Q3 2025 Market Review

By Clint EdgingtonPosted on October 13th, 2025

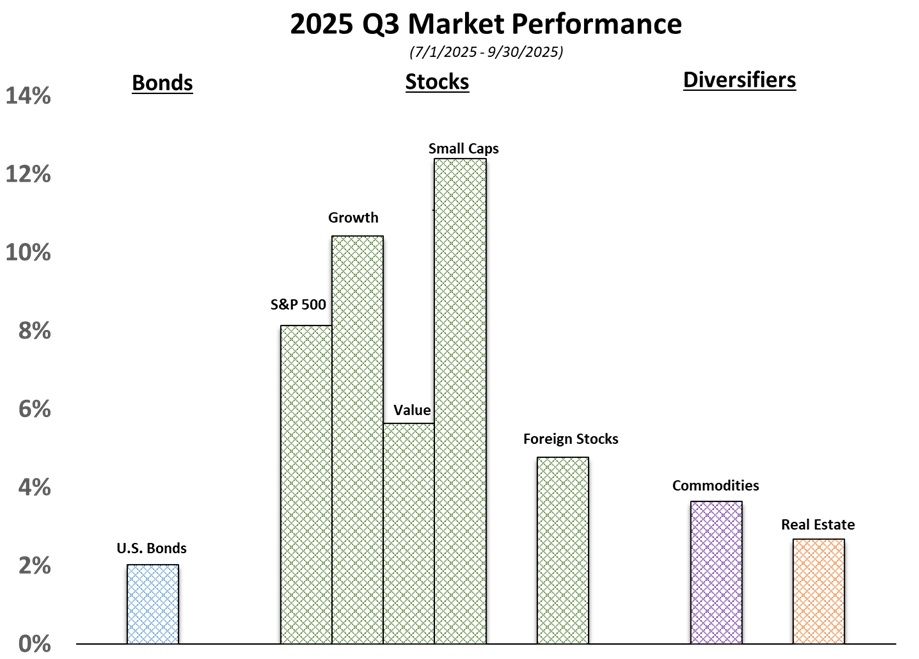

The third quarter continued the trends from last quarter, fully recovering from the drop due to tariff scares this past spring. Equity markets ended at all-time highs, and the bond market enjoyed gains as well, as investor expectations of a rate cut came to fruition.

Economic Fundamentals Maintain Strength

While tariff concerns and headlines weren’t as dominating this quarter and progress was made in areas, a cloud of uncertainty remains, with China in particular. Yet the U.S. economy still shows strength, with a revision to Q2 GDP showing a healthy 3.8% growth rate and corporate earnings reported for Q2 coming in well ahead of expectations.

FOMC Rate Cut Decision

The Federal Reserve Open Market Committee, however, was front and center in the headlines and their September 17 rate cut was widely anticipated (and therefore completely priced into the market) prior to the meeting. As such, the “dual mandate” of the Fed; maintaining inflation at a 2% rate while balancing “full employment”; and the independence it requires to balance those two mandates has come into question. Interestingly, the market was slightly too optimistic as the bond market slightly fell after the announcement. While inflation doesn’t appear to be growing significantly, it’s still above the FOMC’s dual mandate of 2%; however, the labor market did show some softness that allowed the rate cut. Long term bond yields, however, seemed to rise slightly, indicating the market’s questioning of fed independence and their adherence to longer term inflation fighting.

The Quarter Ahead

The release of most economic data has been delayed due to the government shutdown. The shutdown will likely put a drag on GDP and markets but should snapback.