Pandemic + Massive Stimulus = Big Impact

By Clint EdgingtonPosted on April 2nd, 2020

Our Perspective for Individual Investors and Businesses

Executive Summary: Stimulus at a breathtaking, alarming scale

The suddenness in the mandated halt in the economy due to the Covid-19 pandemic is unprecedented. Alarmed at the outlook of a crashing economy, the government has pulled out all the stops. This is a firehose response that makes the stimulus of 2008 and 2009 look like a squirt gun!

The fiscal stimulus package of $2.2 trillion dwarfs the stimulus package during 2008 and 2009. The motives for enacting a program on this scale, with an election coming in November, might be sincere, political or most likely some combination of the two. The Trump Administration’s calling card has been economic growth. To maintain this, they have brought out all the guns.

Monetary Stimulus:

The Fed has moved so far and fast since its March 15 actions that it’s breathtaking.

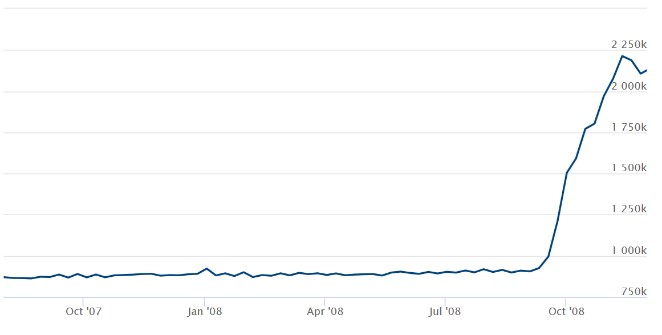

During the Great Recession of 2008-2009, the Fed shocked small government adherents by purchasing not just treasuries, but “agency” debt that financed our housing market. The Fed wasn’t given that right with the Federal Reserve Act of 1913, but Congress granted it during the 1960s. The Fed used this tool for the first time at scale during the Great Recession. At the peak of “Quantitative Easing,” the Fed held some $2.1 trillion in assets purchased through QE on its balance sheet. The Fed is not enabled to risk taxpayer money (though the Treasury is), so sticking to the government guaranteed debt historically was paramount.

On Sunday, March 15, the Federal Reserve embarked on our new Quantitative Easing, announcing a cut to the Fed discount rate to 0%-.25% and purchasing “at least” $700 billion of treasuries and agency backed securities. [1]

The Fed has now (as of April 9, 2020) promised “unlimited” quantitative easing if required and is pledging to buy assets that may not truly be within their authority to purchase. This includes commercial paper, commercial mortgage backed bonds, corporate bonds, high yield bonds, collateralized loan obligations, municipal bonds, direct loans to, among others possible actions. The change in the paradigm of the Fed previously only lending to banks and buying government guaranteed bonds to directly buying corporate securities (including those of low credit quality prior to Coronarivus) and lending directly to corporations is drastic both in scope and purpose.

I know nothing more about the Covid-19 virus than other armchair quarterbacks. If it is handled quickly, this stimulus will be overkill. If it’s not, it could still turn out to be overkill as there is only so much benefit to reducing interest rates and increasing liquidity in an economy that isn’t working. Hopefully the $700B in pledged monetary stimulus and the promise of more if needed will allow the economy to get back on its feet without having to pump “unlimited” money in the economy. At a certain point, the Fed loses its ability to apply leverage. If no one can work, the economy can’t grow again, and we potentially have inflationary pressures at the same time as high unemployment. This “stagflation” is an outcome all economists fear and folks who remember the recession during 1973-1975 do as well.

Who will be the winners and losers?

As we saw with the stimulus of 2008 and 2009; after the economy began growing again and fear subsided, there was a large increase in asset values. This inflation shows up in many ways. For example, real estate prices have had robust growth (until the past month) as have stock prices. Owners of assets that exhibit pricing power generally will do well. Borrowers will benefit from reduced interest costs. Hard assets, such as certain sectors of real estate and infrastructure, may be good places to be. Lenders and savers, on the other hand, will be the ones who foot the bill. Those on fixed incomes will have their real spending power reduced.

