January 2021 Market Recap: Predictability!

By Clint EdgingtonPosted on February 2nd, 2021

Frankly, not much happened in the markets last month. With a new President and Congress shifting power, it’s an odd time for nothing major to happen to impact the markets. Our new President perhaps ushered something into our lives that you either love or hate…predictability.

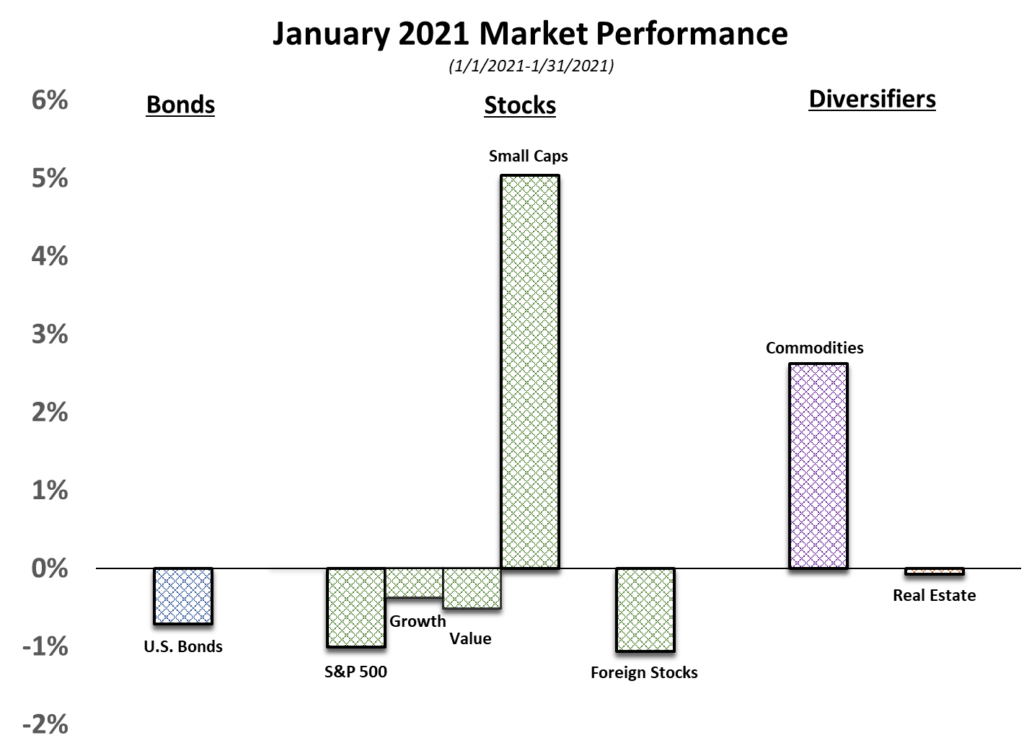

Both U.S. and Foreign stock markets had a tiny pullback of 1%[1]. While the Fed assured the market that rates would stay low for longer, increased expectations of larger fiscal stimulus due to a Democratic President and Senate offset that and increased interest rates (as it will require more capital, and interest rates are, in effect, the cost of capital). This brought bonds down slightly[2]. The stimulus expectations plus a decrease in COVID-19 cases, as well as vaccination timetables largely staying the same, allowed Smaller Cap stocks, which are more dependent on the U.S. economy and “Main Street” business than larger companies, to continue their significant rebound.[3]

The story of the month for us finance nerds was the GameStop fiasco. It didn’t impact the market, but it sure kept us engaged. In short, a Reddit forum member with a following orchestrated a short squeeze against a few hedge funds that were shorting GameStop, a brick and mortar retailer of video games that, prior to this month, no one paid much mind to. Gamestop started the month around $17/share, popped up to almost $400/share and is, at the time of this writing, at $120/share. The nuances, players, and conflicts of interest are fascinating, and I’d recommend googling… or hopefully reading the Michael Lewis novel when it comes out!

[1] S&P 500: -1%; MSCI Europe, Asia, Far East: -1%

[2] Barclay’s Aggregate Bond index: -.7%

[3] Russell 2000 TR: +5%