Q1 2025 Market Review

By Clint EdgingtonPosted on April 7th, 2025

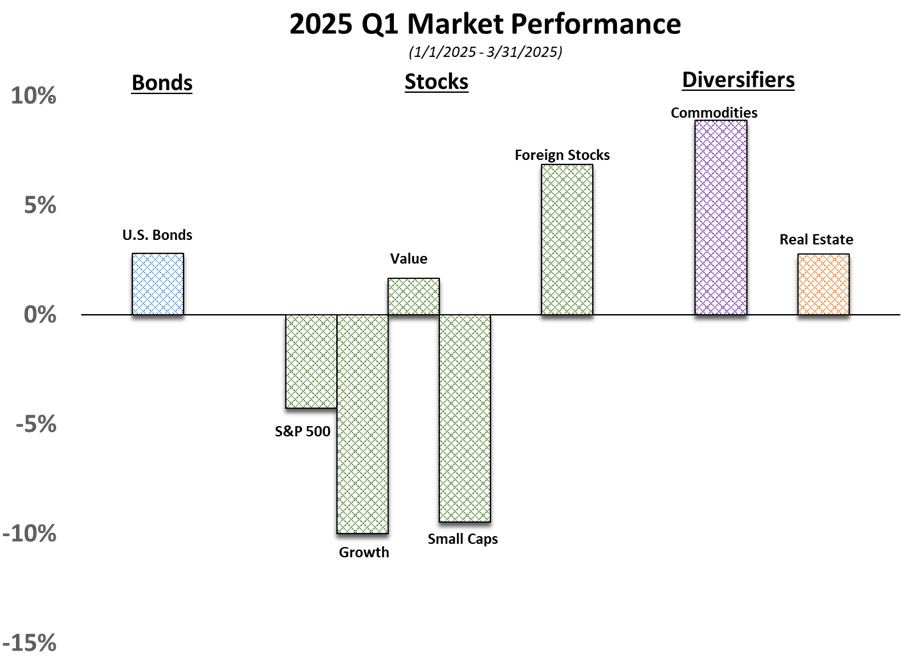

Relatively subdued inflationary pressures and strong economic performance across the economy started the quarter with the bull market intact, hitting all-time highs in February. The trends from 2024 continued, with Growth stocks continuing their outperformance, further stretching their valuations.

The Fed seemingly was on its way to a soft landing, as the Federal Reserve Committee meeting in late January kept rates steady.

Since his first day in office, Trump has set expectations of Tariffs. Generally seen as a successful negotiating technique in his first term and widely expected the market reacted little. The relatively focused tariffs started officially on February 1, 2025, with an executive order imposing tariffs on imports from Mexico, Canada, and China met muted market reactions but prompted outrage and threats of reciprocal tariffs from those countries.

The market drifted down throughout February as additional tariff announcements were made. On April 2, however, Trump broadened these tariffs to a 10% baseline tax on imports from all countries with higher rates for nations that run a trade surplus with the U.S. under an overly simplified formula. The widening shift to global, across the board, has caught the market by surprise and; expecting retaliations, higher prices for local consumers, and inflationary pressures reacted as would be expected with a swift drop, moving into a correction area with a 15% drop from the market highs in February.

Diversification, which has been painful the past few years, paid off in spades as the trends of 2024 quickly reversed as investors abandoned U.S. growth stocks and piled in Value and foreign stocks and stores of value, such as bonds, commodities, and real estate. All members of the “Magnificent 7”, and most AI-driven companies, are down for the year. Diversified portfolios escaped the quarter relatively flat or with muted losses.