Tax Numbers and Inflation Adjustments for 2026

By Anne ZavagliaPosted on January 14th, 2026

The Internal Revenue Service makes annual cost-of-living and inflation adjustments. For 2026, these changes increase contribution limits for retirement plans and update various tax deduction, exclusion, exemption, and threshold amounts. Highlights for 2026 are outlined below.

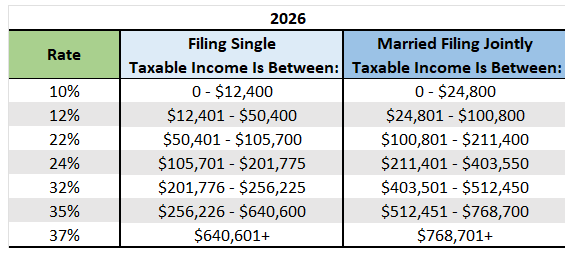

Marginal Tax Brackets

The One Big Beautiful Bill (OBBB) made permanent the federal marginal income tax brackets, that were originally set to revert back 2017 levels starting this year. An extra inflation adjustment applies to the lower two tax brackets which increased by 4% for 2026. The higher brackets increased by 2.3%.

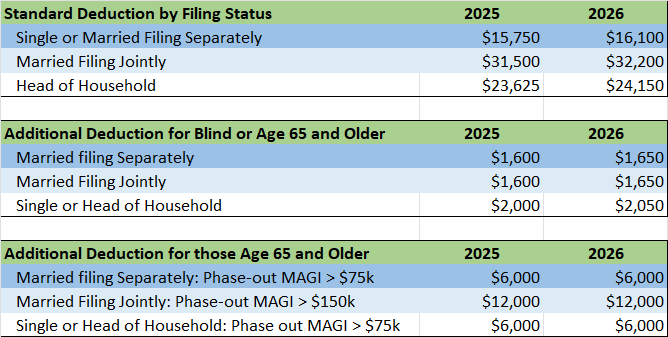

Standard Deduction

The Standard Deduction for 2025 saw additional increases between $1,150 and $2,300 with the passage of the OBBB. A benefit for 2025 and beyond, with the 2026 inflation adjustments based on the new amounts.

For taxpayers age 65 and older, an additional deduction of $6,000 per taxpayer is available for tax years 2025 through 2028, subject to income limits. This deduction is in addition to the existing additional standard deduction for seniors under current law.

A taxpayer may either itemize eligible deductions or claim the standard deduction on a federal income tax return. Since the enactment of the TCJA, most filers have chosen the standard deduction. However, with the increase in the SALT deduction cap to $40,000, more taxpayers may now benefit from itemizing.

2026 Child Tax Credit

The maximum child tax credit (CTC) for both 2025 and 2026 is $2,200 per qualifying child and will be indexed for inflation going forward. The OBBBA made permanent the expanded CTC originally enacted under the TCJA, increased the maximum credit from $2,000, and introduced ongoing inflation adjustments. The refundable portion of the credit is also indexed for inflation and will be $1,700 in 2026.

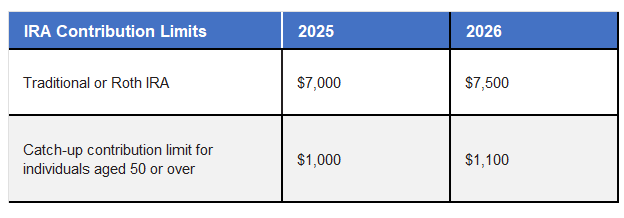

Individual Retirement Accounts (IRAs)

The combined annual contribution limit for traditional and Roth IRAs increased to $7,500 for 2026, with individuals aged 50 or older permitted to make an additional catch-up contribution of $1,100. Under SECURE 2.0, the IRA catch-up contribution is now subject to an annual cost-of-living adjustment, with 2026 marking the first increase.

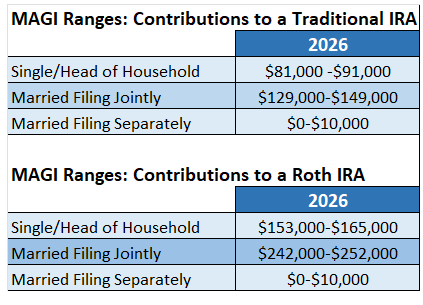

If during the year either an employee, or their spouse, was covered by a retirement plan at work, the deduction to a traditional IRA may be reduced, or phased out until it is eliminated, depending on filing status and income. If neither person is covered by a retirement plan at work, the phase-outs of the deduction do not apply. The limit on nondeductible contributions to a traditional IRA is not subject to a phase-out based on MAGI.

The limit on contributions to a Roth IRA phases out for certain modified adjusted gross income (MAGI) ranges. Taxpayers may be able to make non-deductible contributions to a traditional IRA and convert to a Roth IRA as a workaround.

Note: The 2026 phaseout range is $236,000-$246,000 when the individual making the IRA contribution is not covered by a workplace retirement plan but is filing jointly with a spouse who is covered. The phaseout range is $0-$10,000 when the individual is married filing separately and either spouse is covered by a workplace plan.

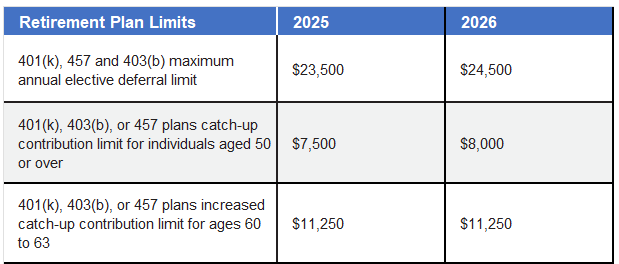

Employer-Sponsored Retirement Plans

Employees who participate in 401(k), 403(b), and most 457 plans may defer up to $24,500 in compensation in 2026. Employees aged 50 or older can defer up to an additional $8,000 in catch-up contributions. For those aged 60 to 63 the increased contribution limit will remain $11,250.

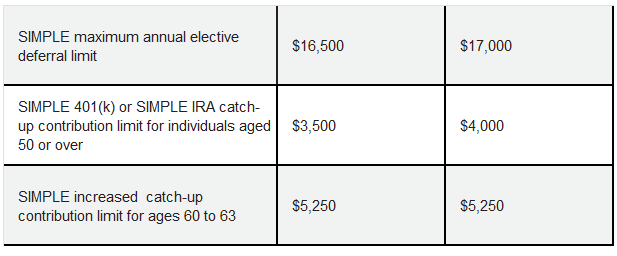

Employees participating in a SIMPLE retirement plan can defer up to $17,000 and those age 50 or older can defer up to an additional $4,000.

The combined employee and employer contributions cannot exceed $72,000 for 2026. Roth 401(k) contribution limits are the same as those for traditional 401(k) plans.

Estate, Gift, and Generation-Skipping Transfer Tax

The annual gift tax exclusion (and annual generation-skipping transfer tax exclusion) for 2026 remains $19,000 per individual, or $38,000 for married couples. The gift and estate tax lifetime exclusion amount (and generation-skipping transfer tax exemption) for 2026 is $15,000,000 per individual, or $30,000,000 for married couples.

Kiddie Tax: Child’s Unearned Income

Under the kiddie tax, a child’s unearned income above $2,700 in 2026 is taxed using their parents’ tax rates. The Kiddie tax applies to individuals 18 years of age or under or dependent full-time students under the age of 24.