After Biden Win, How Should You Plan With Taxes In Mind?

By Anne ZavagliaPosted on October 31st, 2020

Although President-elect Joe Biden has not yet officially been sworn into office, it’s not too early to start thinking about changes ahead. Joe Biden’s Tax Plan includes a number of proposed changes affecting primarily those earning more than $400k per year. Should there be a change in administration, particularly if the Senate flips, year-end tax planning for high income earners will become a top priority for 2020.

In short, with an increase in tax rates and a reduction in the value of deductions, high earners will want to consider the counterintuitive approach of pulling as much income into 2020 as possible. Year-end Roth Conversions are an easy way to pull forward income that will be taxed at higher rates in the future. Realizing capital gains this year may also be prudent.

Key changes in Biden’s tax plan are highlighted below.

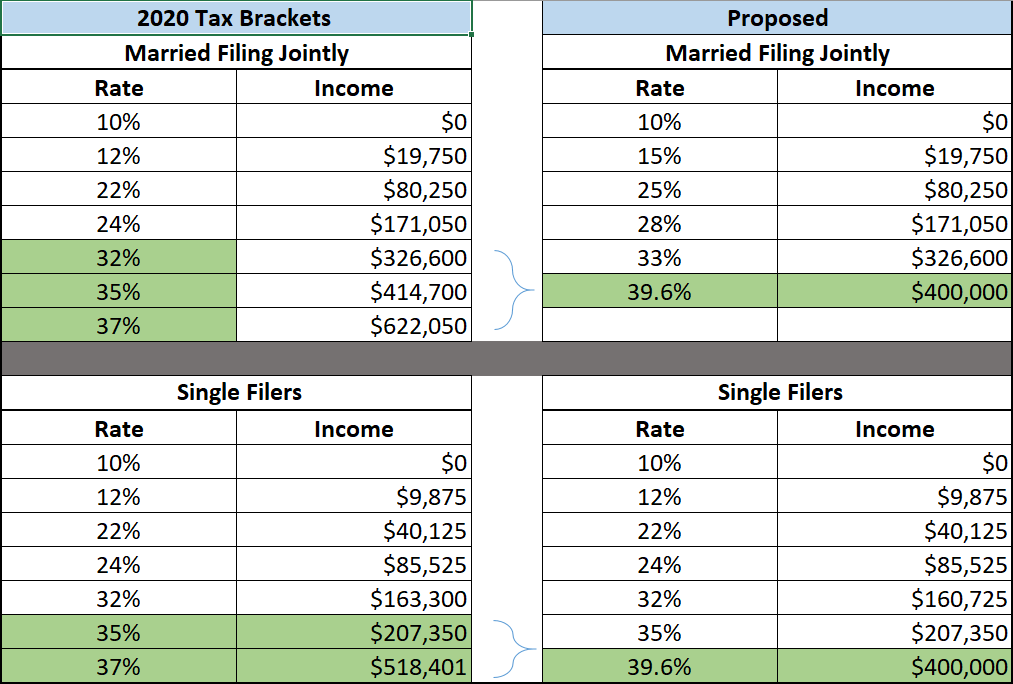

Reverts Top Income Brackets to Pre-TCJA and Raises Rate on Top Ordinary Income

There would be adjustments made to the top brackets, so that earnings above $400k would be subject to the higher 39.6% tax.

Currently the top brackets for married filer’s is at 37% and 35% earnings above $622,050, and $414,700, respectively. A small portion of the 32% bracket would also move to 39.6%. Single filers in the 35% bracket would see a chuck of their earnings move to the 39.6% bracket.

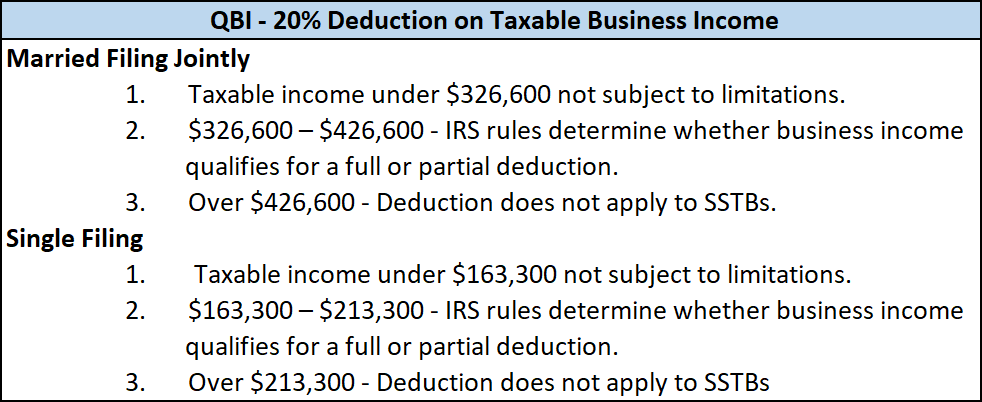

Eliminates the Qualified Business Income Tax Deduction for High Earners

Currently, the QBI deduction allows certain pass-through business owners to deduct 20% of their business income. To claim the QBI deduction, a taxpayer’s total income on their tax return, which includes a spouse’s earnings, interest income, and other non-business income, must be within certain income thresholds.

