November Market Recap

By Clint EdgingtonPosted on December 2nd, 2020

In a year that the markets were driven by Covid, November may be remembered as a turning point. Three different vaccines for Covid were announced effective. Fears of a contested election further dividing our political environment diminished, and a Biden victory ushers in a return to a more conventional Presidency with a split Congress being likely.

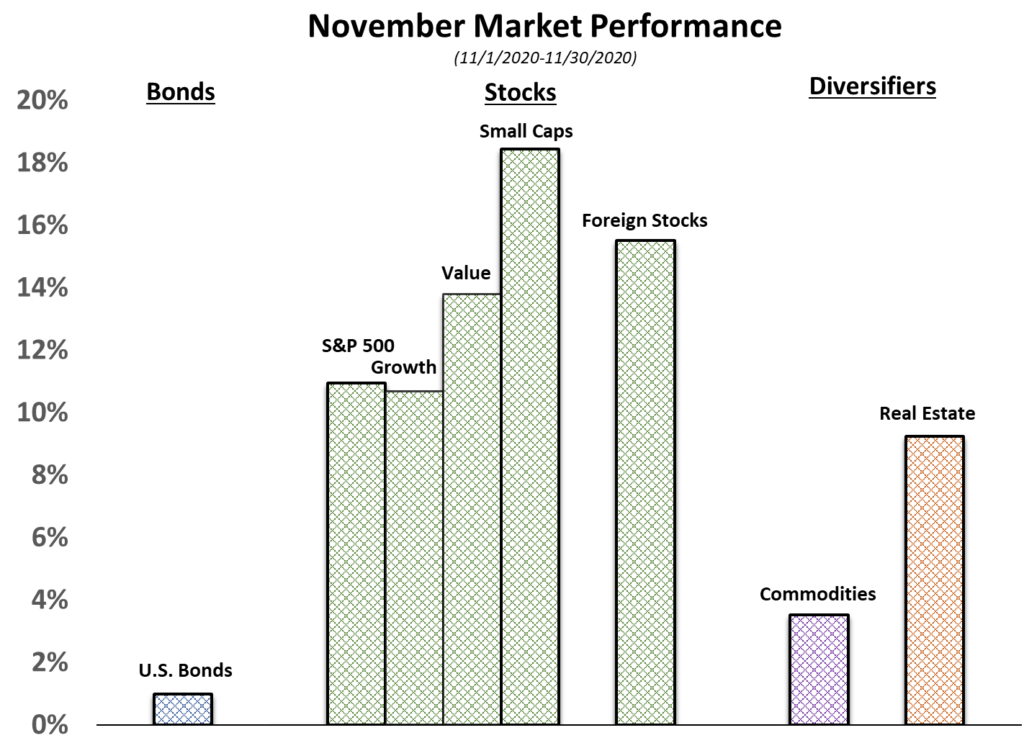

Monday, November 9th had Pfizer announcing the efficacy of its vaccine being over 90%, above expectations. Since that point, a reversal in the market has taken place. The growth stocks that were buoyed by economy wide shutdown (i.e. anything you can do at your computer: Amazon, Facebook, Zoom, etc.) showed growth that was muted by Value companies (i.e. energy, materials, etc.). Smaller cap companies, less able to invest in the cap-ex required to compete in a suddenly online world, outperformed. November, in summary, marked a wide divergence from the rest of the year when it came to the markets. Small caps, value, and foreign stocks all turned to outperform for the year. The U.S. markets, an outperformer for the year, yielded to foreign stocks that had a torrid month.

Yet while an end to the Covid crisis appears to be in sight, case counts in the U.S. continued to rise entering the winter season when the virus may be more difficult to subdue. Add the logistical challenges of the vaccine to our view, and the exact endpoint gets hazy. Europe is coming off shutdowns and have seen a drop in case counts and hospitalizations that the U.S. hopes to follow.

A Biden administration likely ushers in a period of normalizing relations with foreign partners, including reuniting with global peers to combat climate change. Biden ran on raising taxes to reduce deficit spending, a (likely) divided congress will likely subdue that and the size of a potentially upcoming fresh stimulus package.