In addition, keep in mind that our government’s debt must be financed. If it gets out of reasonable ranges, our financing costs go up. In very round numbers, our government collects about $3 trillion in taxes and spends about $4 trillion per year; for an average annual deficit of a bit less than $1 trillion. The federal government was already running at a high deficit after the TCJA tax cuts in 2018, and this stimulus package only exacerbates it. In the long term it does not seem sustainable. While I generally believe that politicians focus on the short term and their reelection windows, I would not count on taxes being lowered in the future.

How should this impact my investments?

- Focus on tax efficiency. Income taxes are currently set to sunset back to the higher income tax brackets in 2026. If our escape from this pandemic isn’t relatively swift, it is fair to say the odds of a tilting of power towards the Democratic Party in the November elections is more likely today than it was in January. Should the GOP remain in power, they still will have a difficult time keeping taxes at current rates or even lower with a growing, massive debt – and politicians already are discussing additional spending in the coming months. With reduced stock values and the odds of higher future tax rates, now is a good time to analyze converting a portion of your tax-deferred IRAs to Roth accounts. This allows you to lock in the current lower tax rates, and any gains in those accounts will be tax free in the future, during a higher tax regime.

- From an asset allocation perspective, if you are comfortable with your portfolio and the losses it has likely taken, I would not recommend changing your asset allocation so that you can benefit when the market turns. If you buy individual securities, think about how this will impact their future cash flow and whether they have the reserves required to weather a prolonged downturn.

How should I protect my business?

For business owners, I would recommend preparing for winter but hope for a quick resolution. Take advantage of every government and local assistance in the case this impacts your business in unforeseeable ways. Even if your particular business doesn’t appear to be impacted, there could be major impacts to supply chains and your partners. Do what you can to get a cash cushion or liquidity. It’s a good time to identify alternate sources for key materials and supplies if you haven’t done so already.

A Deeper Dive for Those Interested: Historic Perspective

The scope and breadth of the current operations are enormous

For context of the scope of change, let’s zoom out and look at the big picture. The government has two basic tools to stimulate an economy:

- Fiscal Stimulus – This is direct spending or reduced taxation that is passed by legislation. It generally takes a while to percolate into the economy but can be targeted.

- Monetary Stimulus – This is basically increasing the supply of money. It can be implemented instantaneously. This is conducted by the Federal Reserve and is supposed to be independent of politicians. That independence has always been called into question. The current President does not shy away from making his feelings known.

Fiscal stimulus, the Federal Reserve and money

The Federal Reserve Act of 1913 established the Federal Reserve to address banking panics due to crises of those times, most notably the panic of 1907. [2] The Federal Reserve has two main policy goals, which often exist in conflict:

1.) Low unemployment and

2.) Price stability

It is a balancing act, and they have crude tools to manage it. Both of these policy aims are influenced by the money supply in opposite ways. The money supply is effectively the stock of money (which is defined in a hundred different ways) times the velocity of that money, or how often that money changes hands. If you have a $100 bill under your mattress, it doesn’t add much to the money supply since there is no velocity. More economic activity is generated if someone has that same $100 and instantly spends it at a business which in turn instantly spends it, etc. In the middle of the two, if you take your $100 from your mattress and deposit it with your bank; and the bank then lends out $80 to another business, your “mattress $100” now generates economic activity.

If the money supply increases, then unemployment will generally go down and inflation will go up, and vice versa.

The Fed is not omnipotent in managing the money supply, however. Citizens, business owners, and bankers directly impact the velocity. If I believe I will lose my job, I will generally spend less and save more, therefore decreasing the velocity of money. If a bank believes a business won’t last through a recession and won’t lend to it and thus increases its reserves, it has also reduced the velocity of money. In those cases, the Fed acts as a counterbalancing force.

The Feds’ historical tools:

- Reserves

The amount that banks must hold are called their “reserves”. For each dollar they bring in as a deposit, they cannot lend that full dollar out. If they make commercial loans that eat into their reserves, they must borrow from other banks or the Fed itself through its “discount window” at the Federal Reserve Rate.