Business owners in the phase-out range will be limited depending on whether or not their business is a Specified Service Trade or Business (SSTB). Those with a SSTB business and have income above the phase out ranges currently do not benefit from the QBI deduction.

The Biden tax plan would eliminate the QBI deduction for business owners with total income above $400,000, regardless of business type.

Regardless of who wins the election, the QBI deduction is set to expire after 2025.

Value of Itemized Deductions Capped

For those that benefit from itemizing deductions, the value of the deductions will be capped at 28% for those earning more than $400k per year.

Essentially, the higher a taxpayer’s marginal tax brackets is, the less beneficial the deduction will be.

Imposes an Additional 12.4% Payroll Tax

OASDI (Old-Age, Survivors, Disability Insurance) will be imposed on income earned above $400,000. The tax will be evenly split between employers and employees. Wages between $137,700, the current wage cap, and $400,000 would not be taxed.

Long Term Capital Gains Rate Increase

For those with income over $1 million, any capital gains and dividends received above the first $1 million of income would be taxes at ordinary rates. This means instead of the currently 20% tax, the income would be taxed at 39.6% along with the 3.8% net investment income surtax

Elimination of Step-Up Basis

The tax plan would eliminate the “step-up” in basis on inherited assets at death. Currently, “when the owner of an asset dies, the beneficiary of that asset generally receives the asset with a cost basis equal to the fair market value of the asset on the date of the decedent’s death.[1]” The step-up eliminates the capital gain that would have been realized on an appreciated asset at death. Under Biden’s tax plan, the gain on the asset would be taxable at death and paid for by the decedent’s estate. The result would be a lower inheritance passed on to heirs.

Eliminates Tax Deduction for Contributions to IRAs, 401(k)s, and Other Qualified Accounts

Instead of reducing taxable income by the amount contributed up to the COLA limits, workers contributing to a qualified pre-tax retirement account would receive a tax credit. The credit is estimated to be 26%.[2]

For those in the higher income brackets, the credit become less valuable. The entire contribution will no longer be tax deferred and will be subject to double taxation – Meaning that they are taxed now and when distributions are taken in retirement.

Furthermore, the contribution to an IRA or 401(k) would be now be included in adjusted gross income. The federal adjusted gross income carries on to the state level, where it may end up being fully taxed.

What to Do?

High earners, particularly business owners, would see their taxable income go up substantially if the QBI is lost, and contributions to a qualified plan are offset by a tax credit rather than reduce taxable income. Roth Conversions would become an important planning tool for 2020. Cash balance plans and additional Roth savings would be important items to consider for 2021 and beyond.

Of course, it is all speculation at this point. Even with a Biden win, changes to taxes may not come until 2022 due to the state of the economy. Not all aspects of his proposed plan would necessarily pass and would likely be further tweaked as a new tax bill moved through the House and Senate.

We will be paying close attention in the upcoming months to help point clients in the right direction.

Sources:

Jeffery Levine, “The Biden tax plan: Proposed changes and year-end planning opportunities,” FinancialPlanning.com, October 14, 2020, (Source)

Garret Watson, “Biden’s Proposal Would Shift the Distribution of Retirement Tax Benefits,” TaxFoundation.org, August 26, 2020, (Source)

“Tax Cuts and Jobs Act, Provision 11011 Section 199A – Qualified Business Income Deduction FAQs,” IRS.gov, September 20, 2020, (Source)

Taylor LaJoie, Huaqun Li, and Garret Watson, “Details and

Analysis of Democratic Presidential Nominee Joe Biden’s Tax Plan,”

TaxFoundation.org, October 22, 2020, (Source)

[1] Jeffery Levine, “The Biden tax plan: Proposed changes and year-end planning opportunities,” FinancialPlanning.com, October 14, 2020, (Source)

[2] Garret Watson, “Biden’s Proposal Would Shift the Distribution of Retirement Tax Benefits,” TaxFoundation.org, August 26, 2020, (Source)