March 2021

By Mark FisselPosted on March 11th, 2021

Monthly Market Recap

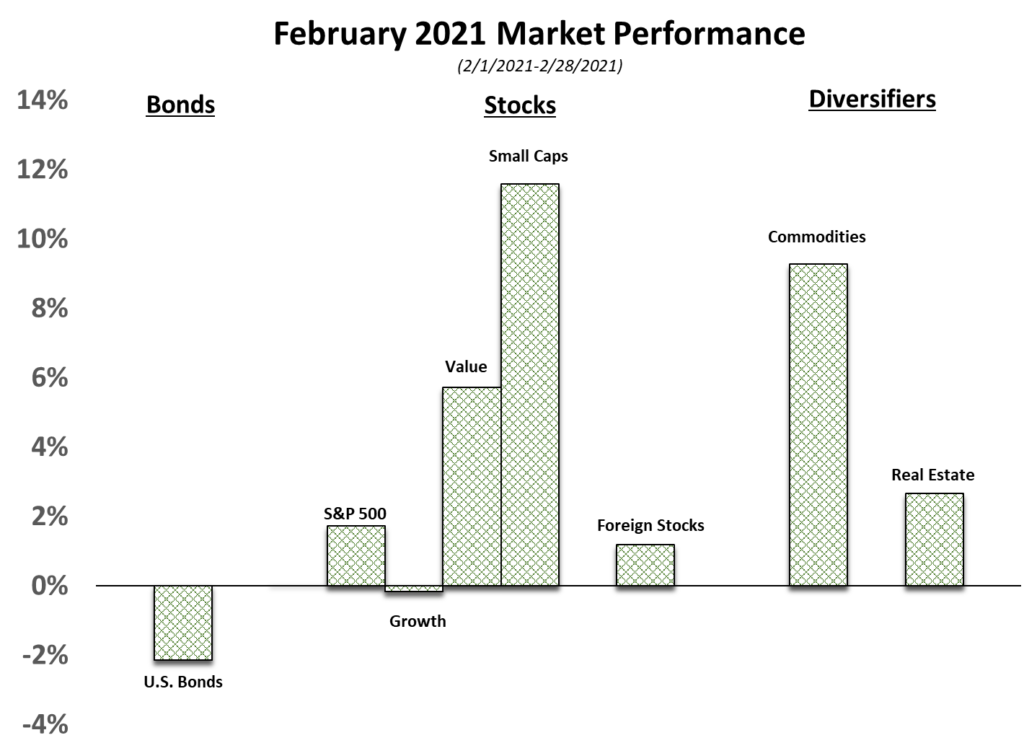

February was a quiet month in the markets, continuing trends that have been in place since December.

Economic expansion seems to be continuing, with positive news on the coronavirus front, unemployment being lower with 50k new jobs created last month, and a Q4 GDP advance estimate of 4.1%. Further stimulus seems likely with the $1.9T coronavirus stimulus bill expected to be voted on shortly with most of the spending, less the $15/hour minimum wage. The market expects this to pass and has priced it in; which is fueling continued rotation out of companies that benefited from the “work from home” economy and into companies harmed from it. This shows in the rotation to small companies and “value stocks”.

The economic expansion and continued fiscal spending is also apparent in the markets through a general “reflation” of asset prices; which is sending longer term interest rates back up; and therefore bonds down and increasing commodity prices. Further fiscal spending will likely continue this. The Federal Open Market Committee meets in the 3rd week of March. They have recently been committed to attempting to maintain low interest rates; it will be interesting to see if they pivot as the market is moving longer-term interest rates up in the face of economic expansion and inflationary pressures.

Tax Filing Due Date Approaching

By Anne Zavaglia, CFP®

Tax filing season officially started on February 12 this year. If you haven’t done so already, you’ll want to start gathering documents — including a copy of your 2019 tax return, W-2s, 1099s, and deduction records. You’ll need these records whether you’re preparing your own return or hiring a tax preparer.

The IRS Provides Guidance on the Employee Retention Credit

By Anne Zavaglia, CFP®

The Internal Revenue Service (IRS) released new guidance this week for employers that are claiming the Employee Retention Credit for 2020. The guidance applies to qualified wages paid between March 12, 2020 and December 31, 2020.

At the end of last year Congress passed a relief bill allowing businesses that received Paycheck Protection Program (PPP) loans to also be able to claim the Employee Retention Credit (ERC). The new guidance, Notice 2021-20, explains how employers that received a PPP loan can claim the ERC.

Tax Filing Information for Coronavirus Distributions

In March 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The legislation included a provision that allowed qualified retirement plan participants and IRA account holders to take penalty-free early distributions totaling no more than $100,000 between January 1 and December 31, 2020. If you took advantage of this measure, here’s what you need to know for tax filing.

A Financial Wellness Plan Can Help Pave the Road to Retirement

If we’ve learned any lesson over the past year, it’s that no matter how carefully we plan and prepare, we’ll likely encounter unexpected hurdles. While a global pandemic has certainly underscored the need to pay close attention to our physical wellness, it has also revealed the need to shore up our financial wellness.

According to PwC’s 9th Annual Financial Wellness Survey conducted in January 2020, financial matters were the top cause of stress for employees even well before the pandemic hit in earnest. More than one-third of full-time employed millennials, Gen Xers, and baby boomers had less than $1,000 in emergency savings. Only 29% of women said they would be able to cover their basic necessities if they found themselves out of work for an extended period, compared with 55% of men. And more than half of millennials and Gen Xers and 35% of baby boomers said they would likely use their retirement funds for something other than retirement, with most noting it would be for an unexpected expense or medical bills.