November 2020

By Mark FisselPosted on March 11th, 2021

Monthly Market Recap

from Clint Edgington, CFA

Writing these market reviews is a humbling experience and solidifies our hesitance to predict what markets will do in the short term. Most months, it’s easy to discern why the various markets performed the way they did. But for some months, such as last month, once you get behind the headlines it becomes more difficult to tease out the why when you look at different markets that appear to diverge from a narrative. It’s simple to calculate what the returns were, but difficult to discern the why. And this is, in effect, predicting the why for what’s already occurred. Any market prediction we’ve ever heard always states “due to X, we believe the market will do Y”; which is a heck of a lot more difficult proposition when you’re looking into the future.

It’s difficult to remember that the equity markets (all markets, really) are impacted by all market participants; which include a broad array of actors with different time horizons, tax situations, etc. For example, for a taxable long term investor, a Biden victory would likely usher in things that would negatively impact forward earnings for a given investment in a stock (higher capital gains tax rates at the personal level, higher corporate tax rates, etc.); offset by positives (likely higher fiscal stimulus, etc.). For a high frequency trader, their time horizon is judged in milliseconds, and none of those factors apply. For a pension fund, capital gains rates don’t matter. Generally, and especially this year during these politically divisive times, it’s helpful to attempt to keep our political beliefs at bay when it comes to investing. What may impact your situation, or your political beliefs, may or may not impact the market in the aggregate.

Economic activity was generally positive this month; 3rd quarter GDP rebounded by 33% from Q2‘s historical plunge of 31%[1]; reinforcing the idea that Q2’s drop was partially temporary. Earnings season kicked off with generally positive earnings, with 81% of reporting companies beating expectation. FactSet models earnings for the S&P 500, and their model adjusted to show a 9.8% profit decline for the year vs. a 20% drop prior to earnings season.