- Discount Rate

Historically, the tool used by the Fed the most was changing the discount rate. This is the rate banks borrow from the Fed and from each other and is a short-term rate. The Fed historically didn’t directly impact longer term rates, such as mortgages. However, by decreasing the Discount Rate it would decrease the bank’s cost of capital, and banks would be incentivized to lend more at lower rates.

When you hear that “the Feds cut interest rates,” keep in mind that the Fed only has direct control over one rate. While that rate won’t directly affect interest rates for consumers, it slowly trickles into other rates as banks make more on their existing loans and are compelled to be competitive to get more loans. With bank lending interest rates reduced, investors are compelled to settle for lower corporate bond rates, etc. However, this takes time.

2008 recession brings a new tool: Quantitative Easing

Prior to the Great Recession of 2008/2009, the Federal Reserve was stuck with the previously mentioned policy tools. However, the strain on our financial markets was acute and focused on the real estate and banking sectors. In addition, the chair of the Federal Reserve, Ben Bernanke, had generally considered previous Fed interventions as “too little, too late”.

Yet the Fed also has a third, previously rarely mentioned or used power. That’s the power to buy additional assets to fulfill its mission. Section 14 [3] of the Federal Reserve Act explicitly gives the Federal Reserve the power to buy assets beyond treasuries, such as gold, state and local government bonds, etc., yet it did not give the Fed the statutory right to buy government guaranteed or corporate debt or equity. However, in 1966 Congress gave the Fed power to buy agency debt – the mortgages backed by Fannie and Freddie Mac. Thrift savings banks were struggling then and not lending to the mortgage market in the amount Congress thought they should. The Fed fought for independence from the legislature and had a view that purchasing mortgage obligations, rather than treasuries, was impacting the price of money for one sector over the others. Congress leaned on the Fed and, in September 1966 passed the Interest Adjustment Action that gave the Federal Reserve that right. Further legislation would have required intervention, intervention that Federal Reserve Board Chairman Martin thought would “violate a fundamental principle of sound monetary policy, in that it would attempt to use the credit-creating powers of the central bank to subsidize programs benefiting special sectors of the economy.” [4] While withstanding Congressional pressure at first, as a token to Congress, the Federal Reserve dipped its toe into this area in the 1970s but by and large stayed out of that market. Peak holdings were less than $10 billion, or less than .5% of what was to come after the 2008-2009 recession.

In 2008, the Federal Reserve focused on the banking and real estate/mortgage sector. While they had reduced their Fed “discount” rate already, they recognized they could more expediently reduce the costs on individual mortgages by buying “agency” mortgage backed securities in the open market. It had always been assumed, but never defined, that Fannie and Freddie Mac were backed by the U.S. government. The two agencies had always operated in a gray area, generally spoken of as “quasi-government agencies,” with an unspoken government guarantee.

2008 “Quantitative Easing 1”

Once the agencies had lost almost $15 billion and had seized up lending, the Fed embarked on “Quantitative Easing.” It was announced on Nov. 25, 2008, that the Fed would begin purchasing debt and mortgage backed securities issued by Fannie Mae and Freddie Mac. And purchase they did, towards the end of 2008 the Federal Reserve significantly tripling its balance sheet to then-unheard-of levels during what is now known as Quantitative Easing 1 (“QE1”).

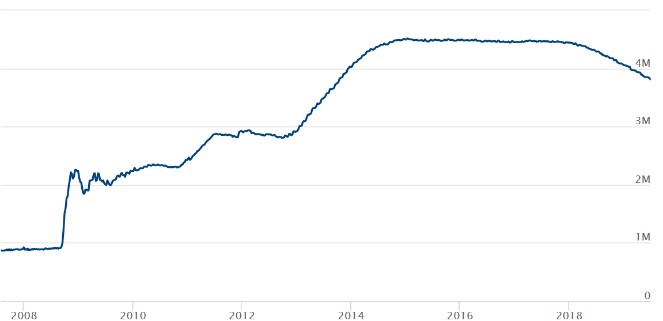

Further Quantitative Easing

Astute readers with no financial history knowledge can probably predict what comes next: QE2 and QE3 further ballooned the Fed’s balance sheet until our “normalization” policy of allowing the bonds to slowly runoff began to occur in late 2017.

