TD Ameritrade Transition to Schwab: Important Details

By Anne ZavagliaPosted on June 29th, 2023

The long-awaited transition to Schwab is on the horizon. The Charles Schwab Corporation acquired TD Ameritrade in 2019. Since that time, TD Ameritrade has been working behind the scenes with Schwab on effectuating a smooth transition for clients.

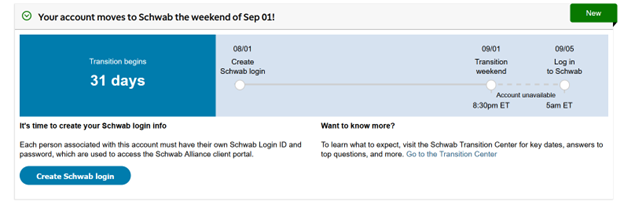

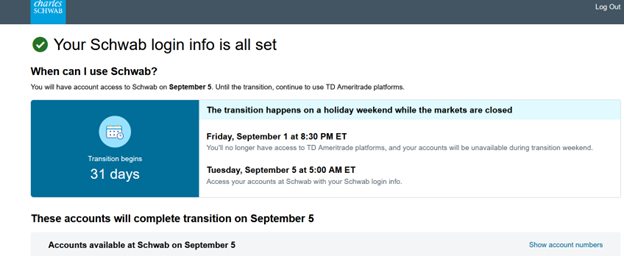

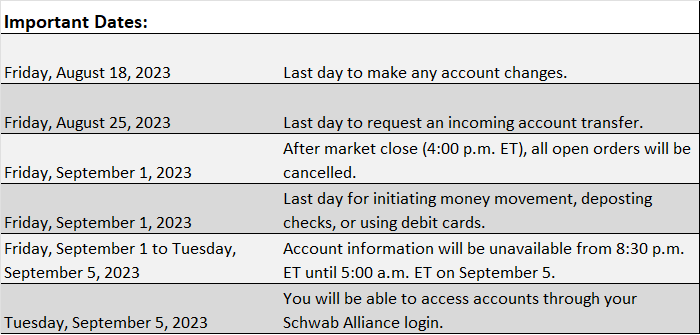

Client TD Ameritrade Institutional accounts will automatically transition to Schwab on Tuesday, September 5, 2023. Clients will be able to access and withdraw cash from TD Ameritrade Institutional accounts through Friday, September 1, 2023, at 8:30 p.m. ET. After that, access to TD Ameritrade Institutional accounts will no longer be available. During this time, if you log on to AdvisorClient.com, you will not be able to see your account(s). Client assets (cash and securities positions) will be moved to Schwab over the transition weekend. Starting Tuesday, September 5, 2023, clients can log on to Schwab Alliance to view and access accounts.

Schwab Online Portal

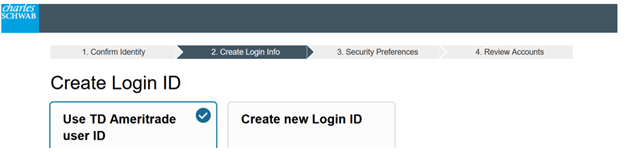

Starting August 1 clients can set up their new Schwab Alliance Login ID and password. Log into AdvisorClient and click on Create Schwab login and follow the prompts.

If you already have AdvisorClient credentials, you will be given the option to retain them. If you don’t have AdvisorClient credentials, we encourage you to set them up now to make sure you can continue to access your account(s). If you have forgotten your username or need a password reset, please reach out to us.

If you choose not to set up a login at AdvisorClient, you will need to start fresh with Schwab Alliance. After you’ve created your Schwab Alliance login and password, you can log in to test your credentials. If you do this before the transition, you will be directed to a success page. After your accounts transition, you’ll be automatically directed to a first login page with disclosures that apply to your Schwab account(s) and information about your paperless preferences. Then you will see a summary of your account(s).

TD Ameritrade Deadlines

August 18 is the last day to make any account changes at TD Ameritrade. This includes updates to your address, phone number, email and delivery preferences. Please reach out to us if any changes are need to your account. Document delivery preferences can be updated through AdvisorClient.

What Is Moving With Your Accounts?

Beacon Hill Investment Advisory will have the same authorizations on Schwab accounts as we have on client TD Ameritrade Institutional accounts. These authorizations may include trading, fee deduction and payment, and first-party money movement.

Your investments, cash balances, preferences, and account information will transition to Schwab including:

- Bank and wire instructions used within the past three years. If you have automatic payments set up at TD Ameritrade, those instructions will transfer to Schwab. This includes outgoing ACH transfers, wires, and third-party checks.

- Authorizations you granted your advisor. This includes any move money authorizations that clients have added to accounts.

- Beneficiaries and Trusted contacts

- Dividend reinvestment plan (DRIP) instructions. Dividend reinvestment settings for eligible securities you already own will transition to Schwab. However, new purchases will not be automatically set for dividend reinvestment at Schwab. You must enroll new positions individually.

- Margin, portfolio margin, and options futures

- Realized gains and losses

- Transaction history

- Statements, confirmations, and tax forms

What is Not Moving With Your Accounts?

Clients that have checks and or debit cards linked to their accounts will not be able to use them after the conversion. We will reach out to clients the first week of September to order new checks and debit cards. This cannot be done until after the accounts have moved to Schwab. Any checks written from the old account and cashed after the conversion date will not clear. The last day to use debit cards is September 1.

If you provided your TD Ameritrade Institutional account number(s) to an employer, bank, or other third party for the purpose of moving money in or out of your account, you’ll need to re-establish those instructions with your new Schwab account number(s) after your account transition is complete.

A Client Information Hub has been set up to support the transition to Schwab. You can also login into your accounts at AdvisorClient.com and visit the Transition Center.

Clients should reach out to us with any questions or concerns regarding the transition.

Updated 8/1/2023