September 2021

By Mark FisselPosted on September 20th, 2021

Monthly Market Recap

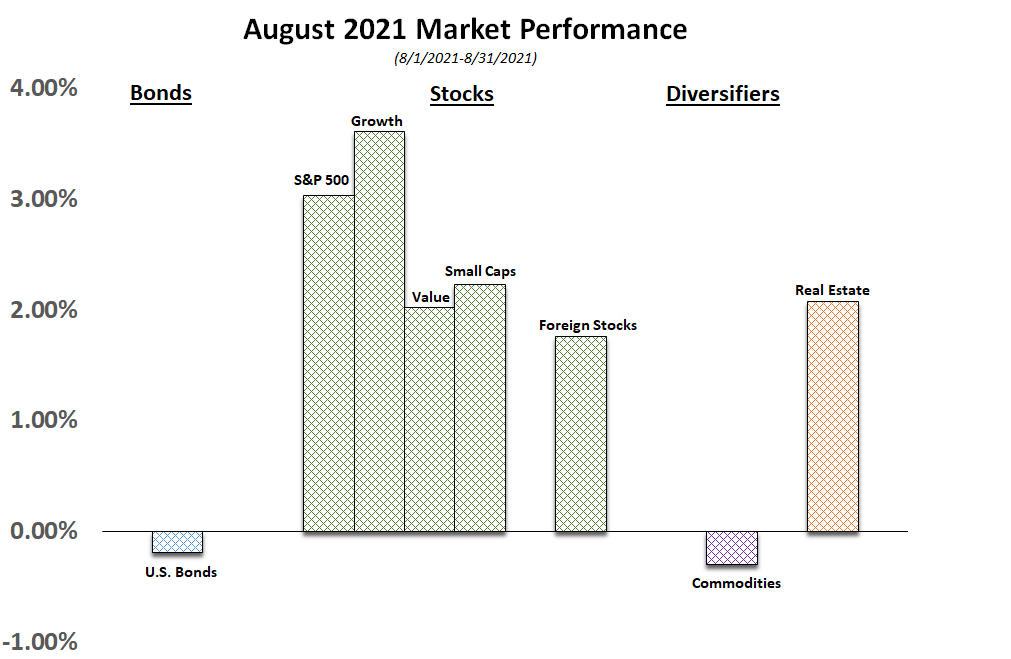

Equity markets worldwide continued their positive momentum as reopening continues, with a number of developed markets further lifting restrictions in the face of continued concerns of COV-19. Economic data was broadly strong again but appears to generally be exhibiting slower growth.

IHS Purchasing Managers Index’s 61.2 reading[1] of 61.2 fell and showed the slowest growth in 4 months, but only from the record setting July of 63.4.

Orders are up and production is up. Supply chain constraints seem to be working themselves out slowly.

$3.5 Billion Budget Plan Gets House Approval

The House passed a $3.5 trillion budget resolution this week and set forth plans to vote on the bipartisan infrastructure bill by the end of September. The budget resolution allows Democrats the ability to use the budget reconciliation process to pass the final bill – needing only a simple majority in the Senate.

The Budget Resolution reflects priorities in both the Build Back Better Agenda, and the American Families Plan. Provisions include expanding Medicare, family leave and child care, extending child tax credits, and investments in clean energy.

401(k) Lifetime Income Illustrations

The SECURE Act, signed into law in 2019, requires sponsors of 401(k), and similar workplace retirement plans, to include two lifetime income illustrations at least once annually on participant statements. The interim rule, released last year, is set to take effect on September 18, 2021.

The DOL’s Employee Benefit Security Administration (EBSA) posted Temporary Implementing FAQs which clarify points not addressed in the interim rule. The FAQs address concerns on when the first illustrations must be included on participant statements.

Grandparent 529 Plans Get a Boost Under New FAFSA Rules

529 plans are a favored way to save for college due to the tax benefits and other advantages they offer when funds are used to pay a beneficiary’s qualified college expenses. Up until now, the FAFSA (Free Application for Federal Student Aid) treated grandparent-owned 529 plans more harshly than parent-owned 529 plans. This will change thanks to the FAFSA Simplification Act that was enacted in December 2020. The new law streamlines the FAFSA and makes changes to the formula that’s used to calculate financial aid eligibility..

Under the new FAFSA rules, grandparent-owned 529 plans still do not need to be listed as an asset, and distributions will no longer be counted as untaxed student income. In addition, the new FAFSA will no longer include a question asking about cash gifts from grandparents. This means that grandparents will be able to help with their grandchild’s college expenses (either with a 529 plan or with other funds) with no negative implications for federal financial aid.

However, there’s a caveat: Grandparent-owned 529 plans and cash gifts will likely continue to be counted by the CSS Profile, an additional aid form typically used by private colleges when distributing their own institutional aid. Even then it’s not one-size-fits-all — individual colleges can personalize the CSS Profile with their own questions, so the way they treat grandparent 529 plans can differ.

Company Stock & Your Retirement Strategy

The opportunity to acquire company stock — inside or outside a workplace retirement plan — can be a lucrative employee benefit. Your compensation may include stock options or bonuses paid in company stock. Shares may be offered at a discount through an employee stock purchase plan and held in a taxable account, or company stock might be one of the investment options in your tax-deferred 401(k) plan.

CONCENTRATE ON DIVERSIFICATION

The possibility of heavy losses from having a large portion of your portfolio holdings in one investment, asset class, or market segment is known as concentration risk. Buying shares of any individual stock carries risks specific to that company or industry, so a shift in market forces, regulation, technology, competition, scandals, and other unexpected events could damage the value of the business.