Q1 2024 Market Review

By Clint EdgingtonPosted on April 22nd, 2024

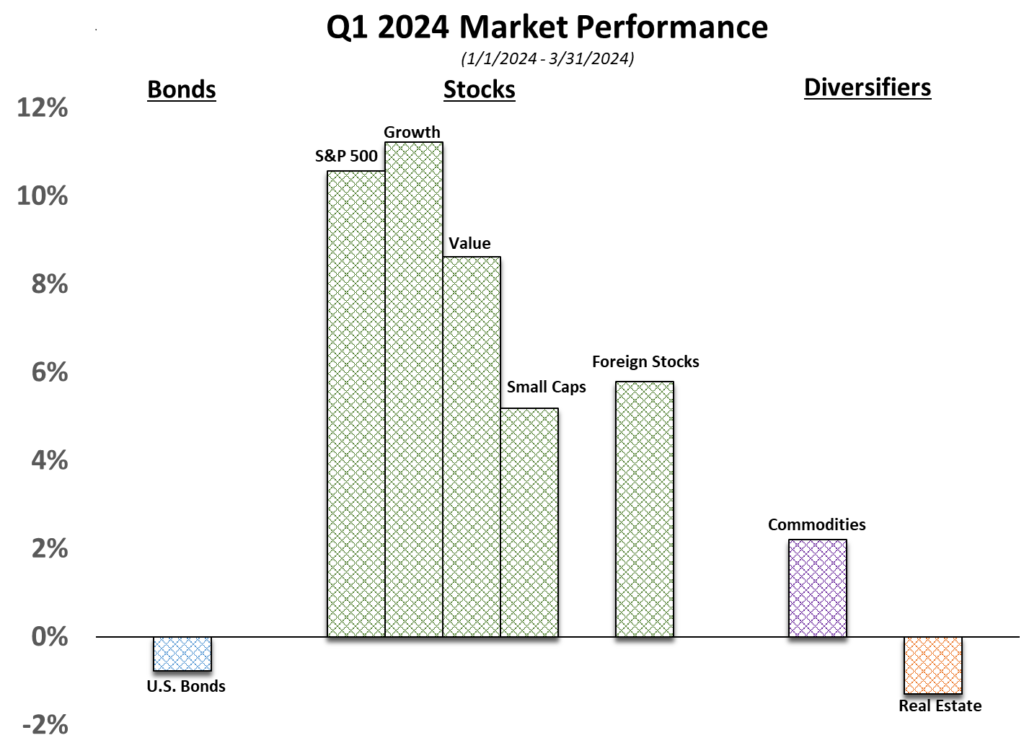

U.S. Equity markets started 2024 off on a tear, although it’s since given a bit back since the end of the quarter. The market has collectively hoped for a soft landing since the Fed began tightening, and it seems we’ve not only achieved that, but the economy remains surprisingly strong.

The gain this quarter was focused on Big Tech, and in particular a few of the larger tech stocks that would benefit from AI powered most of those gains. While the gain continued to focus on a handful of large technology companies, other major equity asset classes (small cap, foreign, value, etc.) also had heady gains.

Real estate and fixed income performance, however, struggled as the trend of decreasing inflation seemed to wane with higher readings in February and March. While the higher readings don’t show the heady inflation experienced in the past few years, they certainly temper expectations we discussed last quarter of significant rate cuts by the Fed early in the year and, generally, the Fed is usually reluctant to make significant shifts as elections approach. With the changes in expectations, bond yields floated up .3%-.4% almost all along the yield curve, decreasing bond pricing and increasing funding cost for real estate.