Covid-19’s Impact on Main Street and Wall Street

By Clint EdgingtonPosted on April 2nd, 2020

Impact on the Market

Covid-19’s impact on the financial markets and the real economy has been severe and historically fast.

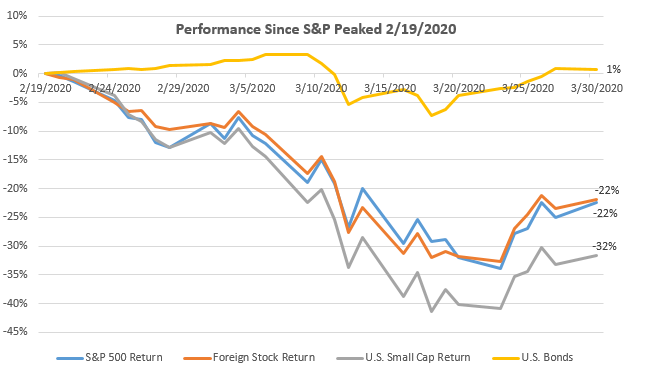

In our March newsletter, we mentioned the market had experienced its “fastest 10% drop from an all-time high” and that “you can quickly daisy-chain a set of scenarios that begins to impact corporate profits significantly.” It wasn’t a prediction, yet it has happened. [1] In sixteen days, we had the fastest bear market [2] in financial markets in modern history. True to past history when stocks drop quickly, bonds maintained their value relative to stocks. Foreign stocks performed relatively in line with U.S. stocks, also not a surprise since this is a global issue. Smaller companies underperformed significantly.

The markets have priced in a medium-mild recession

Since then most states enacted “stay at home orders,” shutting down schools and non-essential businesses. While the National Bureau of Economic Research determines whether and when U.S. recessions occur by “a significant decline in economic activity spread across the economy, lasting more than a few months,” it simply takes driving down empty roads to know we’re in a recession.

The economy won’t recover until Covid is contained

If contained relatively quickly, there is a good chance we will have a relatively fast, V-shaped recovery due to reasonable leverage in the private sector and banks. That will be quite unlike the 2008-2009 downturn. Other factors that can speed recovery include the staggering fiscal and monetary stimulus the federal government has enacted. That doesn’t mean everyone will be okay. You can expect some bankruptcies in directly affected sectors such as entertainment, travel, oil and gas, and negative results in most sectors, but with losses that could be manageable. Keep in mind that the real economy will more slowly return to trend growth, yet the financial markets will likely predict that in advance.

If it not contained, this will spread through most sectors of the real economy and the recovery will take longer, more like the shape of a “U” or an “L.” While a recession brought about by an outside shock, such as Covid, is very different than a recession brought about by major deleveraging (the Great Recession of ’08/’09), it’s instructive to look at financial markets in our last drawdown. When the market started a slow grind downward in late 2007, we were not sure there would be market tumult. At that point, only New Century Financial (a high risk mortgage lender) had declared bankruptcy. While the market was slipping through 2008, it was not until the Treasury took over Fannie Mae and Freddie Mac — quasi-governmental agencies with pseudo government guarantees — and financial giant Lehman Bros. declared bankruptcy that the markets priced in major stress towards the end of 2008.

If we don’t contain Covid quickly what might this recession look like? What’s the closest historical comparison?

Spanish Flu of 1918: Don’t forget about the close of World War I

The first thought is the Spanish Flu that ravaged the globe in from 1918-1919 would be a reasonable comparison. It’s an “exogenous shock” to the economy that comes completely from outside of our own economy; with quarantines, businesses shut down, etc. Sounds similar, right?? The Spanish flu had hit the shores of America by early 1918 and caused the market to drop by a third (consistent with what we’ve seen in the Covid crisis) yet the market rose back up before deaths hit their peak in 1918. And deaths there were, with more than 1.7% [3] of the world’s population killed. That would be equivalent to 100 million people in today’s population.

The Dow Jones performance from 1917-1919 was over a 35% return. Sounds great! Keep in mind the market is a discounting machine, constantly looking to the future to predict economic growth coming from all corners. What else was occurring then? The close of World War I dwarfs any economic factors that are comparable to our time. In 1918 the market saw the likely end to the war that occurred at the end of 1919. The U.S. economy had geared up and we had truly entered the arena of world powers. At the time when much of the developed world needed drastic rebuilding, our factories were untouched by the war damage to facilities in Europe, Asia and Africa. The U.S. had a huge headwind to jump-start its economy that we don’t enjoy now and therefore this is not a reasonable comparison.

Recession of ’73-’75: An exogenous shock like Covid, but with other conflicting factors

Perhaps an “exogenous” shock such as the Arab oil embargo of 1973 could prove instructive. The members of OPEC targeted the U.S. (among others) with an oil embargo in revenge for supporting Israel during the Yom Kippur war. While the markets got chopped in half, the pain was worse as consumer prices rose in double digits.

