August 2021

By Mark FisselPosted on August 11th, 2021

Monthly Market Recap

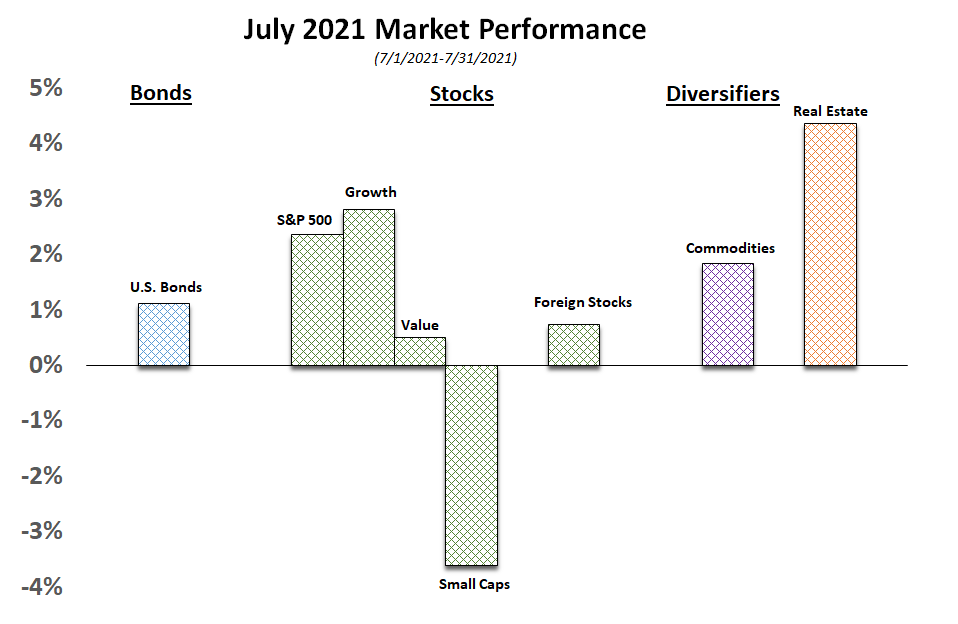

The continuation of the re-opening of the U.S. continues to show the health of the U.S. economy even while dealing with various supply chain issues. The Fed continues to be accommodative and yields on the 10 year treasury continued their recent decline.

As such, U.S. equity markets continued their positive streak in July.

However, the positive returns the overall market returned, masks divergences within different sectors and size. Yes, the economy is very healthy. The emergence of the Delta variant has, however, created uncertainty as to ramifications of potential future partial restrictions.

$1.2 Trillion Bipartisan Infrastructure Plan

Senate Democrats and Republicans came together at the end of July to begin working on an infrastructure spending plan with bipartisan support. The full text of the bill, named the Infrastructure Investment and Jobs Act, was released days later on August 1, and is over 2700 pages long.

The White House states that the investments will add about 2 million jobs per year over the next decade. The $1.2 trillion infrastructure bill includes $550 billion in new spending.

PPP Loan Forgiveness Made Easier

The Small Business Administration (SBA) opened an online “Direct Forgiveness” portal on August 4th. The portal is designed to simplify the forgiveness process for borrowers with Paycheck Protection Program (PPP) loans $150,000 or less. Borrowers can save time by applying for forgiveness through the SBA instead of applying through their bank.

Lenders must opt in to the direct forgiveness program in order to allow the SBA to provide direct forgiveness to borrowers. So far almost 900 lenders have chosen to participate. You can download a list to see if your lender is participating.

Small Business Tax Fairness Act

The Small Business Tax Fairness Act, introduced in July by Senate Finance Committee Chair Ron Wyden, D-Ore., would expand eligibility for middle-income “service” business owners by removing restrictions included in the Tax Cuts and Jobs Act.

Currently, pass-through business owners are able to take a 20% qualified business income deduction (QBID) on their personal tax return. QBI is the net income (profit) a pass-through business earns during the year. Business owners can take the full deduction if their total income is under the threshold.

The American Rescue Plan, signed into law by President Biden this past March, increases the child tax credit for 2021 for many taxpayers. Those with qualifying children under the age of 18, may be able to claim the credit. Taxpayers may also be able to claim a partial credit for certain other dependents who are not qualifying children.

Increased Credit Amount

Children ages 17 and younger are eligible as qualifying children in 2021. Normally the credit is available for ages 16 and under. The credit amount is increasing, for tax year 2021 only, from $2,000 to $3,000 per qualifying child ($3,600 per qualifying child under age 6). The partial credit for other dependents who are not qualifying children remains at $500 per dependent.