February 2021 Market Recap: Continuing Trends

By Clint EdgingtonPosted on March 2nd, 2021

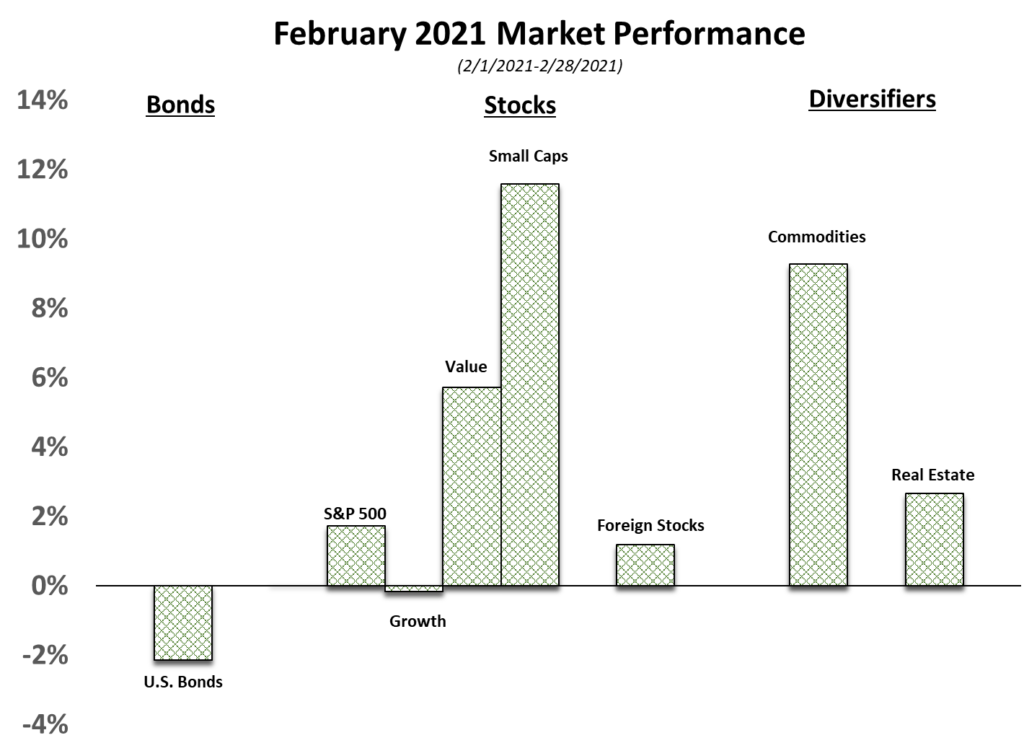

February was a quiet month in the markets, continuing trends that have been in place since December.

Economic expansion seems to be continuing, with positive news on the coronavirus front, unemployment being lower with 50k new jobs created last month, and a Q4 GDP advance estimate of 4.1%. Further stimulus seems likely with the $1.9T coronavirus stimulus bill expected to be voted on shortly with most of the spending, less the $15/hour minimum wage. The market expects this to pass and has priced it in; which is fueling continued rotation out of companies that benefited from the “work from home” economy and into companies harmed from it. This shows in the rotation to small companies and “value stocks”.

The economic expansion and continued fiscal spending is also apparent in the markets through a general “reflation” of asset prices; which is sending longer term interest rates back up; and therefore bonds down and increasing commodity prices. Further fiscal spending will likely continue this. The Federal Open Market Committee meets in the 3rd week of March. They have recently been committed to attempting to maintain low interest rates; it will be interesting to see if they pivot as the market is moving longer-term interest rates up in the face of economic expansion and inflationary pressures.