September 2020

By Mark FisselPosted on September 4th, 2020

Monthly Market Recap

from Clint Edgington, CFA

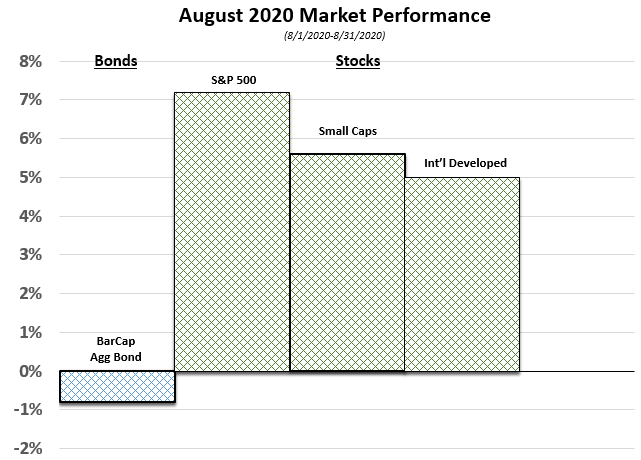

In our last market update, we felt the market is constantly trying to handicap “how the COVID-19 Pandemic will be solved, when…, and how much permanent damage…”. In short, the market liked the news on that front throughout August as case counts began to once again moderate and news of vaccine developments and timelines generally became more optimistic.

In addition, what may appear to be a nuanced change in Fed policy (from targeting a 2% inflation rate to maintaining a 2% average inflation) rate over time while maintaining it’s dual (and conflicting mandate) of maintaining full employment is anything but. Keep in mind, hikes to interest rates generally hit the real economy with a lag and, historically, the Fed would begin bumping the interest rates up in advance of hitting full unemployment. In practice, this means that they plan to overshoot and are willing to deal with higher rates of inflation. This shift continues the Fed’s extremely accommodative stance. Most markets responded by predicting (and pricing in) future asset price increases (and dollar inflation). Bonds, on the other hand, dislike that inflationary policy and were the only major asset class with negative returns for the month. Read More

DOL Releases Interim Final Rule on Lifetime Income Disclosures

By Anne Zavaglia, CFP®

The U.S. Department of Labor (DOL) has released their Interim Final Rule in response to the SECURE Act’s requirement that administrators of defined contribution plans (such as 401(k) plans) provide participants with disclosures regarding estimated lifetime income payments. The idea behind the change is to encourage participants to think about their retirement plan savings in terms of the monthly income it could provide and not just the total balance.

Surge in COVID-19 Scams

Fraudsters and scam artists have always looked for new ways to prey on consumers. Many are now using their tactics to take advantage of consumers’ heightened financial and health concerns over the coronavirus pandemic. Federal, state, and local law enforcement have issued warnings on the surge in coronavirus scams and offer advice on how consumers can help protect themselves.

Accumulating Funds for Short-Term Goals

Stock market volatility in 2020 has clearly reinforced at least one important investing principle: Short-term goals typically require a conservative investment approach. If your portfolio loses 20% of its value due to a temporary event, it would require a 25% gain just to regain that loss. This could take months or even years to achieve.

So how should you strive to accumulate funds for a short-term goal, such as a wedding or a down payment on a home? First, you’ll need to define “short term,” and then select appropriate vehicles for your money.