Yet this is a muddy comparison as well. In 1971 President Nixon marked the beginning of the end for the Bretton Woods monetary system that had effectively pegged most of the major powers’ currencies to gold. The world considered this an inflationary move, which feeds on itself. The additional inflationary pressures of an oil embargo and the Vietnam War makes this more difficult for comparisons to the current situation. On top of all that, the nation was dealing with the Watergate scandal and the resulting impeachment proceedings and Nixon’s eventual resignation.

The Great Recession of 2008 & 2009: A shock that took time to digest

It could be argued that a financial deleveraging recession can’t be compared to a recession from an exogenous shock like a pandemic.

A deleveraging recession on its face is different than other types. It scares everyone. Initially, no one believes that the party will end. Then it becomes a speeding train with leveraged companies declaring bankruptcy. Towards the end, it is a slow-moving train with companies that realize they need to use their declining profits to pay down debt. No one knows when the stress and deleveraging will end until it is obvious long ago in hindsight. Yet because companies are “once bit and twice shy”, they are conservative for a long time. And so, the recovery for most deleveraging cycles is long and slow.

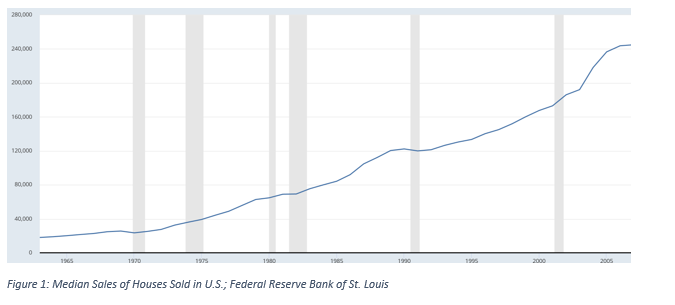

So, how does that apply to April of 2020? It’s not a great fit, but we think it may be the best comparison we have if Covid is not contained in the next few months. However, the beginning of the market slide during the Great Recession is not the right time to start the analysis. At the time, we weren’t sure what we were in for when the market began its slow but sure slide in late 2007. When the market turned downward in 2007, only New Century Financial, a risky mortgage broker, had failed. This was a firm leveraged to the always volatile state of California. It all hinged on the housing market, and data showed that single family houses still had not lost money in any single year nationwide.

In March, 2008 Bear Sterns was forced to sell at a bargain price to J.P. Morgan, and the markets reacted. Yet it wasn’t until Sept. 15, 2008, that Lehman Brothers suddenly declared bankruptcy and at that the markets knew we were in for a rough ride.

Currently, the markets have no doubt we’re in a recession. If Covid is not contained, and people cannot get back to work, it will spread and the markets will react as they did when we knew we were in a recession in September of 2008. Like a deleveraging, if people can’t get back to work; the prospect of the government lending you money does not make you want to employ more people or build more factories.

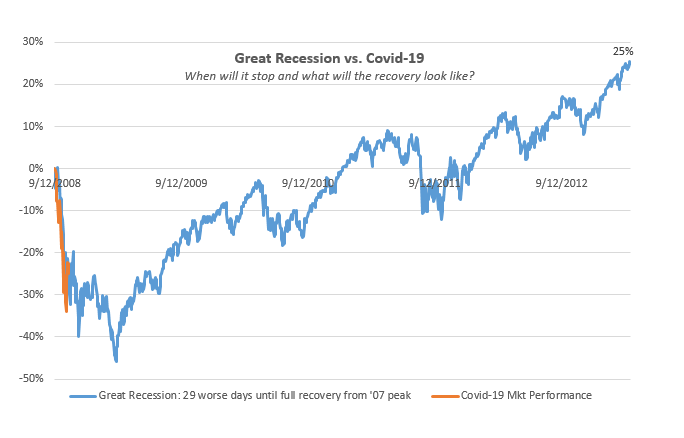

Scaling our analysis beginning in 9/12/2008, when we were sure we were in for trouble, and laying overtop the 29 trading days since 2/20/2020, when we knew we were in trouble due to Covid, shows what could happen if we end up in a similar situation with bankruptcies extending out beyond directly impacted sectors. While this analysis is rife with data issues, it gives us some guardrail to what that experience could look like for us.

In short, with a similar experience to 2008, our equity holdings could likely drop another 25%. For a balanced portfolio with 60% stock and 40% bond, that could be another 15-20% loss. If we experience an L shaped recovery as we did in the Great Recession it could take four years to recover.

We’re more optimistic than that, however. Unlike systemic financial leverage, this is likely a more solvable problem. Recovering from a recession is difficult when deleveraging must occur, which was a headwind in the Great Recession that our corporations and banks do not have today.

Still, all investors must pay close attention. The key is obvious but worth stating: How well everyone – government, businesses and everyday citizens – responds to the virus outbreak and what the virus itself does or doesn’t do in the coming months will determine how bumpy and how long this ride will be.

We’re here to respond to your questions, comments and concerns. Contact us today

[1] We also questioned how new participants would fare. Not great; for example, Robinhood, an online only “free” brokerage option crashed and was unable to be used on March 2, 9 and 12, exactly the days you may have wanted to trade.

[2] Defined as a 20% decrease.

[3] Bryan Taylor, “The Spanish Flu and the Stock Market: The Pandemic of 1919”, Global Financial Data, February 27, 2020, (Source)