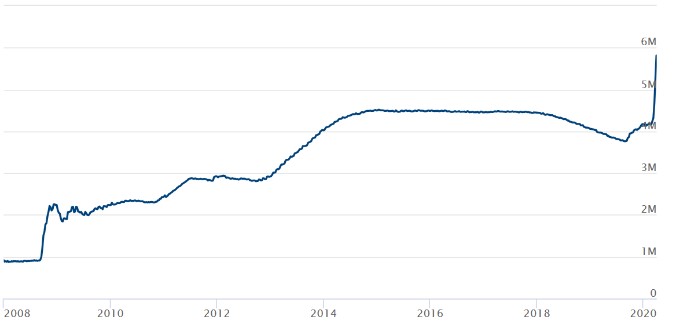

Today’s Stimulus

Today, the scale and speed of the purchases, announcements, and expansions of assets purchased are unprecedented. The spike seen in March of 2020 has occurred in less than 15 trading days and by all accounts just beginning!

The type of the assets is unprecedented, too. While the Fed was in a moral quandary in the late 1960s to include government agency bonds in its purchases; the 2008-2009 Federal Reserve got over their historic qualms quickly.

Yet the limitations on purchasing non-government guaranteed assets still exists. The Fed is not able to buy investments that put taxpayer funds at risk. To get around these limitations in 2020, the Treasury Secretary approved setting up special-purpose vehicles (SPV) that the Fed lends to. The Treasury then injects some “first loss” capital in the form of equity through its Exchange Stabilization Fund as the intent of the Fed is not to put taxpayers’ capital at risk. In addition to more traditional forms of stimulus, the SPV’s we have that bend the definition of the Fed’s mandate so far are, amongst others:

- Credit to Large Employers

- Primary Market Corporate Credit Facility (PMCCF) for new bond and loan issuance

- Secondary Market Corporate Credit Facility (SMCCF) for outstanding corporate bonds

- This includes both individual corporate bonds and exchange traded funds that own both investment grade AND non-investment grade corporate bonds [5]

- Asset Backed Securities for consumers and businesses

- Term Asset-Backed Securities Loan Facility (TALF) to purchase student loans, auto loans, credit card loans, SBA guaranteed loans, etc.

- Municipalities

- Money market Mutual Fund Liquidity Facility (MMLF)- an expansion

- Commercial Paper Funding Facility (CPFF) to include high quality tax exempt short term bonds.

- Main Street Business

- Lend to small and mid-sized companies at up to 4 X EBITDA (highly levered)

With this historical context, we can see how the

federal government has moved significantly beyond its prior mandates. The Federal Reserve of the 1960s resisted

buying government backed bonds backed by the housing market as it would impact

the price of credit for that section.

The actions of our current Federal Reserve in buying bonds of specific

companies, and therefore impacting the price of credit, would have been seen as

“picking winners and losers” and likely would have shocked the Fed’s

predecessors.

[1] “Federal Reserve issues FOMC statement,” Federal Reserve Board, March 15, 2020, (Source)

[2] The panic of 1907 has fascinating parallels to the 2008 financial meltdown. If interested, read more here: https://www.federalreservehistory.org/essays/panic_of_1907

[3] U.S. Congress, House, Federal Reserve Act, H.R. 7837, 63rd Cong., introduced August 29, 1939, Section 14, (Source)

[4] Senator Lausche quoting Federal Reserve Board Chairman Martin, 90th Cong., 2nd sess., Congressional Record 114 (July 24, 1968): pt. 18: 23027

[5] “Secondary Market Corporate Credit Facility,” Federal Reserve Board, April 9, 2020, (Source)