Q2 2023 Market Review

By Clint EdgingtonPosted on August 1st, 2023

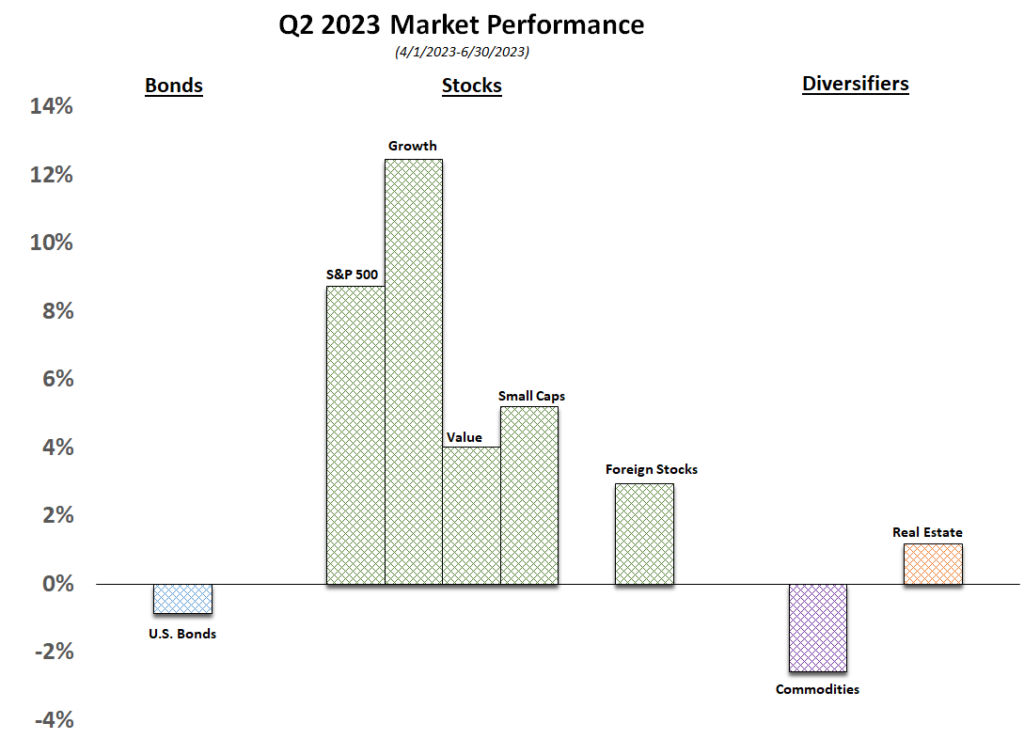

The reversals from 2022 continued into 2023 (thankfully!); with 2022’s worst performing sector, growth stocks; becoming this year’s best performing sector (+28% for the year and 12.5% for the quarter) and last year’s best performer; commodities, being the worst performer. The first quarter’s broad-based rally amongst various asset classes became more mixed. Better than anticipated economic growth buoyed most equities and inflation continued to trend down, however it became apparent that more Central Bank tightening is likely to come, increasing interest rates at most points along the yield curve.

U.S stocks outpaced all developed foreign markets (except Japan) so far this year; driven by the outperformance of tech stocks with general optimism of uses of Artificial Intelligence.

June’s inflation report confirmed our hunch that the downtrend in inflation appeared to be robust, with just a 3% annual increase but, while the FOMC held their target rates steady, they appear to be committed to actions required to move inflation back down to the 2% level. We think it extremely likely that further interest rate increases are likely in the near term.