August Market Recap

By Clint EdgingtonPosted on September 7th, 2021

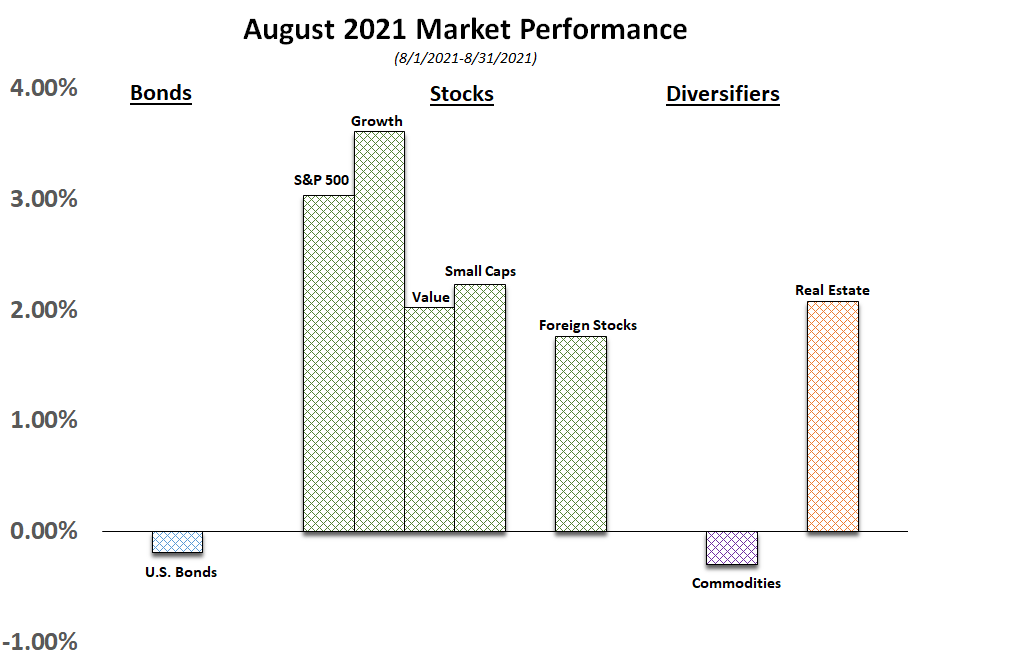

Equity markets worldwide continued their positive momentum as reopening continues, with a number of developed markets further lifting restrictions in the face of continued concerns of COV-19. Economic data was broadly strong again but appears to generally be exhibiting slower growth. IHS Purchasing Managers Index’s reading[1] of 61.2 fell and showed the slowest growth in 4 months, but only from the record setting July of 63.4. Orders are up and production is up. Supply chain constraints seem to be working themselves out slowly.

While economic reopening has continued, concerns grew over variants to COV-19 and increasing case counts and hospitalizations. On that front, the FDA approved booster shots for vaccines and gave permanent approval to Pfizer’s vaccine formula. Vaccination rates, dropping in the early summer, were boosted in August.

Equity markets generally also cheered the passing of the Bipartisan $1T infrastructure bill. Bondholders, on the other hand, were leery of the inflationary pressures brought about by fiscal stimulus. That, coupled with more participants viewing the Fed tapering bond buying sooner pressured interest rates up and bonds down.

[1] Anything over 50 shows an expansion.