How Much Income Does Social Security Replace?

By Content AdministratorPosted on January 2nd, 2024

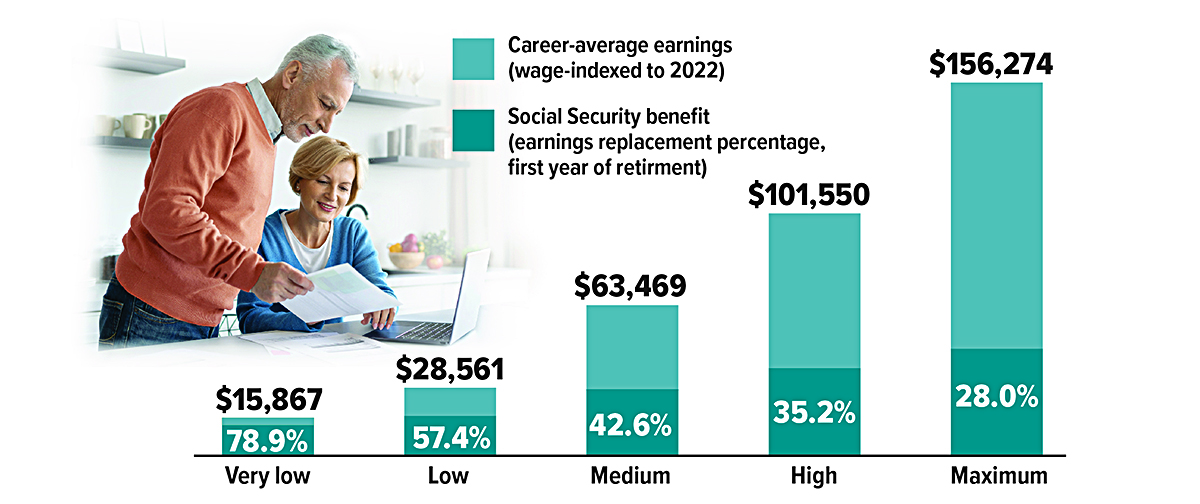

Social Security can play an important role in funding retirement, but it was never intended to be the only source of retirement income. The Social Security benefit formula is based on a worker’s 35 highest-earning years (indexed for inflation). The percentage of pre-retirement income replaced by the social security benefit is lower for those with higher earnings. The assumption is that higher earners can fund their retirement from other sources.

Income replacement rates decrease as wages rise. The chart below is based on five levels of earnings for someone who claims benefits at full retirement age (FRA) in 2024 (i.e., born in 1958 and claiming at age 66 and 8 months). Rates would be similar for those who claim at FRA in other years.

Broadridge