real economy with a lag and, historically, the Fed would begin bumping the interest rates up in advance of hitting full unemployment. In practice, this means that they plan to overshoot and are willing to deal with higher rates of inflation. This shift continues the Fed’s extremely accommodative stance. Most markets responded by predicting (and pricing in) future asset price increases (and dollar inflation). Bonds, on the other hand, dislike that inflationary policy and were the only major asset class with negative returns for the month.

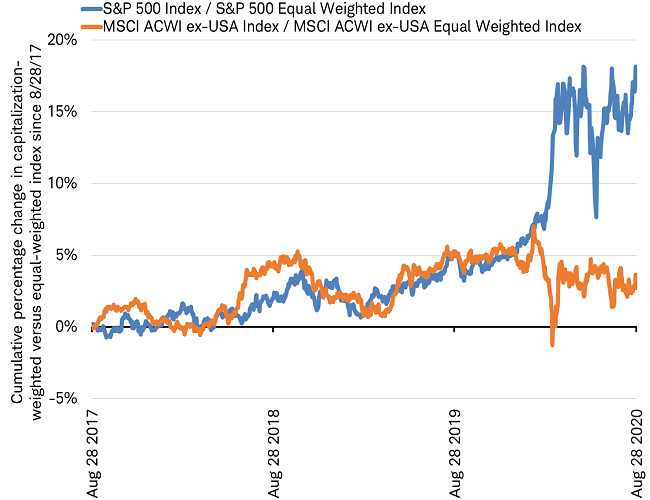

While market weighted indexes have been powered by Large cap companies, specifically technology companies (which makes some sense during these ‘work from home times’), underneath those headlines there are irregularities that have been present for awhile but have extended. Large cap companies have extended gains over small cap companies by historic measures in the U.S. markets. This doesn’t appear to be due to some fundamental difference in the economy due to Covid- as we can see it’s not occurring in international markets.

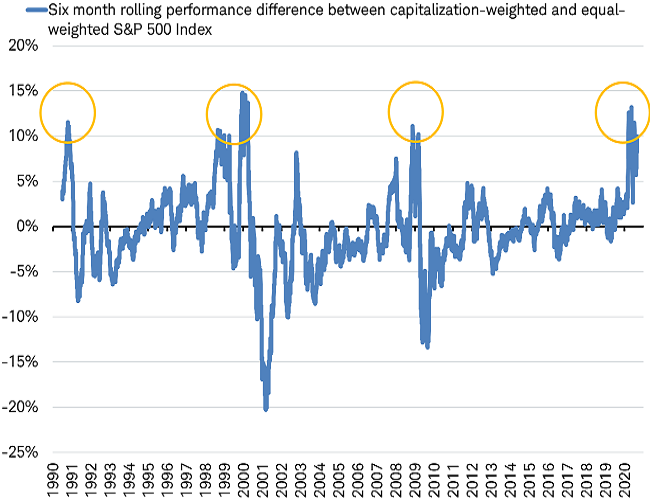

Economic theory (and practice) tells us this is a mean reverting phenomenon and, historically we have seen that to be true:

Peeking behind the curtains, while the U.S. indices have outperformed International Indices due to Large U.S. Company’s robust performance, the average International company has now been outperforming the average U.S. company. This same phenomenon is occurring in Growth and Value within U.S. markets. In short, if investors have not rebalanced their portfolios they will be heavy in U.S. large cap companies and may consider doing so now.

Resources:

Jeffrey Kleintop, “Stock Market “Inequality” Hides A Big Change,” Advisor Perspectives, September 1, 2020, (Source)