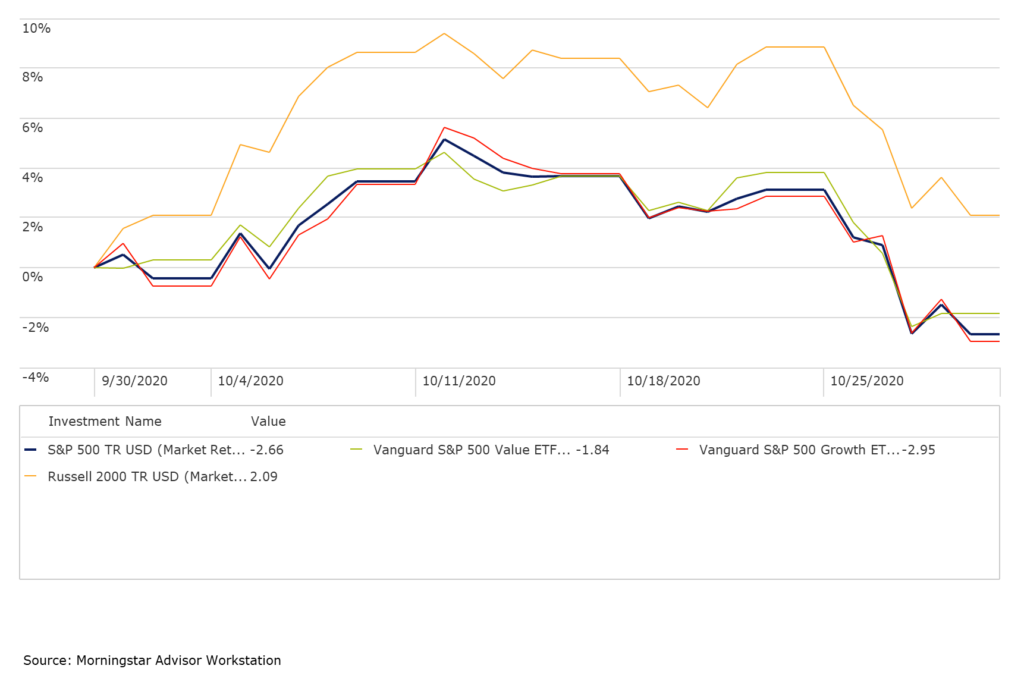

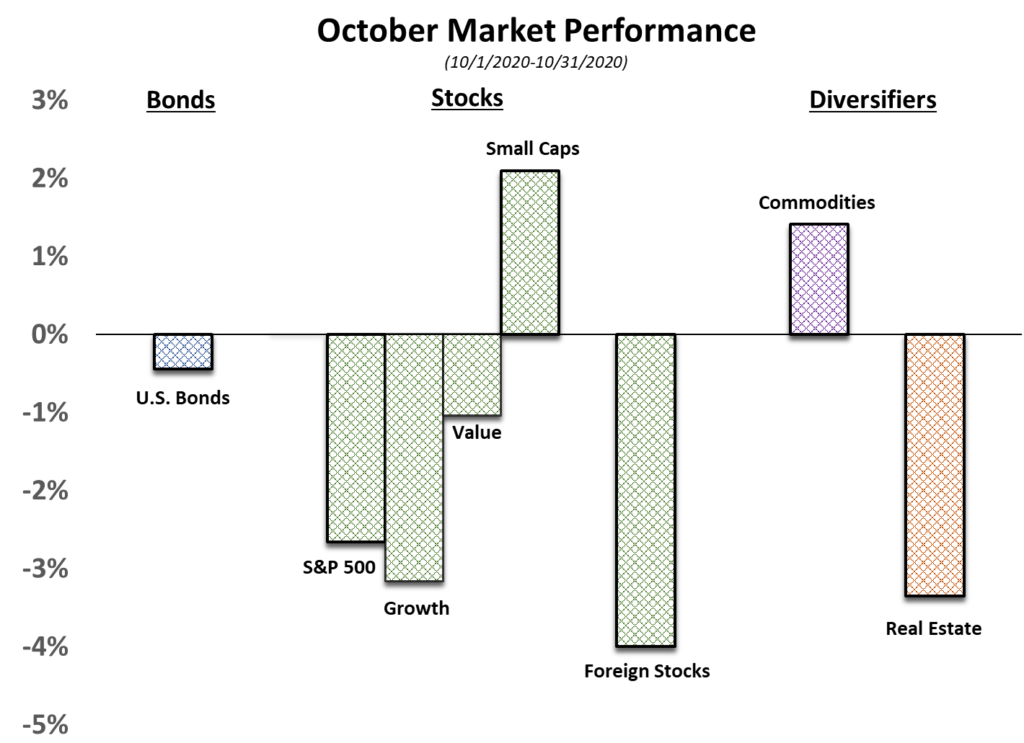

On its face October seems straightforward; U.S. equity markets started the month off on a tear and it can likely boiled down to;

- Presidential Elections – The markets like certainty, and a Biden victory seemed fairly safe.

- Stimulus – Hopes of further stimulus were still alive.

- COVID-19 case counts – Seemed to maintain a plateau.

The back half the month shed those gains plus some; culminating in last week being the worst week since March. This can likely be boiled down to:

- Presidential Elections – Biden’s victory became less clear, but what did become clear is that there will likely be no certainty in the election this Tuesday and perhaps not this week.

- Stimulus – Hopes of immediate stimulus were dashed when the Senate went home after confirming Amy Coney Barrett to the Supreme Court

- COVID-19 case counts – Cases began rising again, stoking fears of further restrictions.

Yet why did the IT Sector lead the losses? Why didn’t Small Cap stocks give back all of their gains? Why did the market ignore a slew of generally positive economic data?

My guess is that a subset of taxable investors likely feel the increased volatility in the markets, and they fear the political outcome and/or fear the increase in capital gains tax rates that seem likely with a Biden victory and decided to book gains where they have them; which is in IT and more “growth” areas of the market.

The bond market declined as the 10 Year note yield rose from .7% to .86%. All else equal, a selloff in the equity market many times rotates into safer havens such as the treasury market; which would push yields down. Curiously, this did not occur. Perhaps the offsetting impact of future fiscal stimulus becoming clearer under both presidents (generally inflationary) made fixed income participants shorten the terms of their bonds to decrease the risk of inflation as we saw the yield curve steepen (longer term bonds sold off).

As in many aspects of life in 2020, this market review has more uncertainty than most; crystallizing our notion that markets are not meant to be timed, long term investors should maintain a long term horizon, and planning for your personal investment and tax circumstances should trump any short term views of the market. If you have questions about your investments or financial planning, please contact us to set an appointment. The last two months of the year are always busy for us, and we imagine this year will be more so as we work on decreasing client’s taxes, deferring capital gains, and positioning our clients for long term success.

[1] Keep in mind these are annualized figures and an increase of 33% annualized after a drop of 31% does not get you back to even.

After Biden Win, How Should You Plan With Taxes In Mind?

By Anne Zavaglia, CFP®

Although President-elect Joe Biden has not yet officially been sworn into office, it’s not too early to start thinking about changes ahead. Joe Biden’s Tax Plan includes a number of proposed changes affecting primarily those earning more than $400k per year. Should there be a change in administration, particularly if the Senate flips, year-end tax planning for high income earners will become a top priority for 2020.

Lessons from the Lockdown: A Back-to-Basics Holiday

f there is one thing the COVID-19 stay-at-home orders demonstrated, it was the need to find joy in simple pleasures. In fact, 43% of respondents to one survey said they had “changed their ways for the better” as a result of the lockdown.1 By applying some of the lessons learned from pandemic purgatory to the holiday season, families may be able to create new and meaningful traditions while saving money.

Should You Pay Off Student Loans Early or Save More for Retirement?

For adults with student debt and extra money on hand, deciding whether to pay off student loans early or put those funds toward retirement can be tricky. It’s a financial tug-of-war between digging out from debt today and saving for the future, both of which are very important goals. This decision is relevant today considering that roughly 65% of college graduates in the class of 2018 had student debt, with an average debt of $29,200.1 This amount equates to a monthly payment of $295, based on a 4% interest rate and standard 10-year repayment term.

Seeking Sun or Savings? Explore a Retirement Move

Many people intend to retire in the place they call home, where they have established families and friendships. But for others, the end of a career brings the freedom to choose a new lifestyle in a different part of the country — or the opportunity to preserve more wealth and protect it from taxes.

Is Now a Good Time to Consider a Roth Conversion?

This year has been challenging on many fronts, but one financial opportunity may have emerged from the economic turbulence. If you’ve been thinking about converting your traditional IRA to a Roth, now might be an appropriate time to do so.

Here are some things to consider as you weigh potential tax moves before the end of the year.