March 2021 Market Recap

By Clint EdgingtonPosted on April 5th, 2021

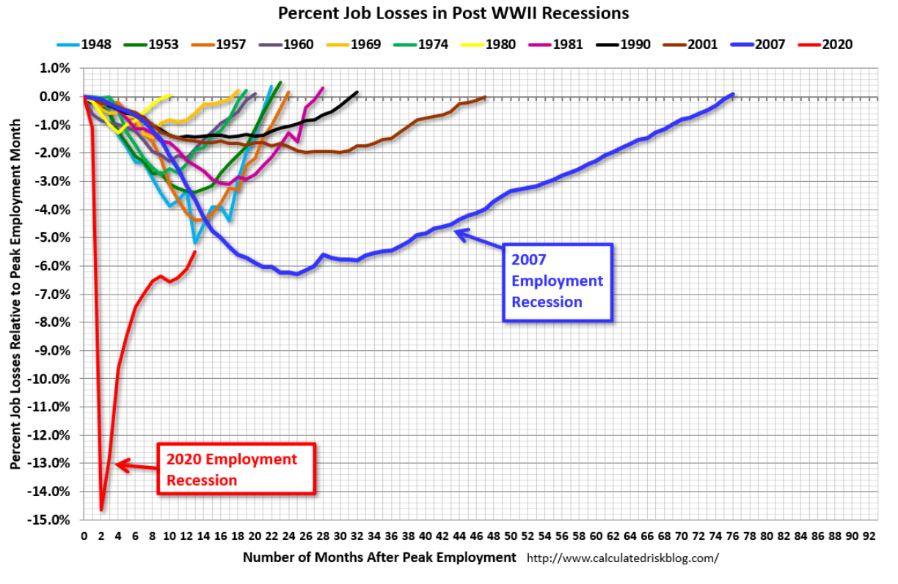

The gradual economic growth discussed last month showed signs of accelerating in March. Employers hired more, with January and February’s employment gains of +545k being revised up by 156k more jobs. March’s non-farm payroll employment shot up by another 916k jobs to move the unemployment rate down by 6%. In addition, the “participation rate” (those looking for jobs) increased slightly as well. This points to one of the sharpest recoveries to one of the sharpest contractions.

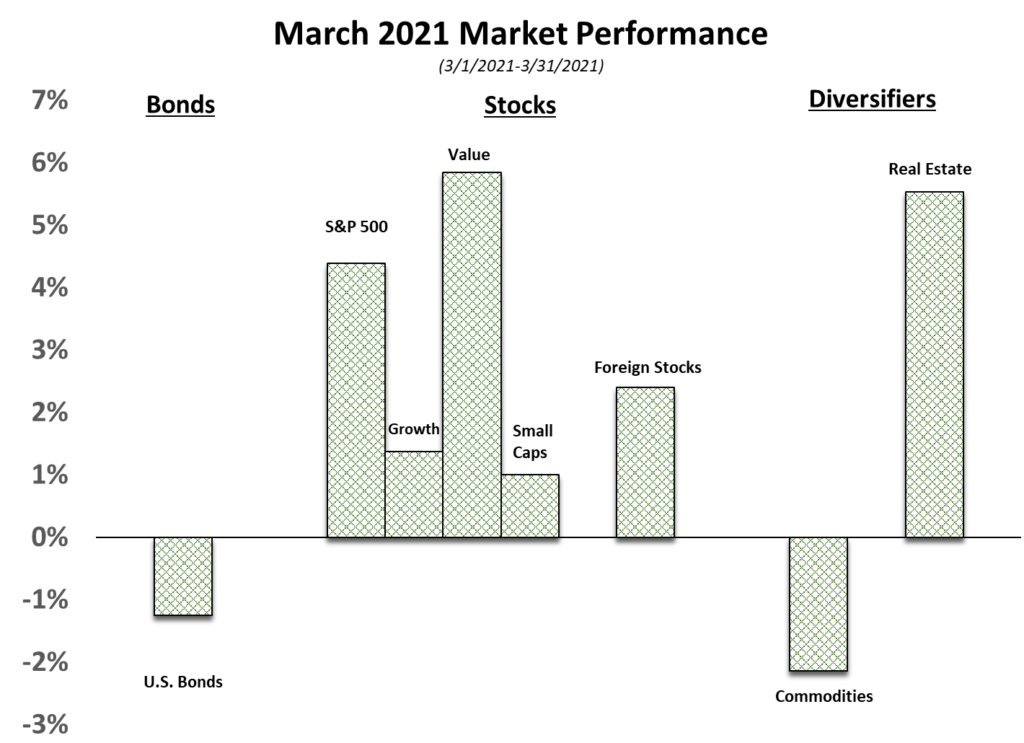

The reflation of assets, the economy, and the inflation likely to come along with it was made apparent in how markets performed this quarter.

The trend away from “work from home” big tech and towards more “old line” companies and higher interest rates generally continued, although less defined. Value companies continued their outperformance yet smaller companies did not. Biden’s American Jobs Plan (announced last week with hopes of passage by July) would have major implications for future interest rates with another $2T in spending over the next decade, on top of the significant stimulus of the past year. Markets haven’t reacted much, in our estimation, to the chorus of tax increases both on corporations (Biden’s infrastructure plan would be paid for by increasing the corporate tax rate from 21% to 28%) and individuals earning more than $400k.