2020 Q2 Market Recap

By Clint EdgingtonPosted on July 2nd, 2020

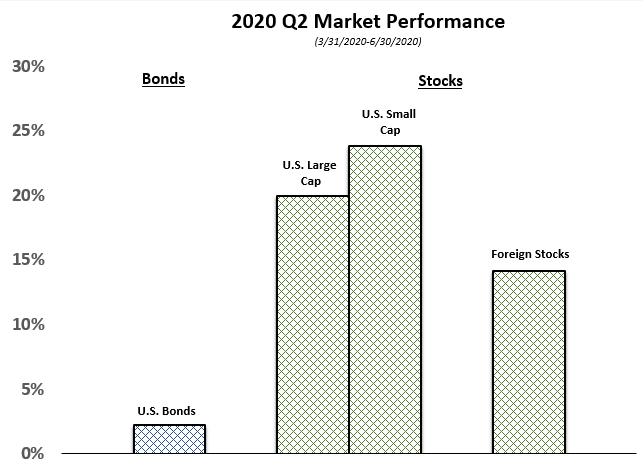

The markets have quickly taken into account optimistic news on the new case counts, vaccine front, and amazing amounts of fiscal and monetary stimulus, posting a huge bounceback from last quarter with the S&P’s return of 20%.

Last quarter we posed: “The question going forward is how much does the harm spread throughout our economy.” While it appears that the potential high end of the potential harm has gone down- our question still remains. Job losses have certainly slowed but are still very high. There has not been a wave of bankruptcies yet, but there have been a lot compared to more normal times. The virus appears to be containable with a vaccine likely on the horizon, but the virus is currently not contained, and we currently have no vaccine.

The most likely explanation of the majority of the bounceback in the markets is due to the initial large drop in COVID-19 cases after distancing took effect. Yet we now seem to be experiencing a more gradual increase in cases as states across our nation open up at different rates and testing has increased. During the initial phases of the lockdown, states acted more in lockstep to shut down than they are in their reopening. It appears that “social distancing”, on the whole, likely works to reduce the case count and that the infection rate was not, as initially feared, exponential. It appears now that states taking a faster approach to their reopening are, unsurprisingly, having more of a resurgence than those states taking more of a conservative approach.

We’ll continue to keep a vigilant eye on the markets as news unfolds regarding the economy, the stimulus, unemployment, vaccine potential, COVID-19 case counts, and who knows what else 2020 has in store for us. For now we caution everyone to stay safe and prioritize your health.