April 2021

By Mark FisselPosted on April 6th, 2021

Monthly Market Recap

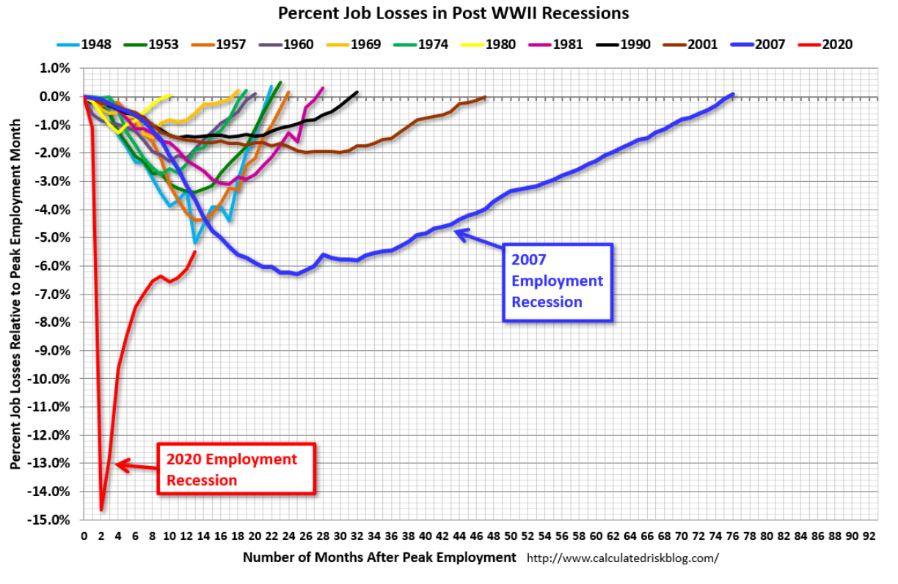

The gradual economic growth discussed last month showed signs of accelerating in March. Employers hired more, with January and February’s employment gains of +545k being revised up by 156k more jobs. March’s non-farm payroll employment shot up by another 916k jobs to move the unemployment rate down by 6%. In addition, the “participation rate” (those looking for jobs) increased slightly as well. This points to one of the sharpest recoveries to one of the sharpest contractions.

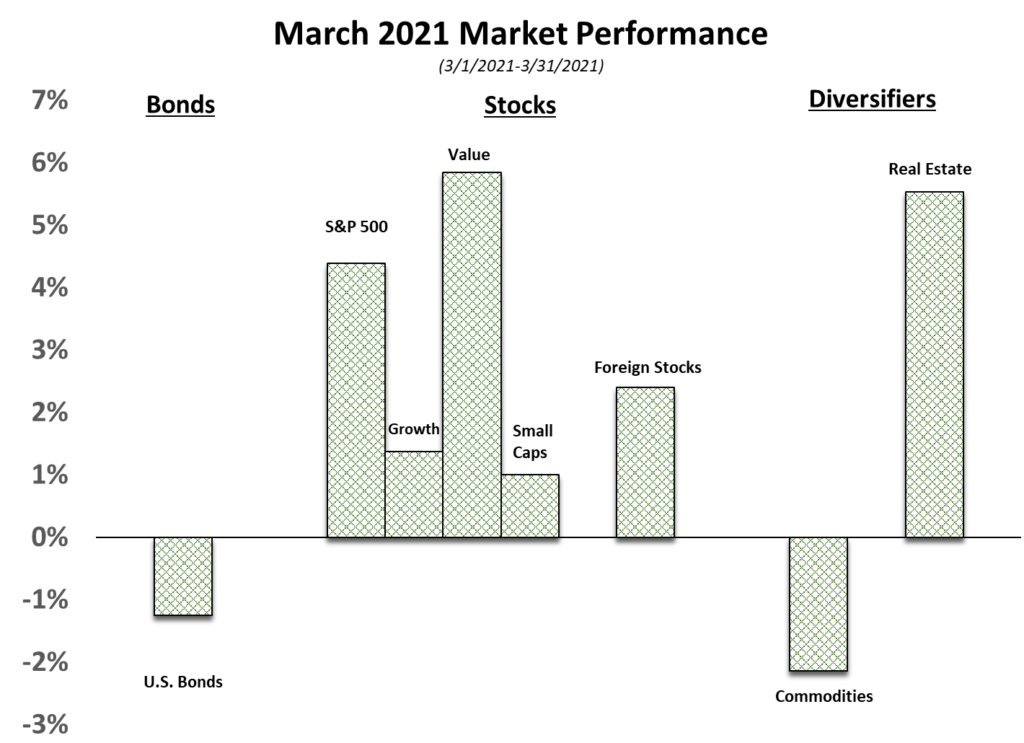

The reflation of assets, the economy, and the inflation likely to come along with it was made apparent in how markets performed this quarter.

The trend away from “work from home” big tech and towards more “old line” companies and higher interest rates generally continued, although less defined. Value companies continued their outperformance yet smaller companies did not. Biden’s American Jobs Plan (announced last week with hopes of passage by July) would have major implications for future interest rates with another $2T in spending over the next decade, on top of the significant stimulus of the past year. Markets haven’t reacted much, in our estimation, to the chorus of tax increases both on corporations (Biden’s infrastructure plan would be paid for by increasing the corporate tax rate from 21% to 28%) and individuals earning more than $400k.

Paycheck Protection Program Extended

The Paycheck Protection Program has been extended to June 30, 2021. The American Rescue Plan provided an additional $7.25 billion in funding to the program. The PPP Extension Act of 2021 takes it a step farther, extending the application deadline to May 31, 2021. The Small Business Administration (SBA) has until June 30, 2021 to process applications.

Should You Convert Your Term Life to Permanent Life Insurance?

Term life insurance provides life insurance coverage for a specific time period (the term). The face amount of the policy is paid if you die during the term of the policy. When you live longer than the term of coverage, nothing is paid, as there is no cash surrender value. Permanent life insurance provides protection for your entire life, regardless of your age or health, as long as you pay the premium to keep the policy in force.

Is Your Home Office Also a Tax Shelter?

The pandemic ushered in the age of video meetings, providing a glimpse into many kinds of home workspaces. For many workers, a dedicated home office became more important than ever in 2020, though not everyone will get a tax break for having one.

Real Estate for Income and Diversification

An estimated 145 million Americans own real estate investment trusts (REITs) in their retirement accounts and other investment funds.1 The primary appeal of REITs is the potential for a consistent income stream and greater portfolio diversification. Of course, like all investments, REITs also have risks and downsides.