Use the Increased RMD age to Boost your Roth Savings

By Anne ZavagliaPosted on April 11th, 2023

The required minimum distribution (“RMD”) age has steadily increased over the last few years with the passage of the SECURE Act and SECURE 2.0, raising the RMD age from 70.5 to 72 starting in 2020, to 73 in 2023, and age 75 starting in 2033. The increased RMD age has changed retirement planning, particularly for those born after 1951 who’ve seen their first RMD delayed multiple times. This increase in the time when a typical retirement starts (with generally lower taxable income) and the RMD age gives us an opportunity to increase our retirement accounts and save money on taxes.

Approaching Retirement

If you have already retired or are working part-time before RMDs start, your ordinary income:

- Is likely lower now than it was during your working career; falling into the lower marginal income brackets.

- Your tax bracket is likely lower now until the sunsetting occurs on 12/31/2025.

If you don’t need to draw yet from your retirement accounts, you could do Roth conversions while in the lower tax brackets. This effectively shifts income from higher tax years to lower tax years and may;

- lower your RMDs

- lower taxable income during the RMD years.

You will still pay tax on the converted amount, albeit at today’s lower rates. The money in your Roth IRA will then grow tax free and be tax-free for beneficiaries. Plus, there are no RMDs for Roth IRAs, and any withdrawals you make are tax-free.

How It Works

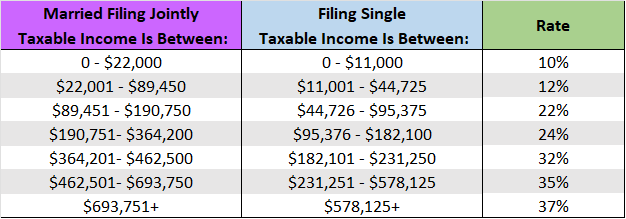

You and your spouse are both 66 and have $1 million in tax-deferred IRA and 401k accounts, and $500k in taxable accounts. With $60k income, you’re currently in the 12% marginal tax bracket but will move to the 25% tax bracket in 2030 when RMDs begin. You decide to fill up the 12% bracket this year by converting $29,450 of your Traditional IRA to Roth. You’ll owe an additional $3,534 in taxes which are paid from your taxable accounts.

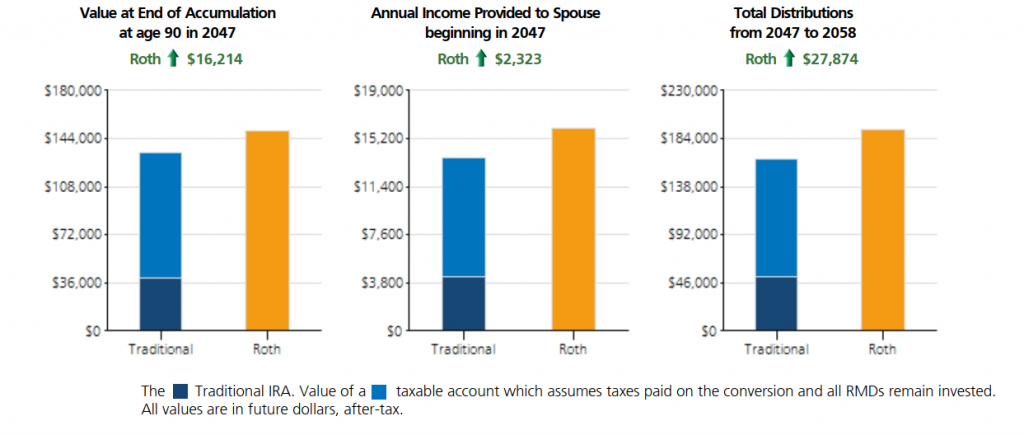

Figure 1 Assumptions: 7% average rate of return until age 73, 5% rate of return after. Life expectancy: 90. Roth passes to your spouse at death.

From doing this once at a tax cost of $3,534 the converted amount is worth $16,214 more at age 90, compared to leaving the money in a traditional IRA.

Roth IRA and 401k Contributions

Roth Conversions aren’t the only option to increase your tax-free investments. You can make Roth IRA contributions while still working. If you have earned income, and your income falls between $138k – $153k for singles and $218k and $228k for married people, you can make direct Roth IRA contributions. Annual IRA contributions limits are $7,500 for those over age 50.

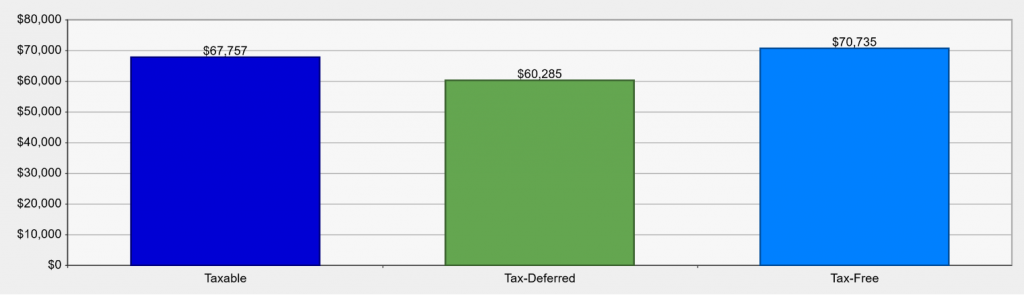

Thinking about the same couple above, if one person is still working until age 73, they can make $7,500 per year in Roth IRA contributions. The value of making Roth IRA contributions over a 7-year periods vs. a taxable account or making tax-deferred IRA contributions is illustrated below.

If you have a workplace retirement plan, you should check if it offers a Roth option. There are no income limits to make Roth Contributions through your employer’s plan. You can also make larger contributions; up to $30,000 if you are age 50 or older.

Another change brought by SECURE 2.0 is that Roth 401k accounts no longer require RMDs starting in 2024. Bringing Roth 401k rules into line with Roth IRAs.

Effect on Social Security Benefits

One thing to consider, Roth conversions could increase the amount of social security income that is taxable. If social security is your only form of income before RMDs start, you may want to consider the tax consequences of a Roth conversion. However, most social security recipients find their social security income is taxable. The threshold is easy to hit since the income amount is low and does not adjust for inflation.

For example, if you file a joint return, and you and your spouse have a combined income that is:

- between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $44,000, up to 85 percent of your benefits may be taxable.

If you and your spouse receive $45,000 per year in social security benefits, have $3k in nontaxable interest, and do a $20k Roth Conversion; the formula to determine your taxable social security benefits is:

$20,000 Your adjusted gross income, excluding Social Security

$3,000 + Nontaxable interest

$22,500 + ½ of your Social Security benefits

$45,500 = Your “combined income”

85% of your Social Security would be taxable vs. not doing a Roth conversion. In this case, none of your Social Security benefits are taxable.

$20,000 Your adjusted gross income, excluding Social Security

$3,000 + Nontaxable interest

$22,500 + ½ of your Social Security benefits

$45,500 = Your “combined income”

If you are considering a Roth conversion but are concerned about the tax consequences, reach out to us to discuss your situation.