July 2020 Market Recap

By Clint EdgingtonPosted on August 3rd, 2020

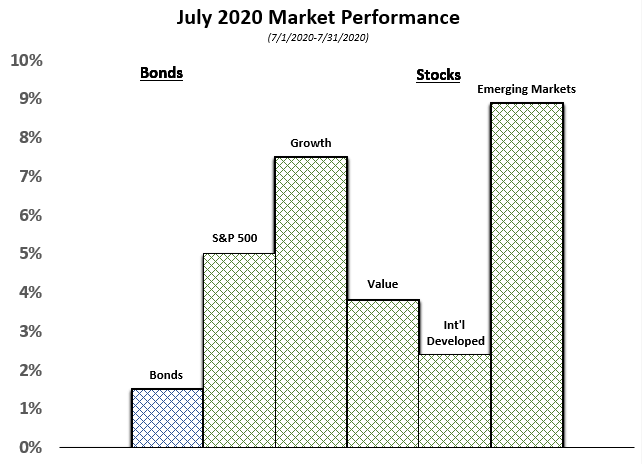

July markets continued general trends already present in equity markets. The S&P 500 returned 5% while fixed income markets continued to exhibit caution with yields dropping and returning 1.5%. The 10 year note yield dropped from .7% down to the current level at .56%, indicating the bond market shows little concern for medium term inflation. Growth stocks continued to outpace Value stocks, with the Russell 3000 Growth clocking a 7.5% return to Russell 3000 Value’s more subdued 3.8% return, as some of the largest Growth stocks in the index (Amazon, Facebook, and to a lesser extent Apple) benefit from the Work from Home trend.

While GDP figures

for Q2 showed a dismal quarter, with GDP dropping by almost a third, the

Government has stepped in to plug the gap, and personal incomes have increased

slightly. This gap won’t be plugged by

the government forever, and the market continues to look to how the COVID-19 Pandemic will be

solved, when it will be solved, and how much permanent damage to the economy

may come. International markets

exhibited strength as well, with developed economies[1]

posting a 2.4% return. Emerging markets[2]

signaling “risk off” with an 8.9% return as investors displayed comforts in

their economic prospects and an outlook of a weaker dollar.

We’ll continue to keep a close eye on the markets during this pandemic. The possible upcoming economic relief proposed by Congress is sure to create a ripple effect as well. Keep an eye on our blog and subscribe to our newsletter to stay updated during these strange times!

[1] MSCI EAFE GR

[2] MSCI EM NR